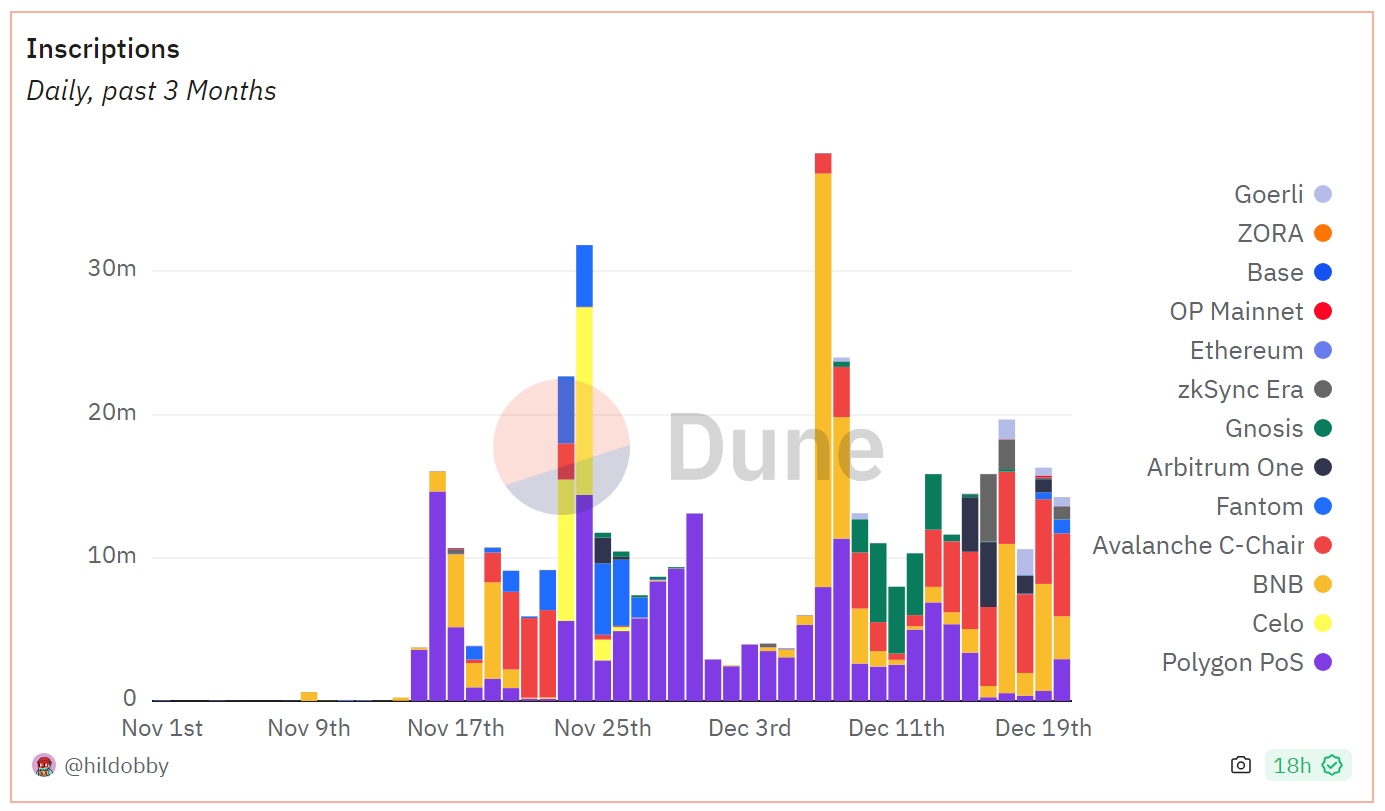

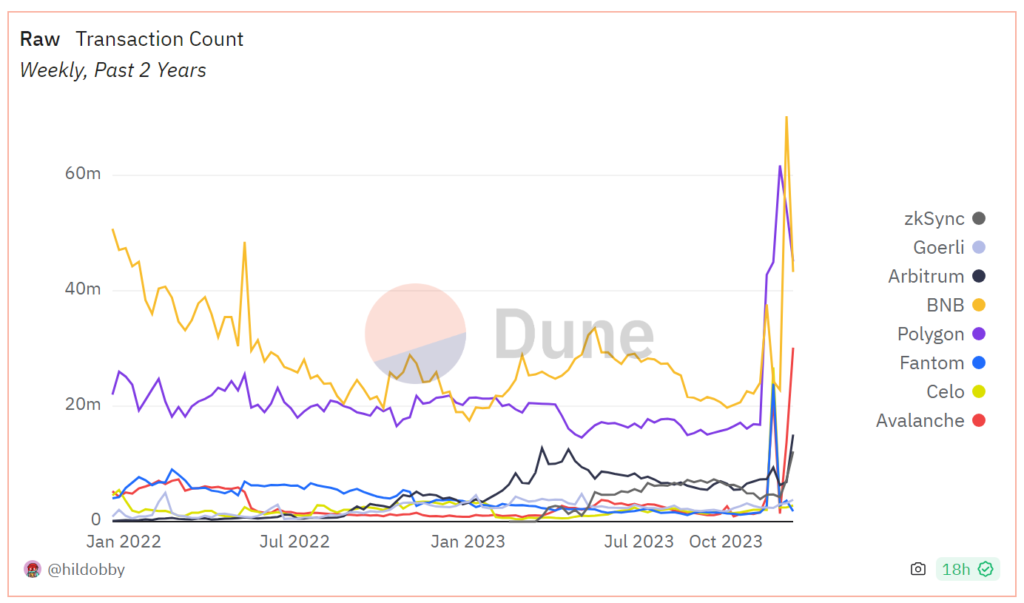

Inscriptions proliferated across various blockchains, causing congestion and a spike in gas fees. The vibrant of the Ordinals ecosystem on the Bitcoin network has extended to other blockchains, such as PRC-20 on Polygon PoS, Ethscriptions on Ethereum, and Solana Inscriptions on Solana. Consequently, the transaction volume on these blockchains has soared as users engage in token minting and transfers.

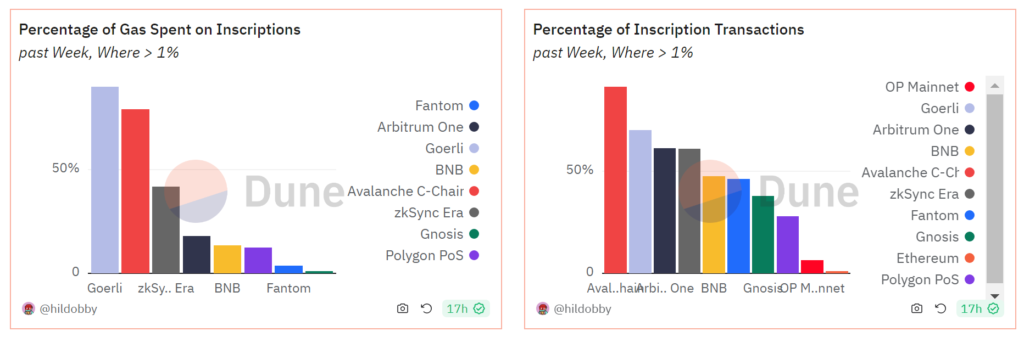

Almost 90% of transactions on Avalanche in the past week were inscription-related, constituting 70% on the Goerli and 61% on zkSync Era and Arbitrum. These transactions spent approximately 90% of the gas fee on Goerli, 80% on the Avalanche, and 41% on the ZkSync Era. Onchain activity has soared since November on multiple chains, causing transaction fees to experience a staggering 4,500% increase on Near from Nov. 28 to Dec. 1, a 6,900% surge in a day on the Polygon in mid-November, and an 8,990% spike on Fantom in late November.

The increase in transactions caused congestion on multiple chains. However, not all chains withstood the inscription stress tests. Ton Network witnessed transactions linked to inscriptions, causing severe congestion for the chain. Onchain data reveals a TPS of 0.5 and a mempool with 2.5 million transactions in the queue. On December 7, the BNB chain encountered a TPS of 1500 due to an inscription campaign, leading to a 4-hour network suspension. Over the past two weeks, zkSync Era and Arbitrum faced a block generation outage for several hours.

