Written by Jin

Disclaimers: This article represents the personal views of the writer, does not represent the views of Blockbase, and is not investment advice.

The blockchain industry in general, and cryptocurrency in particular, have gone through a relatively long period of development. In 2008, there was only Bitcoin with a simple peer-to-peer model. Speculators were mainly concerned with trading or holding in the short or long term. Participants in the overall crypto economy were still primarily hardware-dependent. However, at the present stage, we have witnessed a larger and more diversified economy.

When the ICO (Initial Coin Offering) wave surged in 2017, there was a growing demand for more complex solutions, innovative needs, and, notably, a requirement for lower network usage costs. This led to a race to develop blockchains with improved TPS (Transactions Per Second) and extremely low costs. Speed and affordability seemed to be the primary criteria that developers focused on at that time.

During the hype of that time, many projects had their own relatively simple economy, and basic use cases, and operated independently based on their own theses. This created a vibrant market, but liquidity was fragmented, and due to the use of various programming languages by different blockchains at that time, the developer community was also affected, resulting in reduced consistency and significant resource waste (many blockchains with their own languages were abandoned).

In 2018-2019, we witnessed a prolonged crypto winter, which caused many once-famous ICO projects to disappear from the market and led to a loss of trust among investors. Some names persevered and continued to build, and today we know about amazing products like Solana, Polkadot, Cosmos, and others.

The DeFi summer of 2020 began with Yearn Finance, led by the “God Father” Andre Cronje, and marked a strong transformation in DeFi. For the first time, interacting between individuals and protocols became easy and convenient. It was the first time that communities could participate together in something called a “smart contract.”

Recognizing the arrival of a new game, various innovative models emerged, each bringing different ways to participate in the economy. Some prominent names created the game, while others perfected it. At this point, the concepts of “tokenomics” and “token flow” started to draw the attention of OGs (Original Gangsters) and VCs (Venture Capitalists). If we consider “tokenomics” as an operating machine, then “token flow” is the fuel that helps the machine run smoothly and efficiently.

Token

Before diving into Tokenomics, let’s briefly discuss Tokens and their role in the microeconomics of the ecosystem.

The general question that most market participants often overlook is: What are Tokens created for?

- Economic Aspect: Tokens serve as a means to facilitate fundraising for projects, offering better access to capital (despite the existence of risks) compared to traditional fundraising models like IPOs. While the barriers for a company to go public through an IPO are quite stringent, startups raising funds through IDOs, ICOs, or Launchpads are much more feasible.

- Community Engagement: Launching and allowing even retail investors to participate in early-stage buying and selling contributes to a more efficient investor base. Additionally, startups benefit greatly from the marketing perspective.

- Ensuring Fundamental Benefits: Having a token implies that participants can have certain incentives according to their roles. Investors can view it as a temporary guarantee when investing in a project, while the project gains the funds to realize its journey.

- “Active” Nature: Compared to the stock market, tokens enable a more vibrant marketplace with 24/7 trading, empowering proactive decision-making without the need for intermediaries.

In the early years of the blockchain/crypto era, tokens were primarily used for users to pay gas fees for their transactions. However, as time has passed, more and more innovative models have emerged, leading to tokens having greater use cases and more prominent roles within their own ecosystems, even influencing other ecosystems.

Tokenomics

“Tokenomics is a term that captures a token’s economics. It describes the factors that impact a token’s use and value, including but not limited to the token’s creation and distribution, supply and demand, incentive mechanisms, and token burn schedules. For crypto projects, well-designed tokenomics is critical to success. Assessing a project’s tokenomics before deciding to participate is essential for investors and stakeholders.” - Binance

Tokenomics is a term coined by combining the words “Token” (Cryptocurrency) and “Economics”. Therefore, in simple terms, Tokenomics can be understood as the economic system of cryptocurrencies, and how they are designed and applied to the operational model of a project.

