On January 10, 2024, the U.S. Securities and Exchange Commission (SEC) officially approved the first spot Bitcoin ETF in the United States. The SEC approves spot Bitcoin ETFs which is seen as a major milestone for the cryptocurrency market, opening up broader access to Bitcoin for traditional investors.

The SEC approves a spot Bitcoin ETF, which has been long anticipated by cryptocurrency investors. Many believe that the event will boost the broader adoption of Bitcoin and help the cryptocurrency market grow more robustly. Currently, investors who want to invest in Bitcoin typically have to purchase it directly from a cryptocurrency exchange, a process that can be complex and expensive. Spot Bitcoin ETFs now offer a convenient and secure alternative, trading just like familiar exchange-traded funds on established platforms like the Cboe BZX exchange. According to the CBOE, six ETFs, including the Invesco Galaxy Bitcoin ETF, Fidelity Wise Origin Bitcoin Fund, VanEck Bitcoin Trust, Franklin Bitcoin ETF, and the ARK 21Shares Bitcoin ETF, will be prepped to begin trading on Thursday, January 11th.

The ETFs fee war

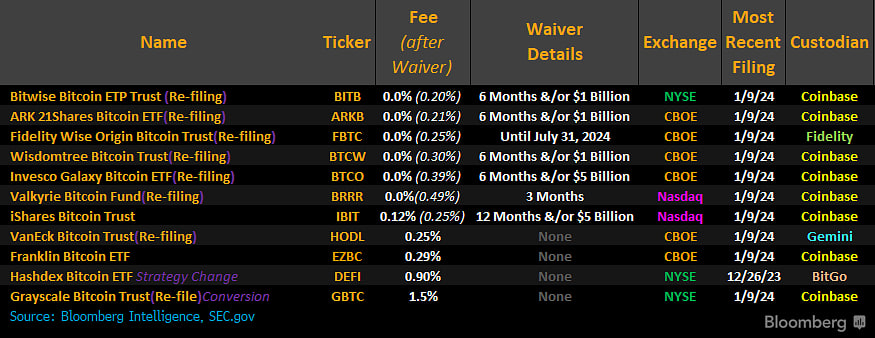

The competition for this promising market has sparked the “ETFs fee war” among issuers. BlackRock, Ark Invest, and others have slashed their fees in recent days, pushing the bar down to near rock bottom. Bitwise currently leads the pack with the lowest permanent fee of 0.2%. BlackRock reduced its sponsor fee for its spot bitcoin ETF from 0.3% to 0.25% in response to the intensifying competition. It also scaled back its temporary discount from 0.2% to 0.12% for the first $5 billion of assets in the initial 12 months from launch. Ark Invest/21Shares similarly lowered its fee from 0.25% to 0.21% and is maintaining zero fees for the first six months or until $1 billion in assets.

Several other applicants have also slashed their fees: Fidelity reduced its fixed fee from 0.39% to 0.25%, Valkyrie from 0.8% to 0.49%, Invesco Galaxy from 0.59% to 0.39%, and WisdomTree from 0.5% to 0.3%. The exception is Grayscale, with its massive $27 billion asset base, which filed with a 1.5% fee (though still higher than most).

Spot Ether ETF is the next?

With Bitcoin basking in the spotlight, anticipation for similar Ethereum ETFs is now at a fever pitch. Major players like Fidelity and BlackRock have already filed applications for a spot Ether ETF over the last few months. The approval of Bitcoin ETFs led to the expectation of the approval of Ether ETFs. This move has fueled a recent surge in the price of both Ether and tokens related to its ecosystem.

Overall, the SEC’s approval of a spot Bitcoin ETF is a major milestone for the cryptocurrency market. The event could boost the broader adoption of Bitcoin and help the cryptocurrency market grow more robustly. Currently, the SEC approves 11 spot bitcoin ETFs, including Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, BZX, Invesco, VanEck, WisdomTree, Fidelity, and Franklin.