Base, Coinbase’s Layer 2 solution built on the Optimism stack, has witnessed explosive growth, positioning itself as one of the leading Layer 2 (L2) networks. With a unique strategic advantage and optimized performance, Base has attracted significant attention from both builders and investors. In this blog, we will analyze key metrics driving Base’s rise.

1. State of Base Network

All metrics below reflect sustained Base’s growth, despite the recent market crash, signals robust user adoption and increasing its network activity.

This should be closely monitored by investors and builders alike.

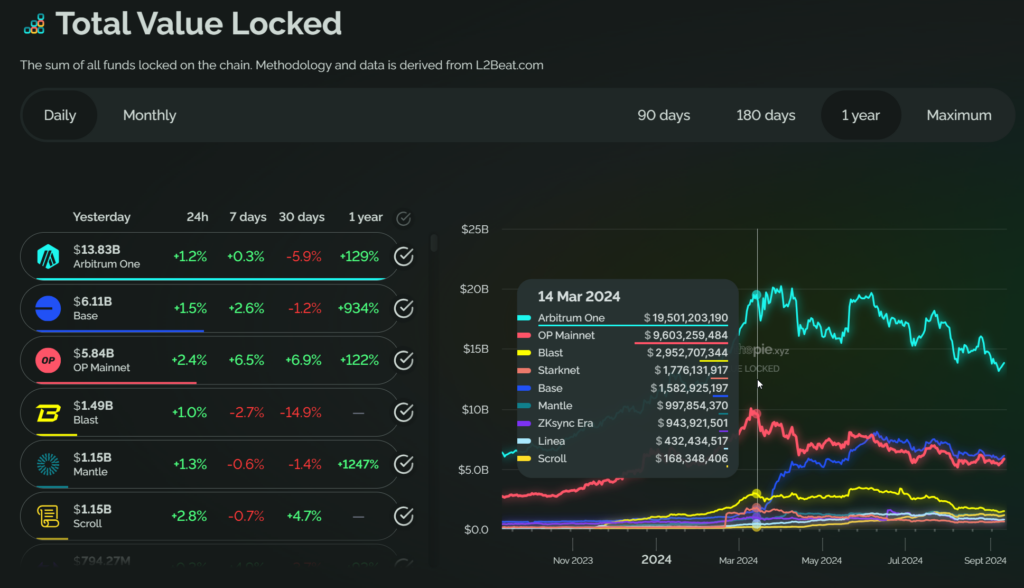

1.1. Total Value Locked

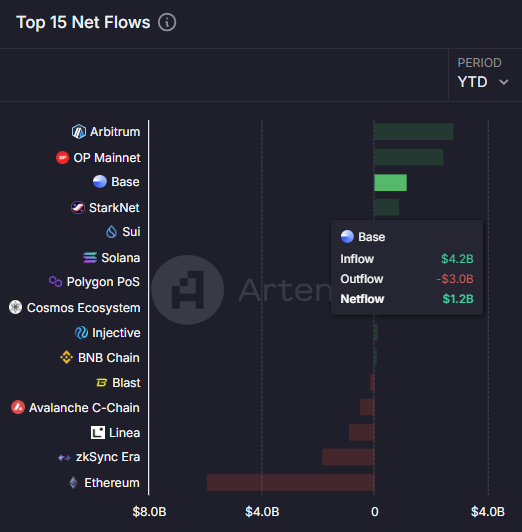

Base’s TVL currently stands at an impressive $6B, marking a 700% year-to-date (YTD) increase. Since June 7th, the network’s TVL surpassed $8B, overtaking Optimism to become the largest chain within the Superchain ecosystem. It is now the second-largest Ethereum scaling solution, only trailing Arbitrum One’s $13.2B TVL.

1.2. Total Value Bridged, Stablecoin

Ethereum remains the largest coin by canonically bridged value at $1.2B, highlighting strong liquidity migration from Ethereum’s main net.

Meanwhile, USDC has emerged as the largest stablecoin by natively minted value, with a circulating supply of $3.2B on Base. USDC’s supply has grown by an astonishing 2100% YTD, emphasizing its critical role in the Base ecosystem.

