Author: Levi

1. Introduction

Stablecoins have revolutionized the cryptocurrency landscape by providing a stable and reliable digital asset amidst the often tumultuous volatility of the market. These cryptocurrencies are anchored to various external assets, ranging from traditional fiat currencies to commodities, ensuring their value remains constant. While the dominance of USD-pegged stablecoins is evident, there lies an untapped potential in non-USD pegs that offers unique opportunities for the global financial ecosystem.

2. What Are Stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a steady value. This is achieved by linking the value of stablecoins to external assets, such as traditional fiat currencies like the US Dollar (USD), Euro (EUR), or commodities like gold.

There are four main types:

- Fiat-Collateralized: Backed by fiat currency reserves (e.g., USDT, USDC).

- Crypto-Collateralized: Backed by other cryptocurrencies (e.g., DAI).

- Commodity-Collateralized: Backed by physical assets (e.g., Tether Gold).

- Algorithmic: Controlled by algorithms (e.g., Terra UST).

The pegging mechanism ensures a consistent value, increasing reliability as a unit of account and store of value compared to other cryptocurrencies. Through this pegging, stablecoins offer individuals and businesses a means to reduce exposure to crypto market volatility. They function as a reliable medium of exchange, a unit of measurement for decentralized applications, and a tool for transferring value across borders without the price fluctuations seen in other cryptocurrencies.

Types of Stablecoins Not Tied to USD

- Pegging to Another Currency (e.g., Euro, Yen): Non-dollar stablecoins can be pegged to other major fiat currencies, such as the euro (EUR) or Japanese yen (JPY). These stablecoins would be designed to maintain a 1:1 value ratio with the chosen currency. Users can benefit from having stablecoins denominated in their preferred currency, making it easier to hedge against currency fluctuations or access financial services denominated in that currency.

- Pegging to Commodities (e.g., Gold): Some stablecoins are pegged to commodities like gold. The stablecoin issuer holds a reserve of the underlying commodity (e.g., physical gold) as collateral for the stablecoin issuance. This type of stablecoin offers exposure to the value of the commodity while maintaining stability relative to it. Gold is the most popular choice for collateralization. Notable examples of gold-backed stablecoins include Tether Gold (XAUT) and Paxos Gold (PAXG).

