The case of Tornado Cash has ignited significant discussions about the intersection of privacy, cryptocurrency, and legal frameworks. Recently, a panel at the DC Privacy Summit addressed these issues, moderated by Nikhilesh De and featuring experts such as Miller Whitehouse-Levine, Michele Korver, Allison Behuniak, and Katherine Kirkpatrick Bos. As the legal proceedings against developer Roman Storm unfold, the implications for privacy tools in the crypto space remain a focal point of contention.

1. The Role of Privacy Tools in Cryptocurrency

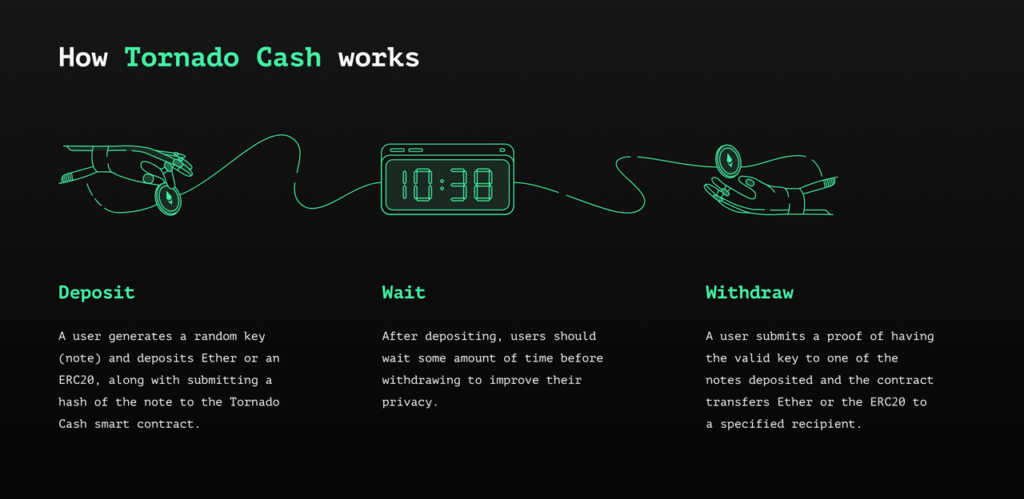

Privacy tools like Tornado Cash are designed to protect user anonymity in cryptocurrency transactions. However, their association with illicit activities has overshadowed their intended purpose. Tornado Cash allows users to obscure the origins of their transactions by mixing funds in a shared pool, making it challenging to trace individual transaction histories. While this feature is crucial for those seeking financial privacy—especially in oppressive regimes—it has also attracted scrutiny from law enforcement agencies.

The U.S. Treasury Department has labeled such mixers as potential “primary money laundering concerns,” primarily due to their use by criminal organizations like North Korea’s Lazarus Group. This negative perception complicates discussions about the legitimate uses of privacy tools. During the panel discussion, Kirkpatrick Bos emphasized that advocates for privacy must acknowledge that arguments for confidentiality may not hold up against the backdrop of criminal misuse.

2. Legal and Policy Implications

As Roman Storm’s trial approaches in December, the broader implications for cryptocurrency regulation become the sharper focus. Whitehouse-Levine expressed concern that pivotal policy discussions occur in court rather than through legislative or regulatory processes. He argues that this approach undermines effective policymaking and could set dangerous precedents for developers.

Behuniak highlighted that lawmakers are beginning to engage more seriously with the implications of mixers and privacy tools but noted that extensive dialogue is necessary before formal hearings can take place. This gradual shift reflects a growing recognition among legislators about the complexities involved in regulating privacy-enhancing technologies.

On the industry side, Korver pointed out that businesses require clarity regarding their regulatory obligations to navigate this evolving landscape effectively. Companies need to understand what actions may expose them to criminal liability and how existing guidance from agencies like FinCEN applies to their operations. The uncertainty surrounding these regulations complicates compliance efforts and raises concerns about potential fines or legal repercussions.

3. Future Outlook: Balancing Privacy and Compliance

The outcomes of the Tornado Cash case will likely have lasting effects on future legislation regarding market structure and privacy tools within cryptocurrency. Kirkpatrick Bos suggested that while new laws may not resolve all existing issues, they could signify progress in addressing concerns related to financial privacy.

The ongoing debate highlights a fundamental tension between privacy rights and regulatory compliance. As noted during the panel, there is a growing consensus that individuals have an inherent right to privacy—an idea supported by Whitehouse-Levine’s assertion that people naturally seek to keep certain aspects of their lives confidential. This desire for privacy is reflected in societal norms, such as using blinds in homes or keeping personal journals private.

However, achieving a balance between protecting individual privacy and ensuring compliance with anti-money laundering (AML) regulations remains a complex challenge. Advocates argue that technological advancements can help bridge this gap by enabling compliance without sacrificing user confidentiality. Emerging solutions may allow for selective disclosure of information to authorized parties while preserving user anonymity.

4. Conclusion

The Tornado Cash case serves as a critical juncture in the ongoing discourse about privacy rights in the digital age. As legal proceedings unfold and policymakers grapple with regulatory frameworks, it is essential to recognize the dual nature of privacy tools—they can serve both legitimate purposes and facilitate illicit activities.

The discussions at the DC Privacy Summit underscore the need for nuanced conversations about how best to regulate these technologies without infringing on fundamental human rights. Ultimately, as society navigates this complex landscape, it must strive to uphold the principles of financial privacy while addressing legitimate concerns about criminal misuse. The outcome of this case could set important precedents for how privacy is understood and protected within the cryptocurrency sector moving forward.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.