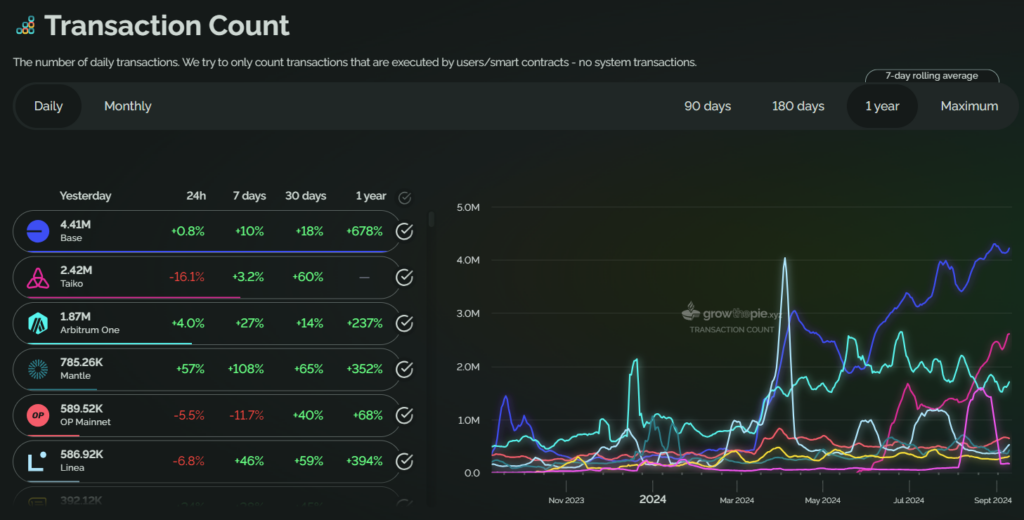

1.3. Daily Transactions

Base consistently handles over 4 million daily transactions since mid-August, showcasing faster growth than other L2 solutions like Arbitrum and Optimism. The transaction count has surged by over 1000% YTD, placing Base at the forefront of Ethereum L2 scalability solutions. This transaction growth is fueled by high DeFi activity, including trading of memecoins, DEX, liquidity providing, NFT, etc,…