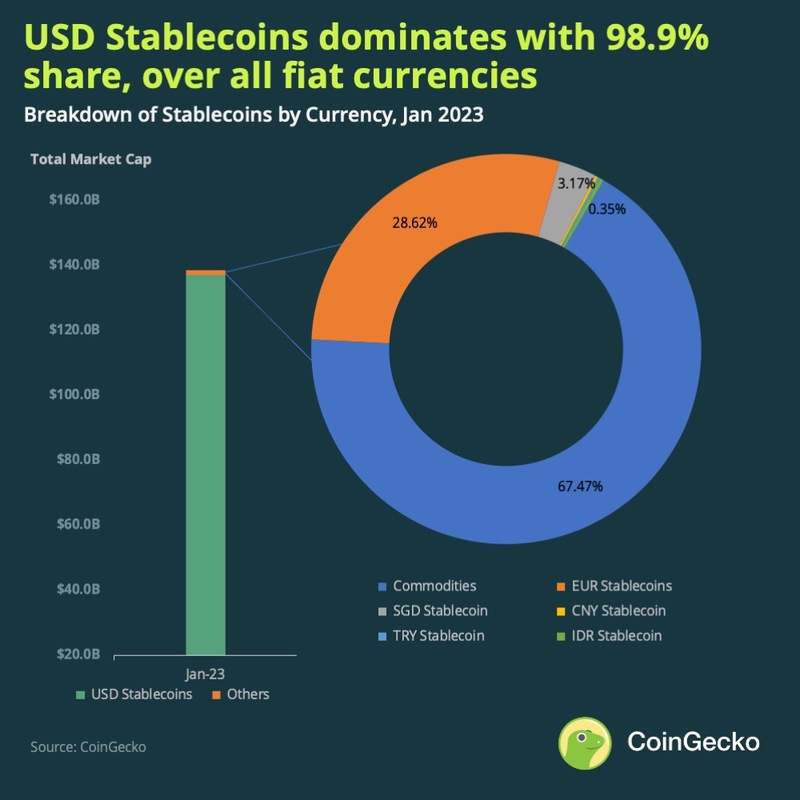

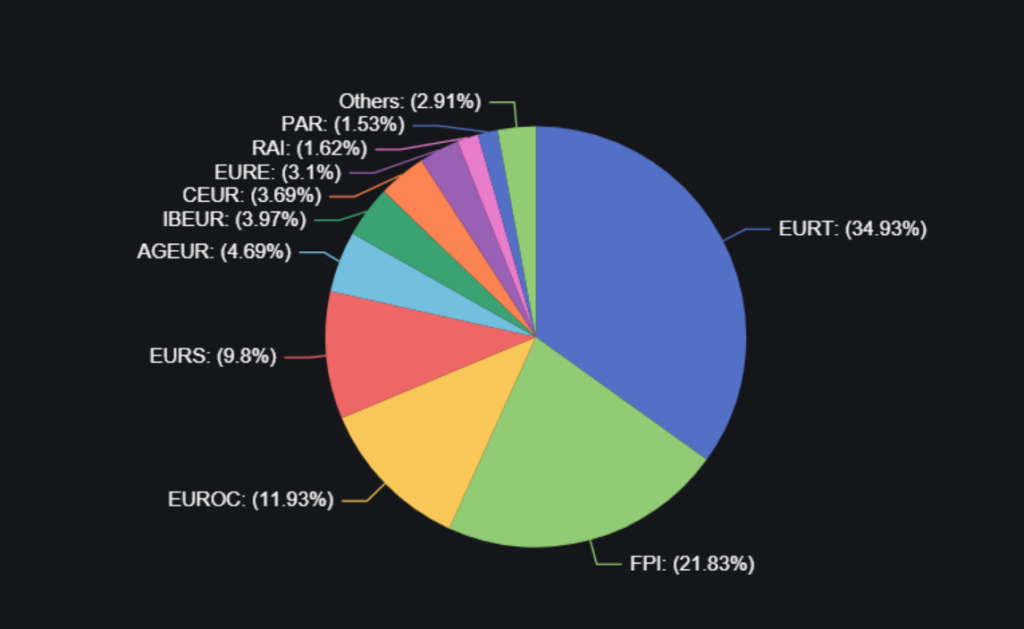

According to a recent CoinGecko report, the USD-backed stablecoins dominate the cryptocurrency market, holding a significant 98.9% share valued at $137 billion as of January 31, 2023. In contrast, stablecoins not linked to USD contribute a total of $1.45 billion. Among these, commodities account for 67.4%, mainly consisting of Paxos Gold (PAXG) and Tether Gold (XAUT). EUR stablecoins make up 28.6%, followed by SGD at 3.17%, IDR at 0.35%, CNY at 0.21%, and TRY at 0.18%.