The controversy around inscriptions

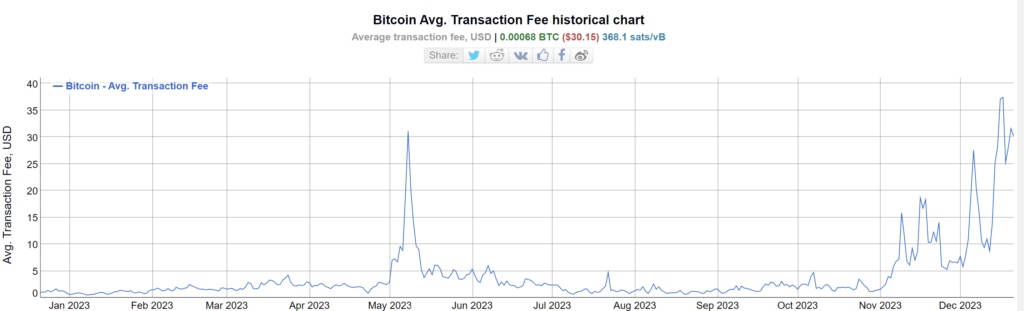

Launched in early 2023, the Ordinals protocol enables users to “inscribe” media such as artwork or videos into the Bitcoin blockchain, functioning similarly to NFTs on other blockchains. In March 2023, Ordinals introduced fungible tokens through the BRC-20 standard, with ORDI being the inaugural token. Currently, ORDI stands as the largest token in the Ordinals ecosystem, boasting a market capitalization of $1.1 billion. Although BRC-20 gained attention earlier in the year, it experienced a lull during the summer and regained prominence in early November. The average daily BRC-10 minted is 300,000 during November and December, and the total fee paid for both transferring and minting tokens is approximately 3,823 BTC (around $164 million) since its inception.

Similar to other chains, the surge in BRC-20 transactions has resulted in congestion on the Bitcoin network, with the mempool once holding approximately 200,000 transactions waiting for validation. Transaction fees have also seen a significant increase, reaching $35 compared to the usual range of $2 to $3. These network congestion issues, coupled with differing perspectives on the intended use of Bitcoin, have once again sparked controversy within the community. Luke DashJr, co-founder of Ocean and a longstanding Bitcoin Core maintainer, stated in X’s post that “inscriptions” are exploiting a vulnerability in Bitcoin Core to spam the blockchain. In addition, Ocean announced its decision to censor Ordinals inscriptions by implementing Bitcoin Knots v25.1, stating that “this upgrade will improve and fix this long-standing vulnerability exploited by modern spammers.”

While Dashir’s comment found favor within the community, others held a different perspective. Trevor Owens, General Partner at Bitcoin Frontier Fund, expressed, “The inscriptions will never stop. People will pay for them, and miners will mine them. As long as the market demands it, there is nothing you can do to stop it.” In reality, the Bitcoin network operates on consensus rules, and miners have the option to propose deploying policy filters that prevent inscriptions from entering blocks. However, if only one miner permits them, inscriptions will persist. The surge of BRC-20 has generated the highest revenue for miners, as evidenced by the total fees paid for both the transfer and mint tokens, totaling around 3,823 BTC (around $164 million) since inception. In comparison, the total fees paid for non-BRC-20 tokens amount to only 623 BTC (approximately $26 million) at the same time. Therefore, most miners have chosen to remain silent amidst this controversy.

Following the dynamic BRC-20 tokens, these token standards have expanded to other blockchains. Inscriptions, propelled into the spotlight by the remarkable success of Bitcoin Ordinals earlier this year, have witnessed a recent surge in adoption across various chains. This uptick in inscription activity has sparked heated debates within the Web3 community, with critics arguing that inscriptions are causing congestion in major blockchains and a waste of block space. On the other hand, proponents suggest that this technique strengthens operations across chains and tests TPS for chains.