In the burgeoning world of decentralized finance (DeFi), the comparative analysis of platforms such as Jito and Marinade offers intriguing insights into market dynamics and valuation discrepancies. This article delves into the financial structures and market performances of both entities, highlighting Jito’s substantial market capitalization and Total Value Locked (TVL) compared to Marinade. Despite Jito’s seemingly overvalued status, as indicated by a high entry price set by venture capitalists at $0.8 per token, it boasts robust technological advancements and substantial venture capital backing. On the other hand, Marinade struggles with technological differentiation and lacks significant venture capital support, which could hinder its market competitiveness. Through a detailed examination of their revenue models, liquidity, and competitive advantages, this analysis aims to provide a clear perspective on their positioning within the DeFi ecosystem.

I. Executive Summary

- Although Jito possesses a higher Market Capitalization/ Total Value Locked (TVL) than Marinade, it does not necessarily imply that Marinade is undervalued.

- Jito’s valuation appears overvalued relative to the entry price set by venture capitalists, standing at $0.8 per token.

- Marinade faces a limited probability of success due to its absence of competitive technological advantages and lacking support from venture capitalists.

II. Jito vs Marinade

1. Jito

How Jito makes money

Jito generates revenue by charging an annual management fee, which amounts to 4% of the total rewards (staking and MEV rewards). This fee is extracted after deducting the validators’ commissions, translating to roughly 0.3% of the deposited SOL’s value per year. Moreover, Jito imposes a 0.1% withdrawal fee for users who choose to directly unstake their SOL via the Jito website.

Competitive Advantage

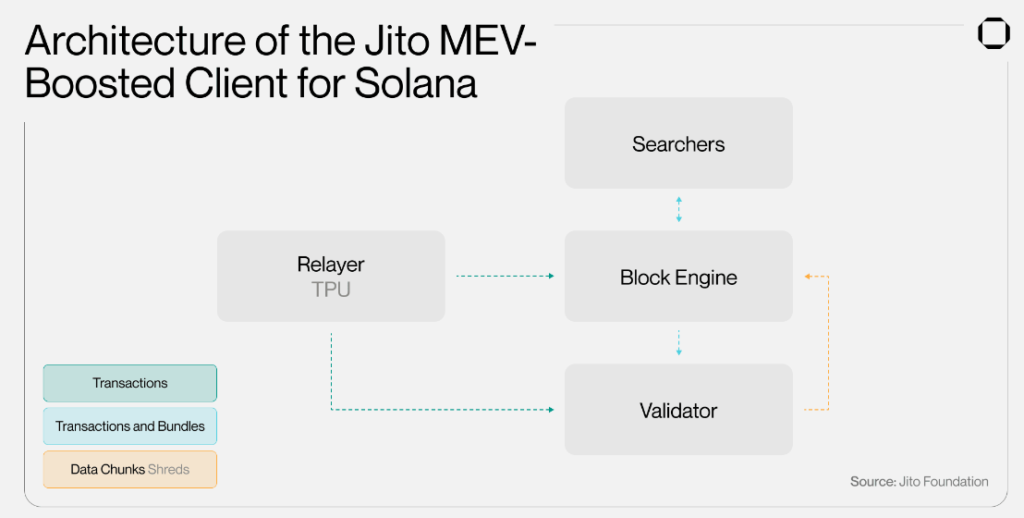

MEV (Maximal Extractable Value) was a major issue on the Solana blockchain due to the spamming of transactions by MEV searchers. This congestion resulted in decreased usability for users. Jito addressed this with their Jito-Solana validator client, a specialized software. It offers three key features: Bundles, grouping transactions to streamline processing; Block Engine, facilitating an off-chain auction to prioritize transactions; and Relayer, filtering and verifying transactions before submission to validators. These innovations alleviate network congestion and enhance transaction efficiency, ultimately improving the Solana ecosystem’s performance. Jito’s solution revolutionizes how MEV issues are managed on Solana, benefiting both validators and users alike.