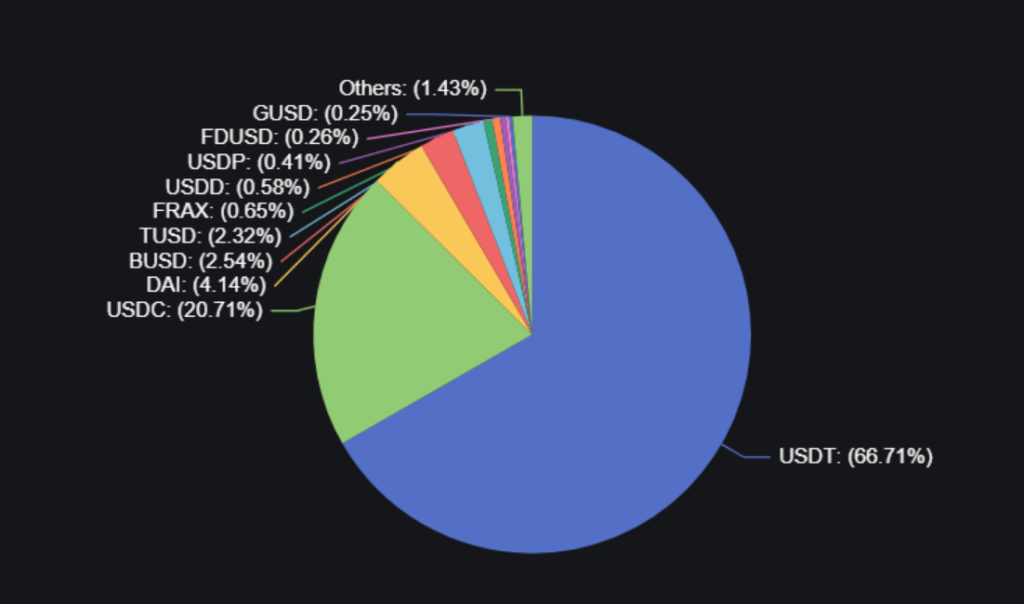

As of August 26, 2022, Coingecko data shows a substantial gap in trading volume between USD stablecoins and non-USD stablecoins. USD stablecoins have a strong daily trading volume of over $16 billion on various exchanges, while non-USD stablecoins struggle with a much lower trading volume of just $5 million. This discrepancy highlights non-USD stablecoins’ trading accounting for less than 0.1% of the activity seen with USD stablecoins. This limited traction due to their smaller market size has led to hesitancy from centralized exchanges in listing non-USD stablecoins, with only a few, like EUROC, managing to secure listings on platforms such as Coinbase and Bitstamp.

On August 27th, 2023, the prominent USDC-pegged stablecoins encompass USDT, USDC, DAI, BUSD, and TUSD, while noteworthy non-US pegged options comprise EURT, FPI, EUROC, EURS, and AGEUR. Within Uniswap V3 and Curve decentralized exchanges, the total value locked (TVL) in the leading USD-pegged stablecoins stands at about $754 million, whereas the primary non-USD stablecoins hold roughly $48 million.

3. Behind the Popularity of USD-Pegged Stablecoin

3.1 Global Dominance of the US Dollar

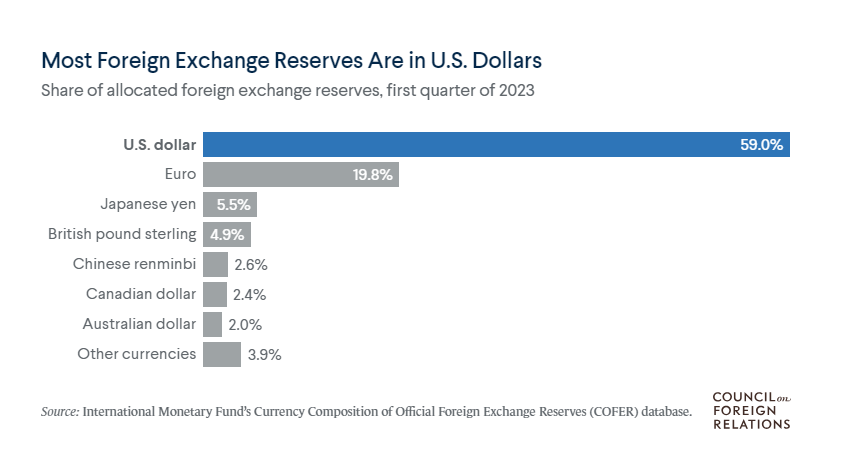

The US dollar holds a dominant position in the global financial system. It’s widely used as a medium of exchange, reserve currency, and unit of account in international trade and finance. The preference for dollars is due to their stability and wide acceptance, making them a reliable currency for transactions.

The prevalence of USD dominance finds similarities in the realm of TradFi, where the US dollar holds substantial influence. As indicated by the International Monetary Fund (IMF), approximately 59% of the world’s allocated reserves are denominated in USD.

3.2 World Trade and Global Transactions

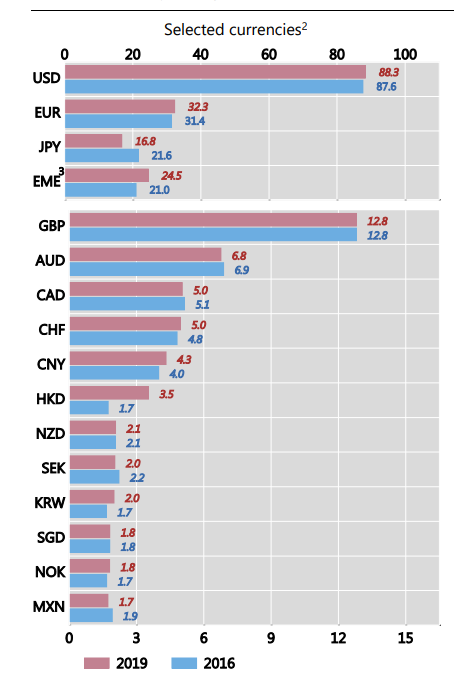

In 2019, 88.3% of global trade transactions were conducted in US dollars, which naturally leads to a demand for USD-pegged stablecoins. Businesses and individuals engaged in international trade often prefer dollars due to the widespread recognition and ease of use in cross-border transactions.

