1. Jito Overview

1.1. What is Jito?

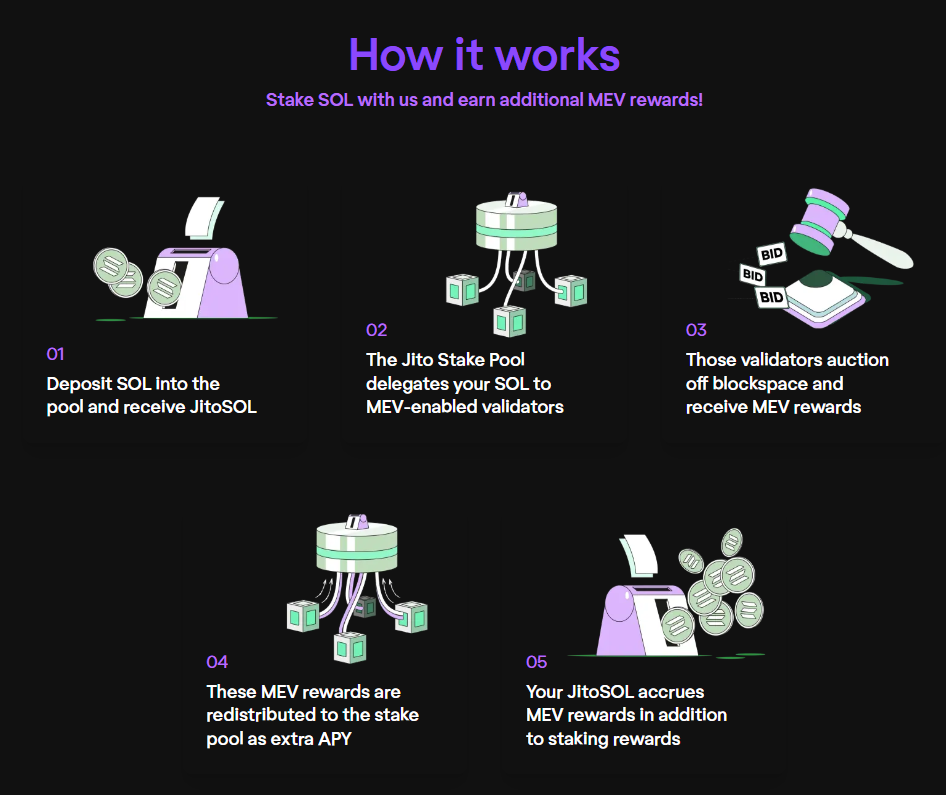

Jito is a liquid staking protocol designed to maximize returns for Solana stakers through staking rewards and MEV optimization. Users deposit SOL into Jito’s Stake Pool and receive jitoSOL, a liquid staking token that provides:

- Dual Yield: Combines traditional staking rewards with MEV rewards.

- DeFi Liquidity: Seamlessly integrates across DeFi platforms, allowing users to utilize their staked assets without locking them.

This innovative model sets Jito apart from traditional staking solutions, offering enhanced yields and flexibility to its users.

1.2. Team background

A technically proficient team leads Jito but lacks substantial expertise in finance and economics:

- Lucas Bruder (Cofounder & CEO): Former Firmware Engineer at Ouster, with deep experience in embedded systems and distributed automation.

- Zano Sherwani (Cofounder & CTO): Former Software Engineer at Parsec, with expertise in crypto analytics.

While the team excels in technical innovation, including venture capital partners has strategically addressed gaps in financial expertise.

1.3. Fundraising

While Jito’s leadership excels in technical innovation, gaps in financial and economic expertise have been bridged by strategic VC partnerships.