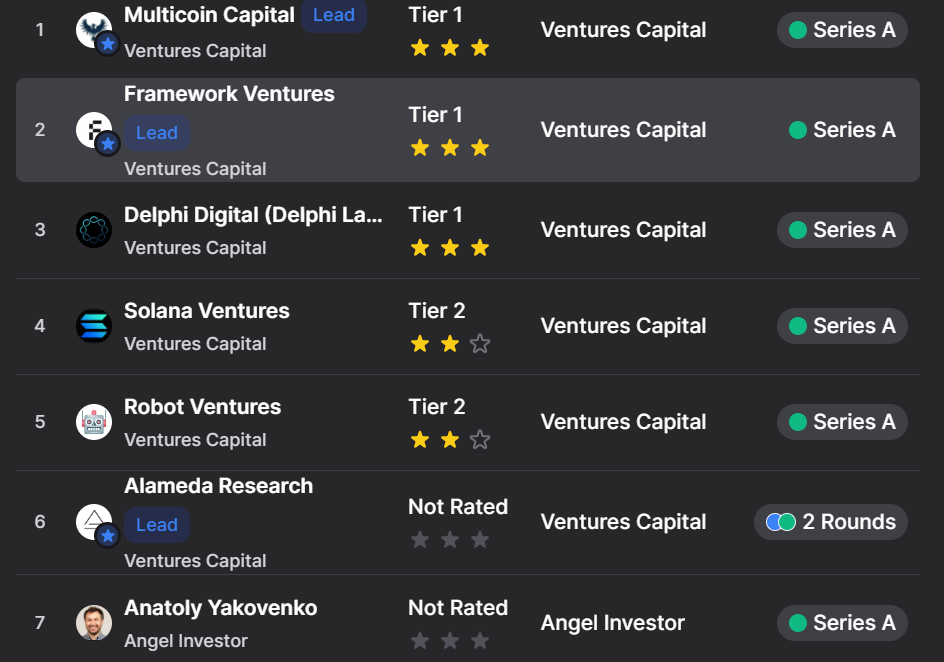

VC Backers

Jito secured a venture capital investment of $14.2 million, with an estimated acquisition price of $0.8 USD per token for the funds. Multicoin Capital, a prominent Tier 1 investor in Jito, boasts a strong reputation and extensive investment acumen. Additionally, Anatoly Yakovenko, the founder of Solana, has invested in the project, indicating a significant endorsement. Given Yakovenko’s association with Solana and the close relationship between the two entities, it is reasonable to expect substantial support from Solana for Jito, further bolstering its prospects.

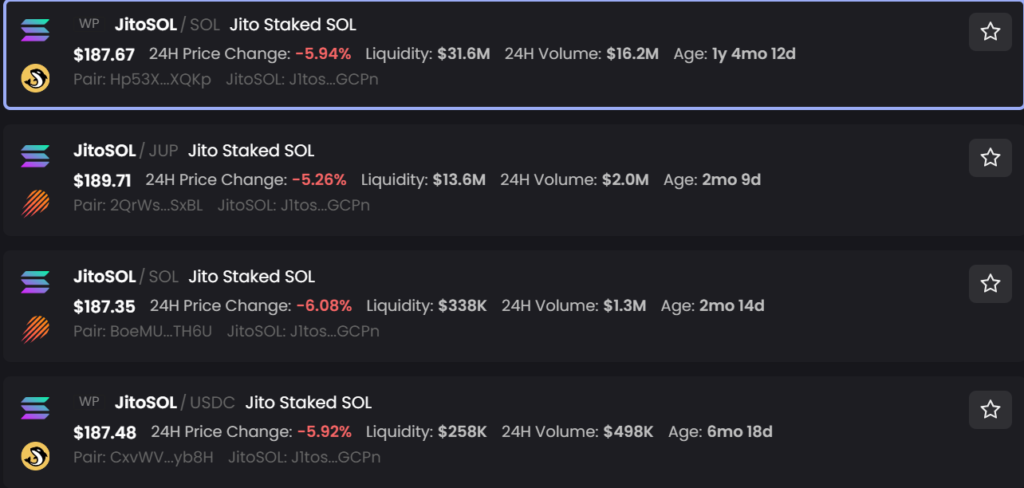

Liquidity of JitoSol

Based on our analysis, the liquidity of JitoSol stands at approximately $46 million, indicating a lower risk profile compared to Marinade.

2. Marinade

How Marinade makes money

Marinade implements a continuous management fee of 0.42% per annum, directed towards sustaining ongoing product development initiatives. This fee is automatically deducted from staking rewards, accounting for 6% of the total rewards earned.

Competitive Advantage

The protocol offers a staking Annual Percentage Yield (APY) that is 8.45% higher than that of its competitors. Nevertheless, it lacks technological enhancements aimed at maximizing profits for both validators and traders.

VC Backers

Based on our assessment, Marinade Finance has not secured funding from venture capitalists, resulting in a lack of technological support and stability in token pricing.