3.3 Migrant Remittances

The universal acceptance and liquidity of the US dollar make it an ideal choice for remittances. People working abroad can effortlessly send money back home in the form of dollar-pegged stablecoins, which can be easily converted into local currencies by recipients.

As of late 2021, IMF data shows the U.S. dollar represented around 40% of cross-border Swift flows, followed closely by the euro. Other currencies like the British pound, Japanese yen, Australian dollar, Hong Kong dollar, and Canadian dollar also held shares over 1%.

3.4 Safe-Haven Status

During times of economic uncertainty or crises, the US dollar tends to appreciate against other currencies. This safe-haven status increases the demand for dollar-pegged stablecoins as a means to safeguard value during turbulent periods.

Moreover, the recognition and longstanding reliability linked with the US dollar further enhance its appeal as a foundation for stablecoins. Users naturally gravitate toward a currency they are acquainted with and hold trust in.

3.5 Cryptocurrency Market Functionality

Within the realm of cryptocurrency markets, numerous digital assets, including stablecoins, are denominated and traded in dollars. This practice streamlines price assessment and trading procedures within the crypto landscape. Furthermore, dollar-pegged stablecoins have been harnessed in decentralized finance (DeFi) protocols to generate yields, further heightening their appeal.

Moreover, the extensive adoption of dollar-pegged stablecoins translates to heightened liquidity and trading volume. This liquidity renders them conducive for a range of financial operations such as trading, lending, borrowing, and hedging.

3.6 USD Interest Rate Advantage for Stablecoin Issuers

The interest rates across currencies and regions vary. Notably, the interest rate for dollar-denominated accounts in the US tends to outperform those of other currencies. Consequently, issuers of stablecoins backed by the US dollar can leverage this comparatively favorable interest rate environment to generate returns on their collateral.

3.7 High Liquidity

Maintaining highly liquid collateral is crucial for stablecoin issuers to manage the risk of mass withdrawals. The US treasury bond market’s exceptional liquidity and depth allow issuers to quickly convert their reserves during periods of high demand, ensuring overall stability. This market’s attributes make it an optimal choice for supporting dollar-pegged stablecoins and bolstering issuer confidence.

4. Use Cases for Non-US Dollar Pegged Stablecoins

4.1 Diverse Options for Individuals

Stablecoins pegged to diverse fiat currencies offer individuals in different regions a convenient way to access the DeFi ecosystem using their local currency. This approach addresses unique regional needs, backed by various fiat currencies, and streamlines participation in DeFi, ensuring smooth on and off-ramping.

4.2 Emergence of Forex Trading for Stablecoins

Stablecoins tied to various fiat currencies open up opportunities for foreign exchange (Forex) trading within the DeFi ecosystem. This involves trading one stablecoin for another based on different fiat currencies, similar to traditional Forex trading but within the crypto space.

The Bank for International Settlements estimates that the global FX markets’ daily trading volume has reached around $7.5 trillion. Even if only a small fraction of this volume is brought onto DeFi, it could lead to a substantial increase in trading volumes within the cryptocurrency ecosystem.

As on-chain FX trading gains traction, centralized exchanges (CEXes) with user-friendly interfaces currently concentrate trading volume. As this popularity continues, CEXes are expected to maintain a significant share of the volume due to their familiarity and ease of use for traders.

However, the landscape is evolving, and the emergence of decentralized exchanges (DEXes) tailored specifically for on-chain FX trading presents an intriguing alternative. Notable DEXes such as Uniswap and Curve could be well-positioned options, given their established presence and capacity to accommodate stablecoin trading pairs. Moreover, DEXes with with a bonding curve exclusively tailored for on-chain FX trading, like the approach taken by DFX Finance, could provide innovative solutions for the distinct requirements of decentralized forex traders.

In the crypto market, there’s no leading DEX for forex trading yet. This opens an opportunity for innovative builders to design DEXs that optimize user experience and algorithms, specifically tailored for decentralized forex trading.

4.3 Resilience Against USD Stablecoin Market Instabilities

The recent disruption in the USD stablecoin market has highlighted the importance of diversification. This unease is connected to an incident involving Circle, a company issuing stablecoins. Circle had $3.3 billion held at SVB (Silicon Valley Bank), and due to certain circumstances, the stablecoin’s peg to the US dollar was affected, leading to a de-pegging event. Businesses can safeguard against potential upheavals by holding stablecoin reserves in multiple fiat-backed stablecoins. This strategy helps protect them from the impact of issues that might arise in any one particular stablecoin.