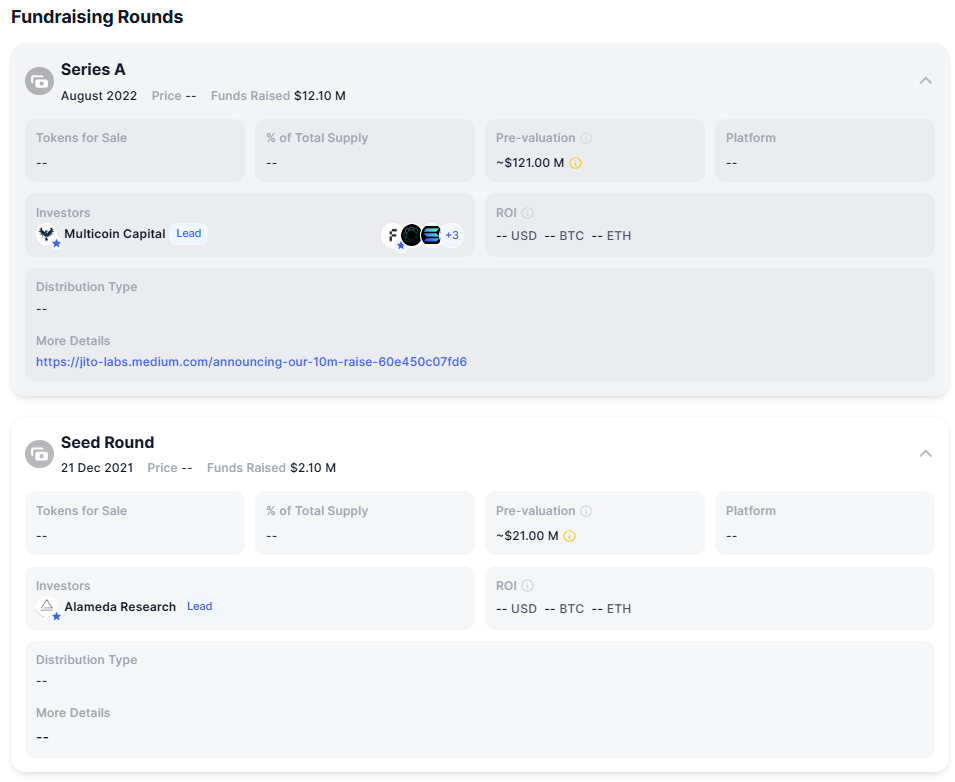

Jito has successfully raised $14.2 million across two funding rounds:

- Seed Round ($2M): Led by Alameda Research.

- Series A ($12M): Led by Multicoin Capital and Framework Ventures. Other notable VCs are Solana, Delphi Digital, Alameda Research, Robot Ventures,..

Notably:

- Delphi Digital: Tokenomics experts behind projects like Celestia and Injective.

- Robot Ventures: Specialists in economic system design for protocols like Optimism and LayerZero.

- Solana Foundation: Drives TVL growth and supports ecosystem expansion.

These partnerships ensure that Jito is well-positioned for long-term growth and operational scalability.

2. Featured Points

Jito’s success lies in its strategic validator partnerships and MEV-optimized infrastructure. By using specialized software, Jito validators enhance network efficiency while capturing MEV opportunities, benefiting both the network and stakers.

- Reduced Congestion: Fewer dropped transactions enhance network performance.

- Spam Deterrence: MEV optimizations discourage spam transactions, improving validator efficiency.

- Higher APY for Stakers: Distributed MEV rewards significantly boost staking yields.

Jito’s revenue is derived from traditional staking rewards and MEV income from validators running the Jito client. Fee Allocation:

- Labs currently take 5% of all fees (soon to be 6% per a recent governance proposal, split 3% to the DAO and 3% to Labs).

- The remaining 95% (soon 94%) of the value generated by the protocol accrues to SOL validators/tokenholders.