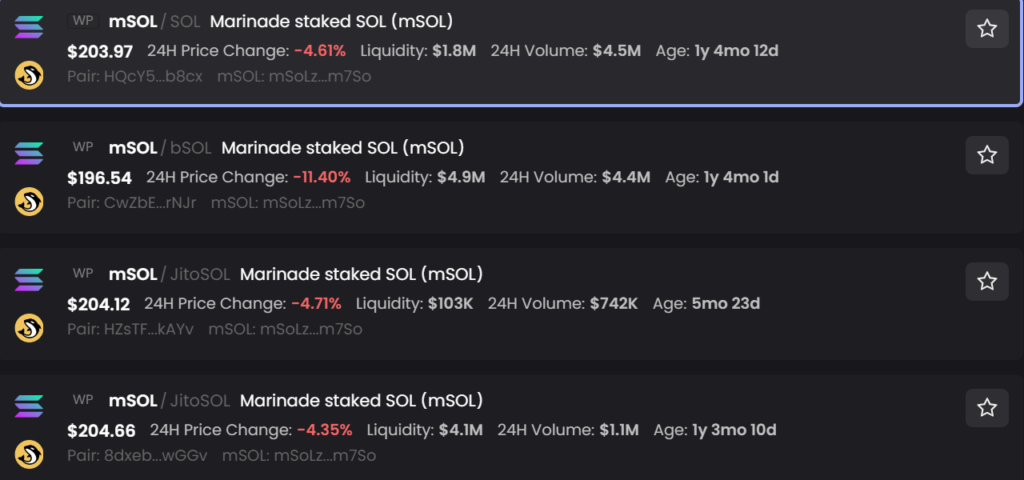

Liquidity of mSol

Based on our analysis, the liquidity of mSol stands at approximately $10 million, indicating a higher risk profile.

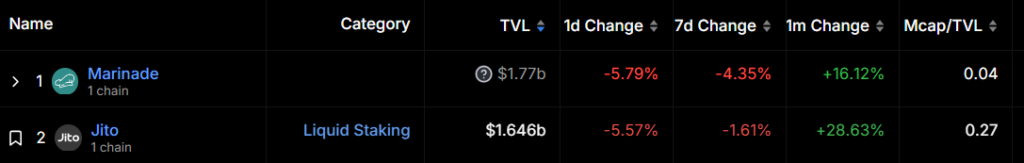

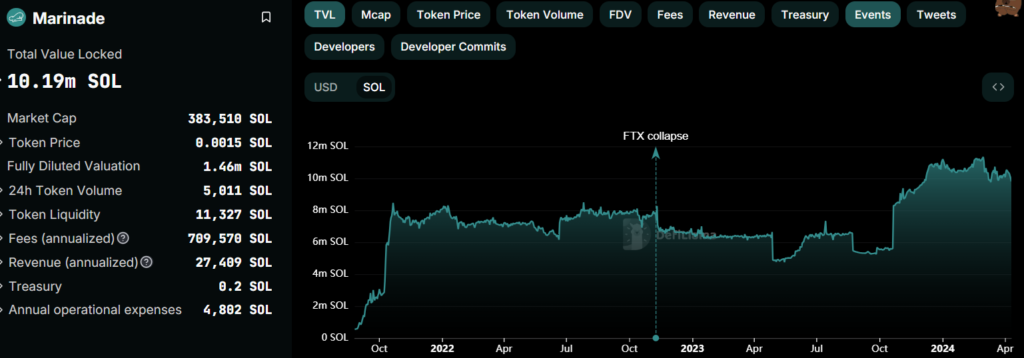

3. Market cap/ TVL

Although Marinade exhibits a lower Market Capitalization/ Total Value Locked (TVL) and holds a TVL similar to that of Jito, it would be inaccurate to assert that Marinade is undervalued. The key determinant here is the TVL metric. Despite both platforms having equivalent USD volume, Jito has experienced a notable uptick in SOL volume, while Marinade’s SOL volume has remained relatively stagnant. This suggests that the majority of Marinade’s TVL increase is primarily driven by the appreciation of SOL’s value, whereas Jito’s growth is attributed to increased user participation in staking activities.

Nevertheless, despite the trading price of $3.85 USD per token, Jito’s valuation remains notably elevated compared to the venture capital acquisition price of $0.8 USD per token. Conversely, Marinade’s token is currently valued at $0.2 USD, and our analysis suggests limited potential for significant price appreciation in the foreseeable future.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.