4.4 Remittance

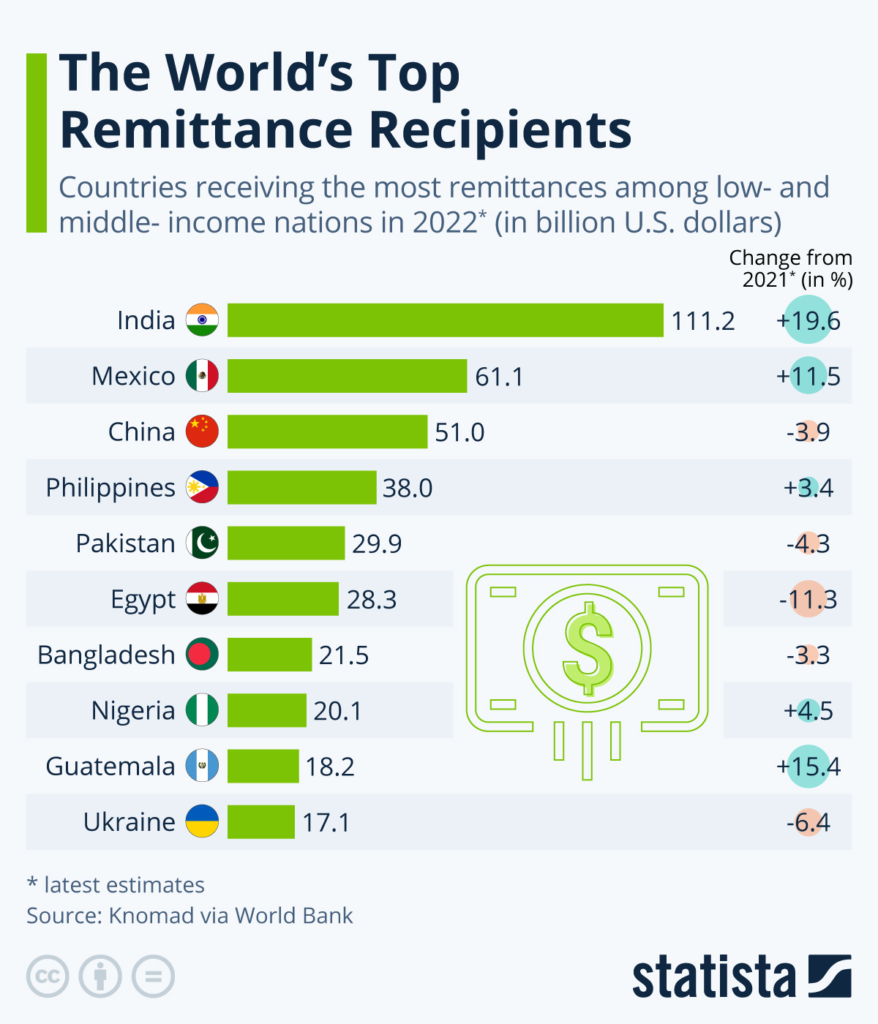

Cross-border remittance stands as a significant and substantial market. According to the World Bank, remittances to low- and middle-income countries (LMICs) demonstrated resilience against global challenges in 2022, achieving an approximate growth of 5% to reach $626 billion. Noteworthy remittance transactions tend to concentrate along specific routes between nations, where considerable sums are transferred. Prominent examples encompass funds flowing from the United States to countries such as Mexico, India, and China, as well as transfers involving the UAE, Saudi Arabia, and Kuwait with India.

Western Union, a prominent remittance firm with a 172-year history, leads the global market, earning $4.5 billion in 2022. Despite shifting employment trends and economic scenarios, Western Union’s forecasts for 2023 suggest a resilient demand for remittance services.

A solution involving cryptocurrency, such as the conversion of USD to MXN, focuses on optimizing a remittance route like the USD-MXN corridor, as indicated by the data presented below. This corridor presents a market opportunity of $61 billion annually.

High remittance fees, especially for smaller transactions, often around 10% and sometimes even 15-20% in less busy corridors, can be reduced through crypto competition. Conventional systems’ limited competition causes wide currency conversion spreads. Shifting to open crypto competition could minimize these spreads.

Based on data from Uniswap blog, DeFi could reduce remittance costs by 80%, saving the unbanked $30 billion yearly. For a $500 remittance, the cost of on-chain FX conversion and on/off-ramping is as low as $4.80, a small fraction relative to the average cost of remittance of $28.00 through banks and $19.04 through traditional remittance operators.

