1. Quick Take:

At press time, Ethereum trades at 3000$, so far this year Ether has climbed 30% versus Bitcoin’s 22% advance. Ether outperformed Bitcoin earlier this month in part on growing speculation over the potential approval of Ethereum Spot ETF this year, after they authorized spot Bitcoin ETFs in January.

2. Catalysts for Ethereum Surge:

Ether will probably continue to outperform Bitcoin in the coming months, thanks to four main crypto catalysts:

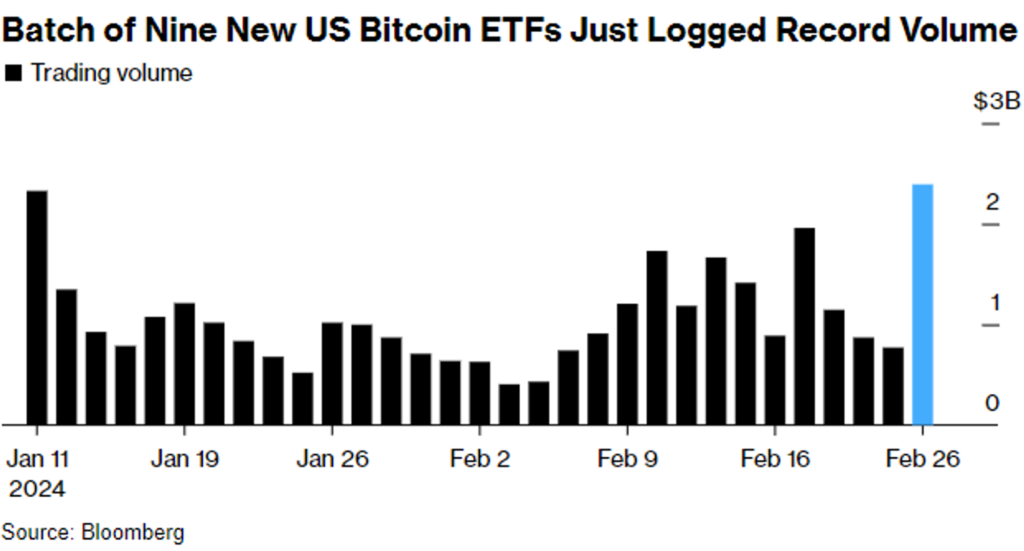

- Firstly, investor demand for Bitcoin ETFs is seen remaining strong, extending a prolonged rally that has also stoked speculative appetite for smaller tokens like Ether.

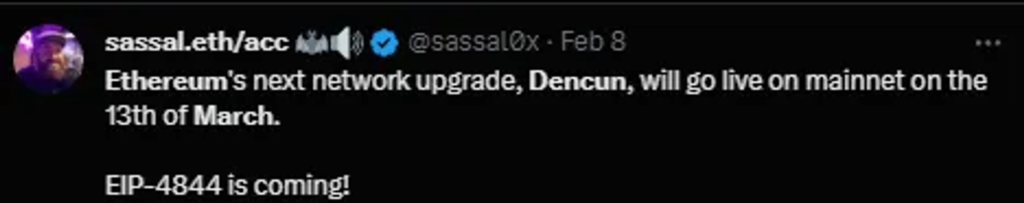

- Secondly, the Ethereum Dencun Upgrade – the next significant update to the Ethereum network, is set to launch on March 13th, aiming to reduce Layer 2 fees. This development is expected to boost the ecosystem’s growth momentum and, undoubtedly, the price, including a handful of tokens related to Ether (ARB, OP, STRK, etc.).