3. Growth Analysis

3.1. TVL

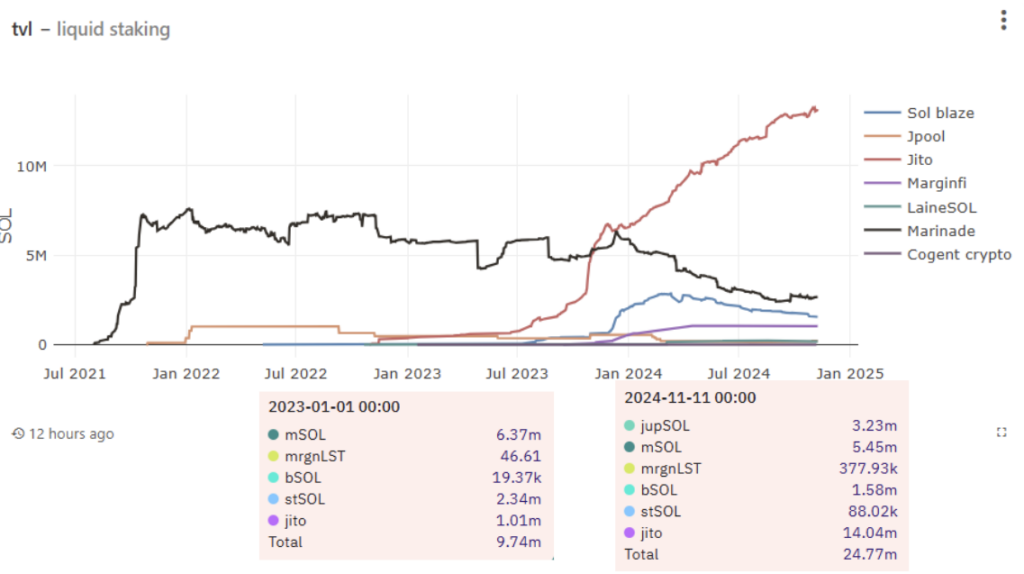

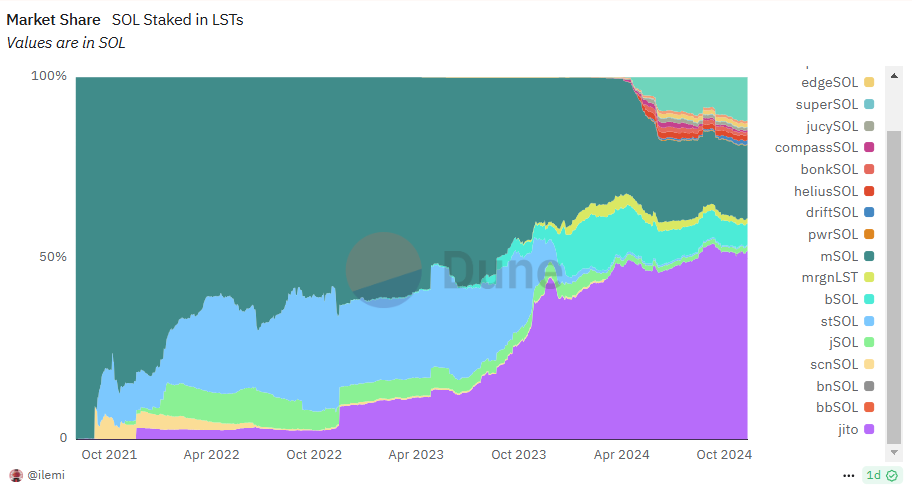

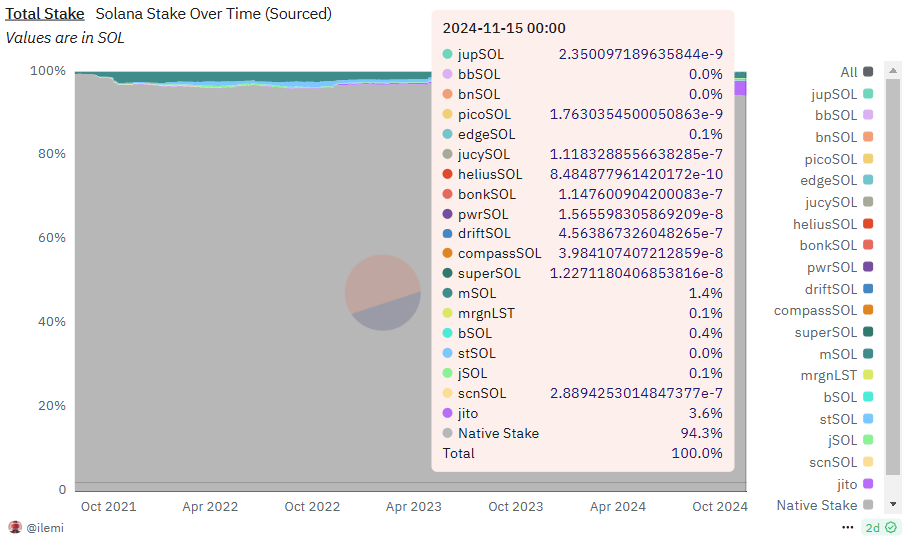

Jito has achieved 1,400% TVL growth since 2023, increasing from 1M SOL to 14M SOL staked by late 2024.