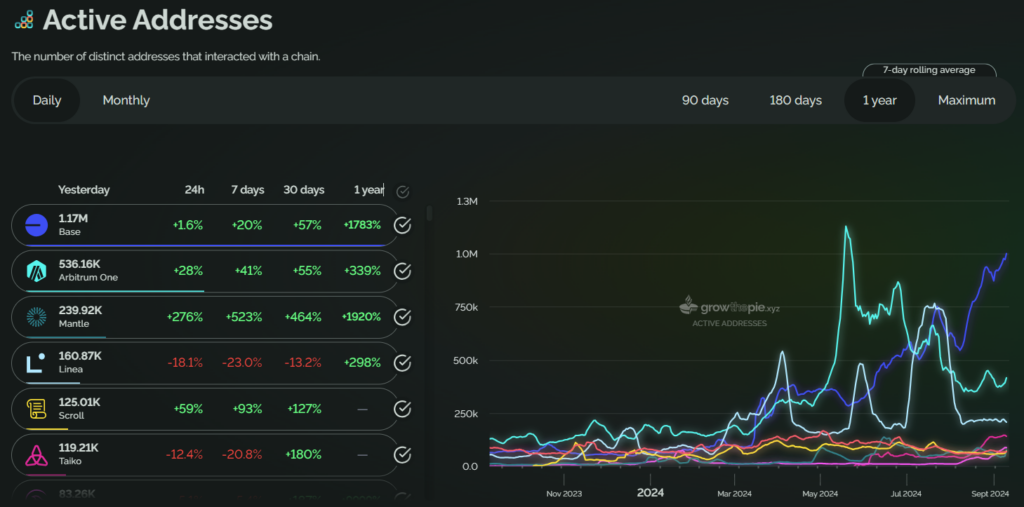

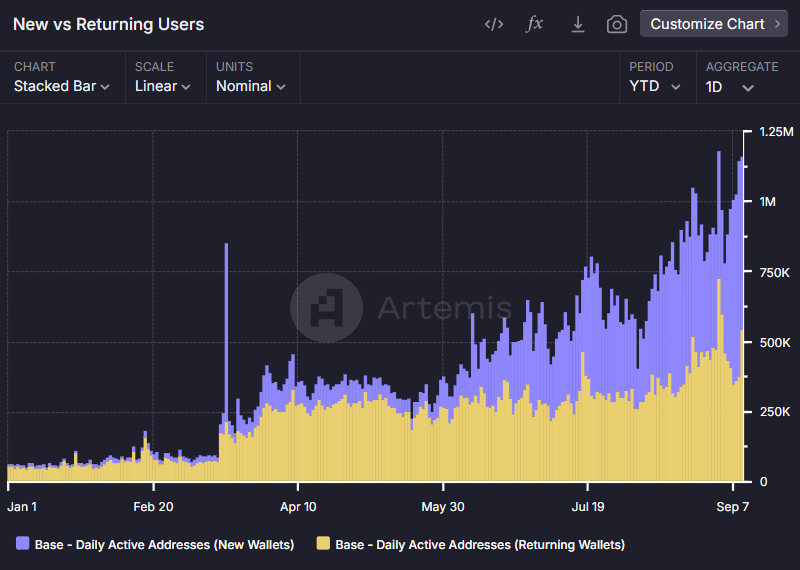

1.4. Daily Active Addresses

Base has experienced a dramatic rise in daily active addresses, surpassing 500k by August 5th and peaking at 1 million by late August. This surge was partly driven by the launch of the “basenames” service on August 21st, which saw over 200,000 basenames minted.

At the same time, Base has witnessed a significant surge in new users, particularly in recent months. This surge underscores Base’s ability to create compelling narratives that resonate with both investors and developers.

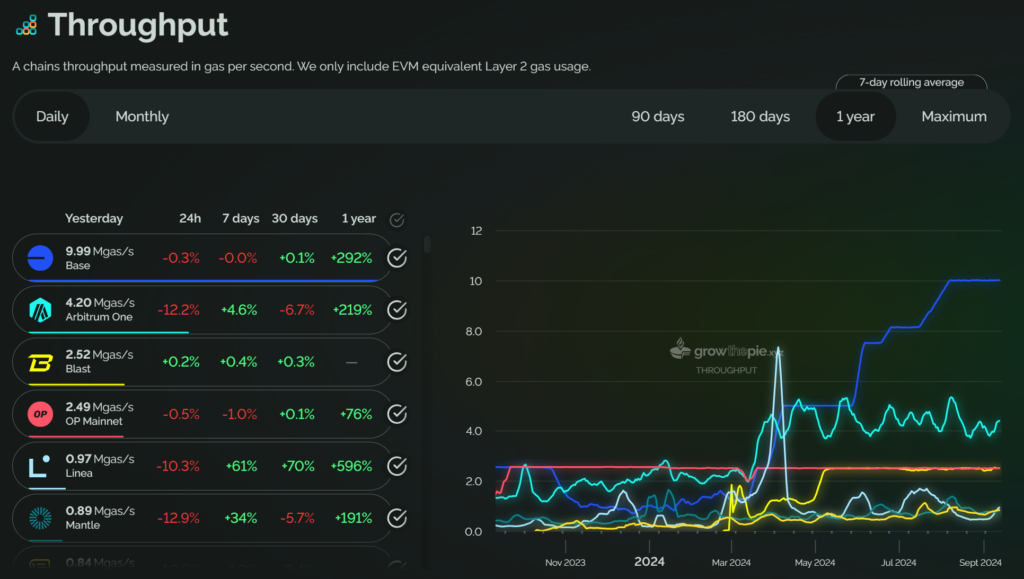

1.5. Throughput

Since its launch, Base has scaled its throughput by 4x, increasing the gas target per block from 2.5 Mgas/s to 10 Mgas/s. The network is poised for further scaling, with the core team committed to raising the gas target by 1 Mgas/s each week starting in late September.

2. Growth drivers for Base Network

Several factors are fueling Base’s meteoric rise. Understanding these drivers is crucial for investors seeking to capitalize on the network’s growth.

2.1. Dencun Upgrade

Ethereum’s Dencun upgrade, introduced in March 2024, has significantly reduced Layer 2 gas fees by decoupling them from Ethereum mainnet fees. This decoupling has allowed Base to reduce transaction costs by 650x, making it the most optimized low-fee L2 chain.

Lower gas fees and high throughput attract high transaction volumes, particularly from trading activities (e.g., memecoins, MEV bot, market making). Consequently, this makes it an attractive environment for both retail and institutional participants.