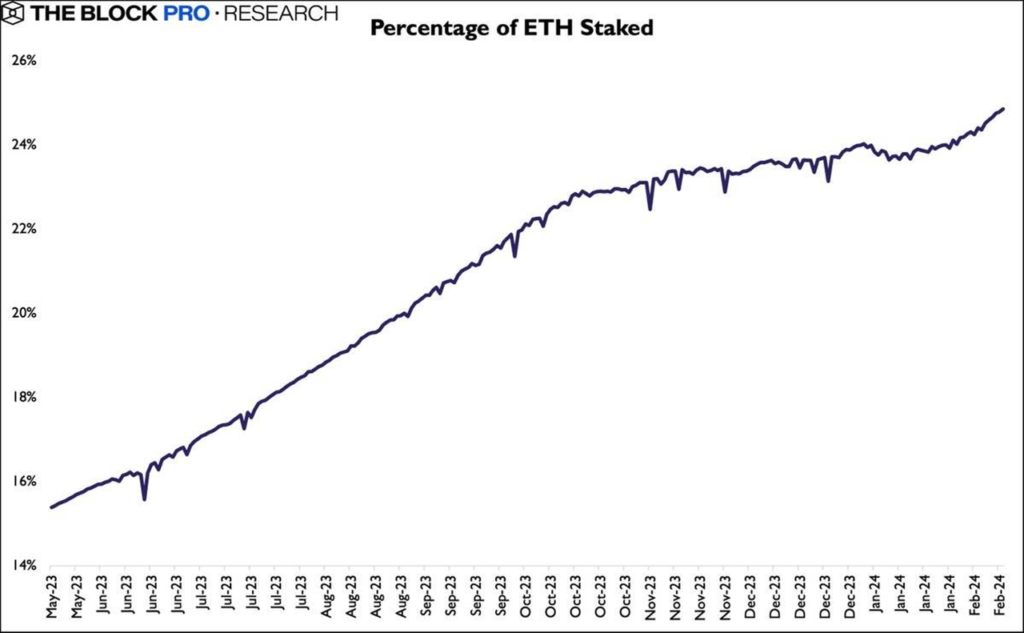

- Thirdly, the proportion of Ether being staked has reached an all-time peak of 25%, curbing supply and providing a potential prop for prices.

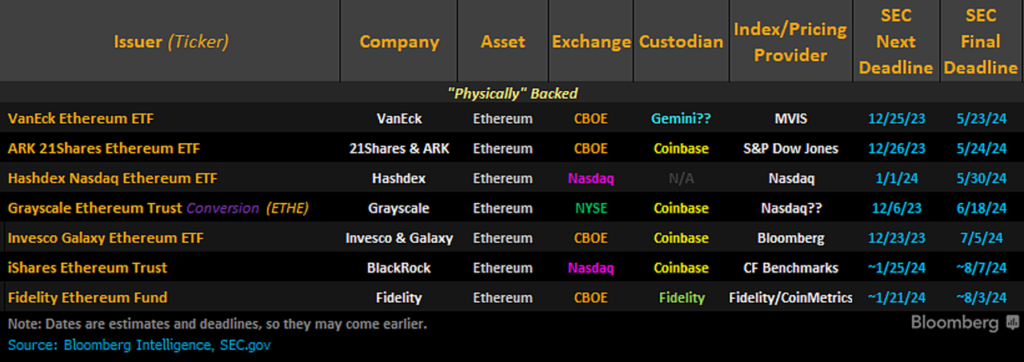

- Finally, the prospect of approval of spot Ethereum ETFs by the SEC in May. Bloomberg ETF analyst Eric Balchunas recently suggested a 70% possibility for approval by May 23 — the final deadline for the Securities and Exchange Commission to rule on a spot ether ETF application from Ark and 21Shares, the first that was filed. Moreover, financial institutions including Fidelity, BlackRock and Franklin Templeton have applied for a spot ether ETF over the last few months

3. The Future Prospects and Price Forecast:

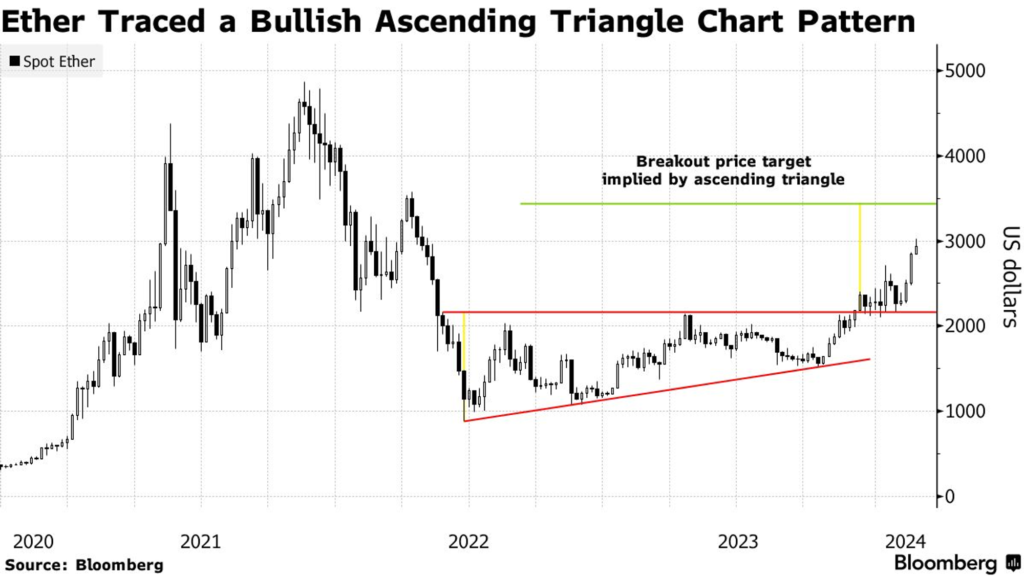

Standard Chartered Bank forecasts ETH could reach $4K (a 30% increase from its current price), drawing parallels with Bitcoin’s performance before the approval of its spot ETF.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.