Its incentivization campaigns and strong backing from the Solana Foundation have enabled Jito to capture 46% of the liquid staking market, surpassing Marinade’s mSOL as the largest liquid staking protocol on Solana.

Despite its dominance in liquid staking, jitoSOL accounts for just 3.6% of Solana’s total network stake. This indicates that the liquid staking market is still in its early stages, with significant growth potential for Jito.

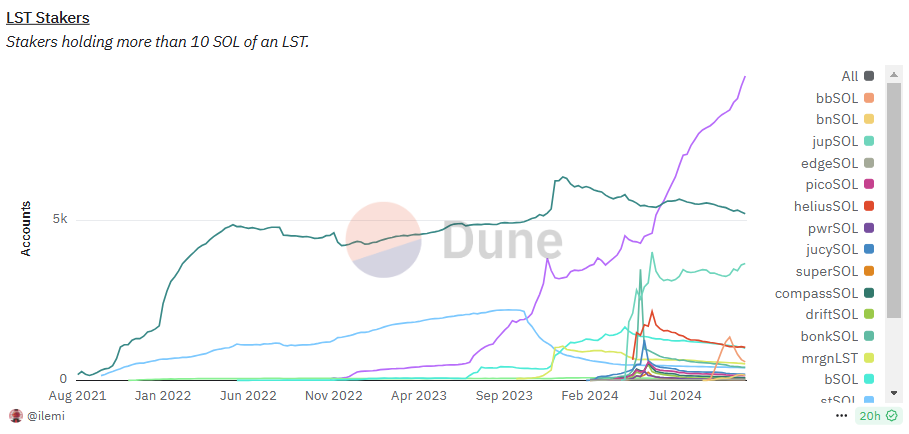

The number of Solana stakers holding more than 10 SOL has increased by 194% YTD, rising from 3.2K to 9.5K. This growth demonstrates Jito’s strong adoption among both retail and institutional participants.

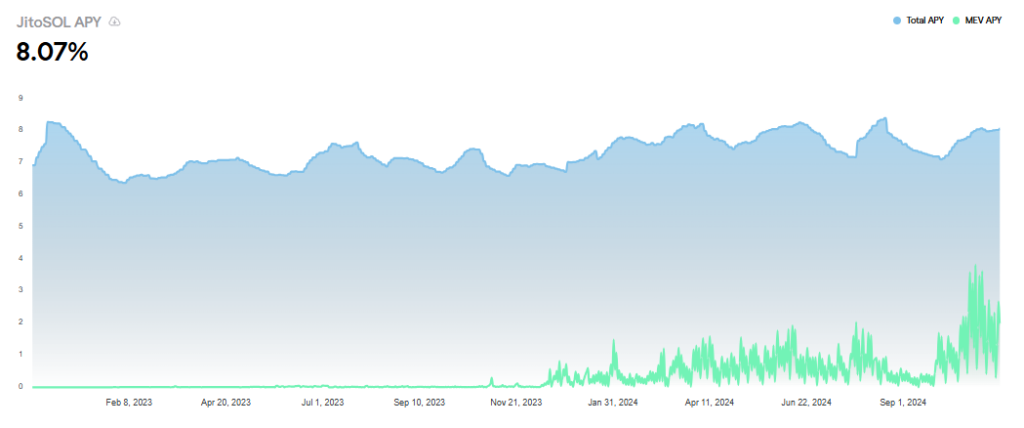

3.2. APY

Jito offers a competitive APY range of 7.1%–8.4%, enhanced by MEV rewards. This outpaces many traditional staking options, attracting both retail and institutional participants.

3.3. Validtor tips

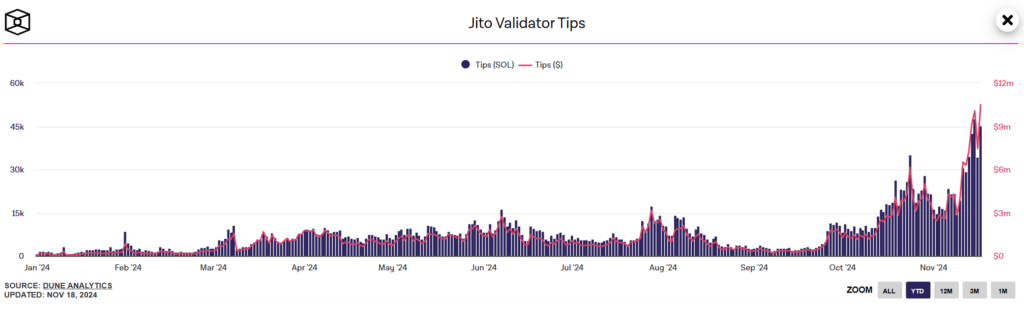

Jito’s revenue is bolstered by booming activity in Solana’s ecosystem, particularly driven by AI memecoin and DeSci trends. Validator tips have reached record highs, showcasing the value of Jito’s MEV optimization:

- November 17, 2024: Tips peaked at $10.5M, a new all-time high.

- October 24, 2024: Previous ATH of $6.14M was surpassed, reflecting rapid growth.

This consistent revenue stream underscores the scalability and profitability of Jito’s business model.

4. Tokenomics

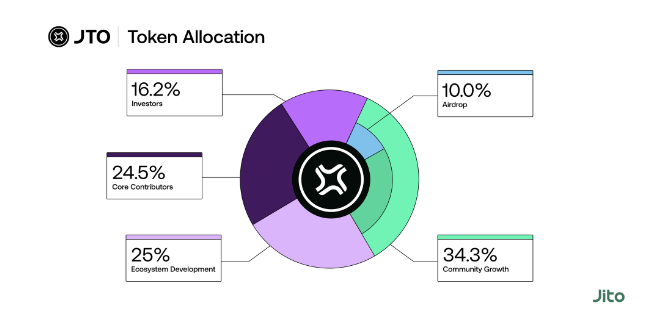

4.1. Token allocation

Total supply: 1B JTO

- Community Growth: 34.3%

- Ecosystem Development: 25%

- Core contributors: 24.5%

- Investors: 16.2%

- Airdrop: 10%

4.2. Token schedule

Circulating supply: 175.7M JTO

Upcoming Unlock: On December 7, 2024, JTO’s circulating supply will double with the release of 150.4M tokens (15% of total supply).

This significant increase is expected to create short-term downward price pressure as the market absorbs the influx. Early investors stand to realize 47x returns at the current price of $0.0617, making this an attractive exit point for some holders.

To mitigate the impact of token unlocks, the remaining allocations will be distributed incrementally over two years at a rate of 11.2M tokens per month.

5. Competitive Landscape

Jito competes with Marinade and Sanctum, two significant players in Solana’s liquid staking ecosystem.

- Marinade: Marinade leverages Jito Validators to boost performance, allowing its stakers to benefit from MEV rewards, offering yields similar to Jito’s model.

- Sanctum: Sanctum differentiates itself by offering tools that simplify the creation of liquid staking tokens for other projects. This flexibility has enabled platforms like Helius (RPC Nodes), Bonk (memecoin), and Jupiter (DEX aggregator) to design and deploy their liquid staking solutions, broadening Sanctum’s ecosystem reach.

| Jito | Marinade | Sanctum | |

| SOL staked | 14m | 8.1m | 7.4m |

| Market share | 46% | 26.7% | 24.3% |

| YTD Growth | 118% (from 6.4m SOL staked | -28% (from 11.3m SOL staked) | 3500% (from 202k SOL staked) |

| APY | 8.3% | 9.5% | Varies |

Key observations:

- Jito is the clear market leader, combining robust growth, strong MEV optimization, and significant market share. Its success is tied to its innovative technology and strategic partnerships.

- Despite offering a higher APY, Marinade’s declining AUM and shrinking market share suggest it is losing ground to Jito’s dominance.

- Sanctum has carved out a unique position by enabling custom liquid staking solutions, but its market share remains constrained despite extraordinary growth.

6. Closing thoughts

Jito Network has firmly established itself as one of the most influential protocols within the Solana ecosystem, excelling across critical metrics such as TVL growth, liquid staking market share, and revenue generation.

However, the December 2024 token unlock introduces near-term risks, with short-term price volatility likely as early investors seek liquidity (47x). Despite this, Jito remains a high-risk, high-return investment with substantial upside for those confident in Solana’s ecosystem growth.

Investors must weigh Jito’s strengths—market leadership, innovative technology, and consistent revenue—against its risks, including tokenomics, competition, and execution challenges. As always, due diligence is key to navigating this promising yet complex opportunity.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.