2.2. Coinbase’s Strategic Advantages

As the brainchild of Coinbase, Base enjoys unique advantages over its competitors, such as:

- Seamless user onboarding: Coinbase’s 100M+ retail users can easily transfer assets to Base without the need for third-party bridges, making it simpler for newcomers to enter the world of decentralized finance.

- Enhanced security: Coinbase’s reputation as a regulated entity provides an additional layer of trust, which is a crucial differentiator in a market often plagued by security concerns.

In addition to the seamless onboarding of millions of retail users, Base benefits from a highly experienced core team, meticulously selected from Coinbase. These experts bring extensive knowledge and expertise, ensuring that Base’s ecosystem is built with strong fundamentals and innovative solutions. This leadership is key to driving Base’s mission for 2024: to build a global onchain economy that fosters innovation, creativity, and freedom, ultimately bringing a billion people into the crypto space.

Base’s 2024 strategy is structured around four key pillars, each representing a focused effort toward building a robust onchain economy:

- Decentralize and scale: Enable everyone, everywhere, to easily access and engage with onchain activities.

- Developer empowerment: Build a powerful developer platform that provides the tools necessary for anyone to create world-class onchain products.

- Ecosystem nurturing: Support a vibrant ecosystem of apps that offer consumers, creators, and businesses meaningful reasons to engage with onchain experiences.

- Deep capital markets: Foster the development of interconnected capital markets that power the onchain economy, ensuring liquidity and sustainable growth.

A prime example of the successful execution of Base’s strategic vision is Onchain Summer 2024, an annual event designed to spotlight thousands of onchain builders and creators. Onchain Summer serves as a showcase of Base’s capabilities and its potential to onboard new users.

Notable highlights from Onchain Summer 2024:

- Generated over $5M in mint revenue for builders, creators, and projects.

- Attracted 2M+ unique wallets to participate in onchain experiences, an 8x increase from the previous year.

- Facilitated the minting of over 24M onchain assets, reflecting the growing demand and engagement with Base’s ecosystem.

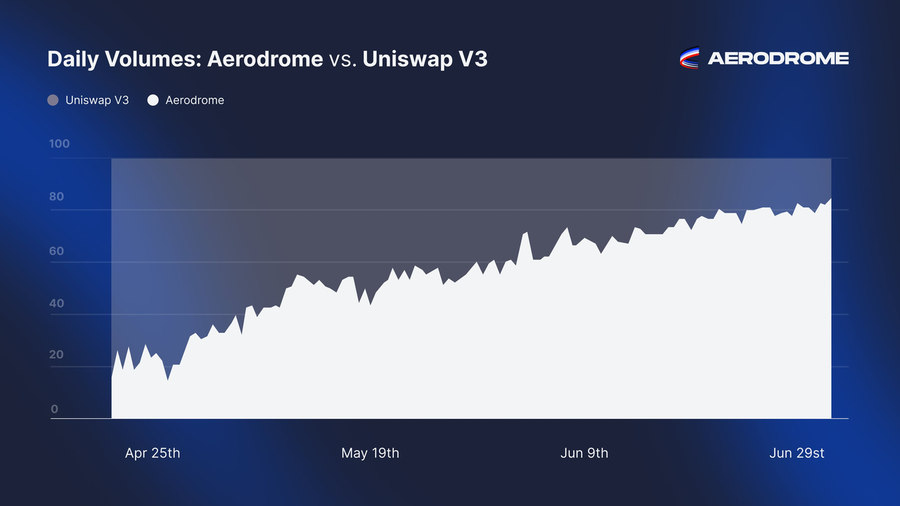

2.3. Aerodrome – An innovation DEX

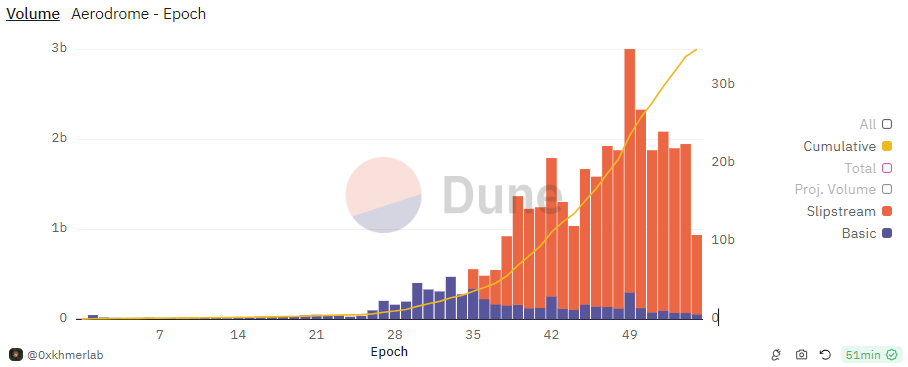

Aerodrome, native DEX on Base, introduces innovation through its Slipstream concentrated liquidity pools, offering higher rewards and capital efficiency for liquidity providers (LPs). This mechanism ensures that LPs can focus their liquidity within specific price ranges, optimizing their returns.