In September 2022, Circle teamed up with Block’s subsidiary, TBD, to create seamless connections between fiat and stablecoins, easing entry and exit challenges in the crypto space. Their collaboration’s first objective is to enable cross-border remittances and establish secure digital wallets for stablecoins, facilitating international transfers and storage.

5. Factors Driving Development of Non-US Pegged Stablecoins

5.1 Regulatory Clarity

Clear and favorable regulatory environments for non-USD stablecoins can encourage their adoption. Governments and regulators can provide guidelines that promote the use of stablecoins pegged to other fiat currencies, ensuring compliance and consumer protection.

Japan’s 2022 regulations limit stablecoin issuance to banks and trusts, spurring competition for a leading Japanese Yen (JPY) stablecoin. Singapore’s consultation on stablecoin policies and the issuance of SGD stablecoins by StraitsX demonstrate ongoing efforts. Additionally, countries such as Hong Kong (HKD) and the United Arab Emirates (AED), whose currencies are tied to the USD, are among the various jurisdictions crafting stablecoin regulations. These currencies offer stability without relying on US banking, making them resistant to disruptions and regulatory control.

5.2 Cross-Border Use Cases Highlighting

Non-USD stablecoins can gain traction by targeting cross-border transactions, remittances, and trade settlements specific to regions using those currencies. Highlighting the benefits of using stablecoins that align with local currencies can attract users and businesses.

5.3 Partnerships and Integration

Collaboration with financial institutions, fintech companies, and e-commerce platforms in regions with strong non-USD currencies can increase the usage of non-USD stablecoins. Integrating stablecoin payment options into existing systems can drive adoption.

5.4 Education and Awareness

Raising awareness about the advantages of non-USD stablecoins, including reduced currency conversion fees and exposure to exchange rate fluctuations, can incentivize users to explore and adopt these alternatives.

6. Conclusion

While USD-pegged stablecoins dominate the crypto landscape, non-USD pegged stablecoins are emerging as a promising alternative. These stablecoins offer diverse use cases, from cross-border transactions to remittances, and are poised to enhance financial inclusion. As regulations mature and partnerships evolve, non-USD stablecoins are set to contribute to a more resilient and globally interconnected crypto ecosystem. The future holds vast potential for stablecoins beyond the boundaries of the traditional USD peg, signaling a new era of innovation and versatility.

7. References

Best, Raynor de. “Forex Market Daily Volume 2001-2022.” Statista, 21 Aug. 2023, www.statista.com/statistics/247328/activity-per-trading-day-on-the-global-currency-market/.

Buchholz, Katharina, and Felix Richter. “Infographic: The World’s Top Remittance Recipients.” Statista Daily Data, 20 June 2023, www.statista.com/chart/20166/top-10-remittance-receiving-countries/.

Crypto Insights the Growth Potential of Non-USD Stablecoins, res.cloudinary.com/drw/image/upload/v1686158824/comm-cumberland/uploads/Cumberland-Research-The-Growth-Potential-of-Non-USD-Stablecoins_wzlijy.pdf. Accessed 27 Aug. 2023.

“The Dollar: The World’s Reserve Currency.” Council on Foreign Relations, Council on Foreign Relations, www.cfr.org/backgrounder/dollar-worlds-reserve-currency. Accessed 27 Aug. 2023.

IMF Data Home Page – IMF Data, data.imf.org/. Accessed 27 Aug. 2023.

Radmilac, Andjela. “20 Global Currency Stablecoins to Form International Standards Body.” CryptoSlate, 1 Mar. 2023, cryptoslate.com/20-global-currency-stablecoins-form-international-standards-body/.

Shaunpaullee. “Stablecoins Statistics: 2023 Report.” CoinGecko, CoinGecko, 13 July 2023, www.coingecko.com/research/publications/stablecoins-statistics#:~:text=The total stablecoins market cap started the year at %24167.9,the total stablecoins market cap.

“Top Stablecoins by Market Cap.” CoinGecko, www.coingecko.com/en/categories/stablecoins. Accessed 27 Aug. 2023.

“Total Stablecoins Market Cap.” DefiLlama, defillama.com/stablecoins. Accessed 27 Aug. 2023.

Triennial Central Bank Survey – Bank for International Settlements, www.bis.org/statistics/rpfx19_fx.pdf. Accessed 27 Aug. 2023.

“How Defi Can Cut Costs & Boost Transparency in Foreign Exchange Markets.” Uniswap Protocol, 18 Jan. 2023, blog.uniswap.org/uniswap-circle-foreign-exchange-defi.