DEXs are the backbone of the DeFi ecosystem, enabling permissionless trading, liquidity provision, and governance without centralized intermediaries. As the DeFi landscape evolves, the design, management, and distribution of tokenomics have emerged as critical factors driving the long-term success of DEX platforms.

Aerodrome is a ve(3,3) MetaDEX on Base. MetaDEX distinguishes itself with its innovative token model, merging the best features from Uniswap and Curve Finance. This approach sets a new standard for balancing liquidity incentives, governance, and sustainable growth in the DEX sector. In this blog, we will discuss more details.

1. Landscape of DEX Token Design

1.1. Challenges Inherent in DEX Tokenomics

The tokenomics models employed by many DEXs present significant challenges:

- Short-Term Liquidity Mining: DEXs rely heavily on liquidity mining through token emissions to attract liquidity providers (LPs). However, this model can foster a short-term mindset among LPs, who withdraw liquidity when token rewards diminish, creating volatility and instability in liquidity pools.

- Token Inflation: Continuous token emissions can lead to inflationary pressures, diluting the value of the native token. DEXs that lack mechanisms such as token burns, buybacks, or capped emissions are particularly susceptible to this challenge, which can erode long-term token holder value.

- Governance Centralization: Governance models that tie voting power to token ownership may unintentionally centralize control. Large holders can exert disproportionate influence over key decisions, including the allocation of liquidity incentives, which risks undermining the decentralized ethos of these platforms.

1.2. Key Success Factors for DEX

A successful DEX needs to meet several critical requirements:

- Deep Liquidity and High Trading Volume: Liquidity is the lifeblood of any exchange. Without sufficient liquidity, traders face high slippage, reduced trading efficiency, and lower platform adoption. Attracting and retaining liquidity providers through well-designed incentives is paramount.

- Effective Tokenomics: The native token must serve dual purposes—providing liquidity incentives while ensuring decentralized governance. Tokenomics should balance immediate rewards with long-term engagement to avoid speculative short-term participation.

- Equitable Value Distribution: To foster long-term engagement, a DEX must ensure that the value generated by the platform, such as trading fees, staking rewards, and governance benefits, is distributed fairly among all stakeholders. This alignment of interests encourages sustained participation and fosters a vibrant, growth-oriented ecosystem.

2. MetaDEX’s Innovative Token Model

MetaDEX introduces a novel token model that addresses many of the shortcomings seen in current DEX tokenomics, positioning itself as a leader in the next generation of DEX.

2.1. At the core of MetaDEX is the AERO/veAERO token

AERO serves multiple critical functions:

- Liquidity Incentives: AERO is distributed to liquidity providers as a reward for contributing liquidity to the protocol’s pools. This mechanism ensures that MetaDEX can attract and retain liquidity providers, creating deep liquidity pools that facilitate efficient trading with minimal slippage.

- Governance via veAERO: AERO holders can lock their tokens to receive veAERO (voting-escrowed AERO), granting them governance rights. Through veAERO, users can vote on key protocol decisions, including the allocation of AERO emissions to liquidity pools. This structure allows for a decentralized decision-making process in managing liquidity incentives.

2.2. The veAERO token is central to MetaDEX’s governance and value distribution model

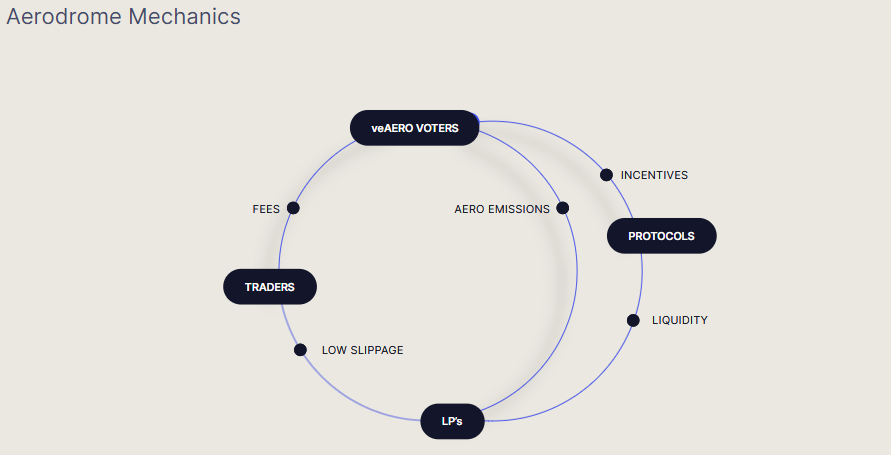

By locking AERO tokens into veAERO, participants not only gain governance power but also access 100% of the value generated by the platform. This value is derived from trading fees and other incentives, creating a feedback loop that reinforces protocol growth:

- Liquidity providers stake AERO and convert it into veAERO, gaining governance power.

- veAERO holders vote to direct AERO emissions to specific liquidity pools, boosting liquidity where it’s most needed.

- Increased liquidity enhances trading conditions, leading to more trading fees and volume.

- All generated fees are distributed back to veAERO holders, incentivizing further governance participation and long-term engagement.

This flywheel effect ensures that MetaDEX remains liquid and governed by its users, fostering a robust and sustainable ecosystem.

2.3. Comparison with Major DEXs: Uniswap and Curve

To fully appreciate MetaDEX’s innovations, it is instructive to compare its tokenomics model with those of industry leaders Uniswap and Curve.

| Uniswap | Curve | MetaDEX | |

| Token Design | Uniswap’s model is simple. Uniswap’s governance token UNI primarily grants voting rights on protocol upgrades and changes. | Curve’s model is complex.veCRV holders lock their CRV tokens to vote on emissions, deciding which liquidity pools receive rewards. To attract valuable veCRV votes, many protocols resorted to bribing veCRV holders directly to attract liquidity to their own tokens, adding another layer of value to the CRV token. | Combining the best features from Curve and UniswapUniswap V3: Concentrated liquidity (clAMM) for LPsCurve: Incentivization model |

| Value Management | LPs receive 100% of trading fees. UNI holders do not directly benefit from trading fees, limiting the token’s ability to capture value for long-term holders. | LPs earn a mix of trading fees and emissions, with each comprising 50%. | Unlike Uniswap, which lacks direct value capture for token holders, and Curve, which partially retains value, MetaDEX distributes 100% of trading fees and rewards to veAERO holders. This complete value distribution aligns user incentives with platform growth, making it more attractive for long-term engagement. |

3. Conclusion

MetaDEX is unlocking the future of DEX tokenomics with its innovative token model. By combining complete value distribution, active governance participation, and sustainable liquidity incentives, MetaDEX offers a compelling alternative to established DEXs like Uniswap and Curve. For traders, MetaDEX represents an opportunity to participate in a platform that prioritizes long-term engagement, value sharing, and decentralized control – key elements for the future of DeFi.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.