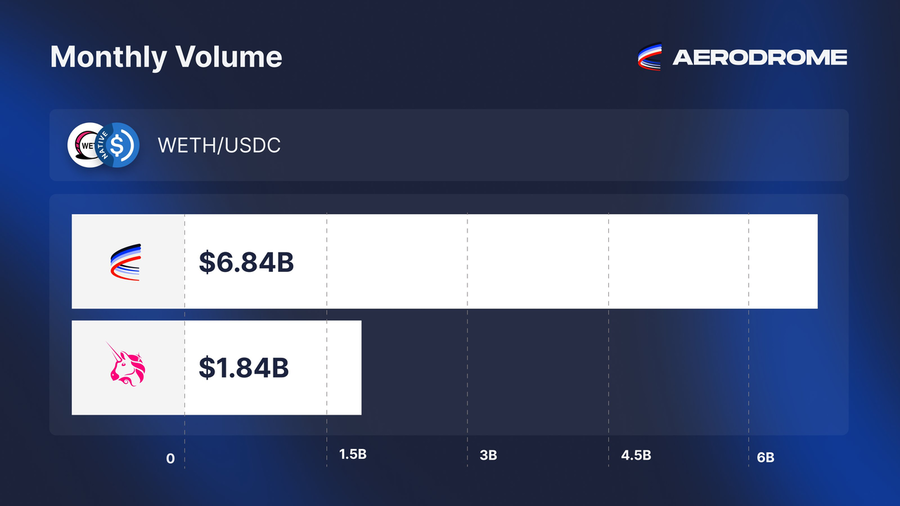

Impressive number since the launch of Slipstream on Apr 25 (epoch 35):

- Aerodrome captures over 80% of the trading volume on Base, and 85% of the volume flows through capital efficient Slipstream pools.

- Slipstreams accounted for 72% of the volume on the crucial WETH – USDC pair in August, recording $6.84B compared to UniV3’s $1.84B.

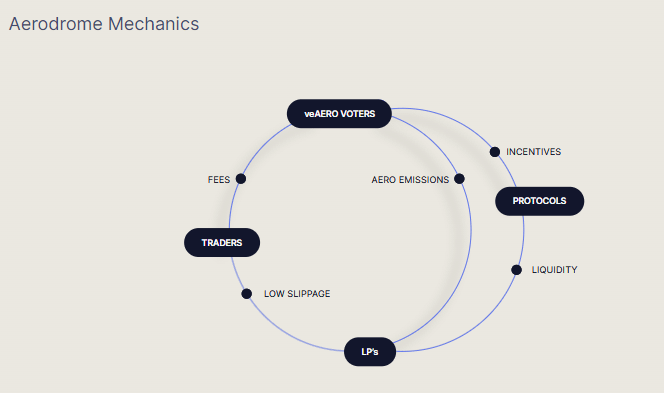

As Slipstream pools win on volume and fees, LPs see increasing $AERO rewards directed by veAERO voters. This dynamic sets off a powerful flywheel effect:

- $AERO rewards attract liquidity → high liquidity drives more trading volume → volume generates higher fees → fees attract more veAERO votes, further reinforcing liquidity flows.

This cyclical mechanism allows Aerodrome to continuously scale its dominance within the Base ecosystem. In particular, memecoins and WETH-USDC pairs are well-positioned to benefit from this flywheel effect

3. Closing Thought

From an investor’s standpoint, Base is uniquely positioned to become a dominant player in the Layer 2 ecosystem. Its rapid growth in TVL, daily transactions, and user adoption, combined with its strong alignment with Coinbase, sets it apart from competitors. Base’s innovative approach to reducing gas fees, its seamless integration with Coinbase’s platform, and its mission to build a global chain economy offer clear paths for future expansion.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.