Token Allocation

In the economy of a crypto project, there are several key participants who play different roles. Here are some of the common participants:

| Participant | Details | Examples |

|---|---|---|

| Founder/Core team | Must have. This allocation is often locked in for the longest time as opposed to the others. | Avax, Sol, Bnb,… |

| Investor | Including early investors | Seed Investor, Private Investor, Angel Investor,.. |

| Public sale | Including rounds like ICO, IDO, IEO,… | ICO, IDO, IEO, Launchpad |

| Foundation | Allocating funds to projects within the ecosystem, expenses contributing to liquidity incentives or ecosystem development, etc. | ETH Foundation, Solana Foundation,… |

| Ecosystem/Incentive | Including sponsorship in protocols built within the ecosystem, airdrops, yield farming, and other forms of financial support. | Staking, yield farming |

| Others | Allocating a portion to strategic partners, early ecosystem participants, validators, nodes, etc. | Early adopter |

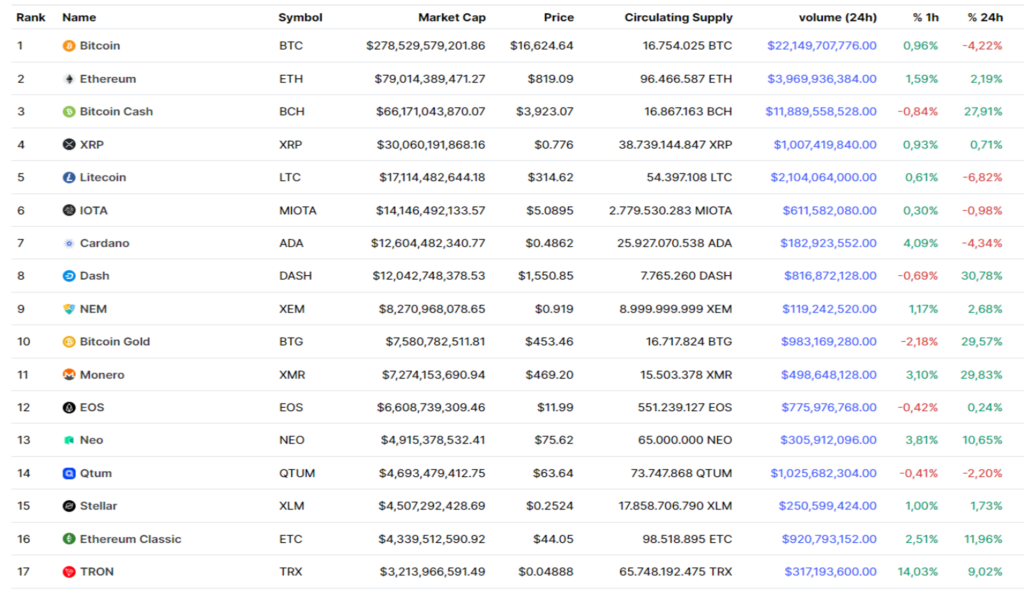

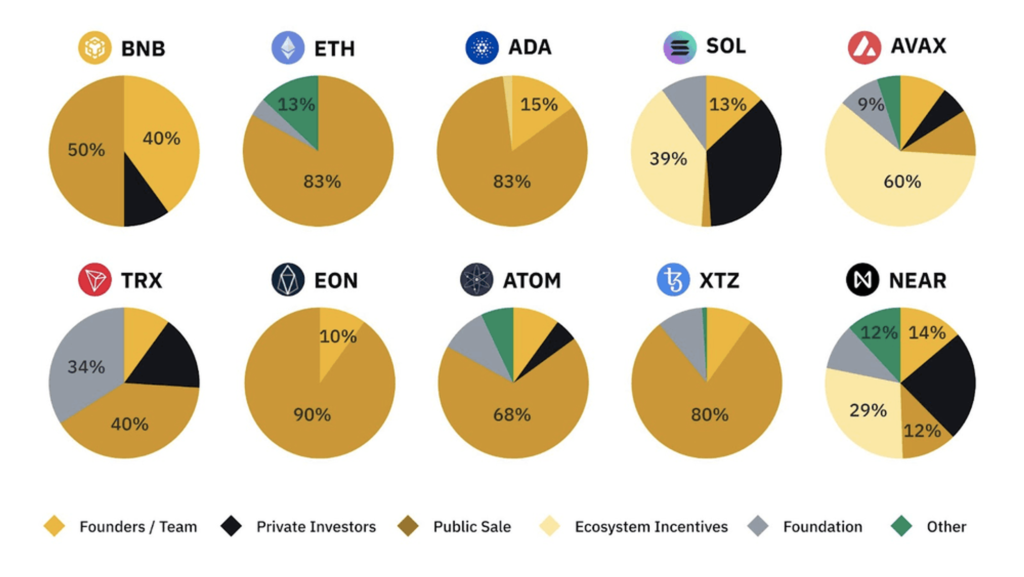

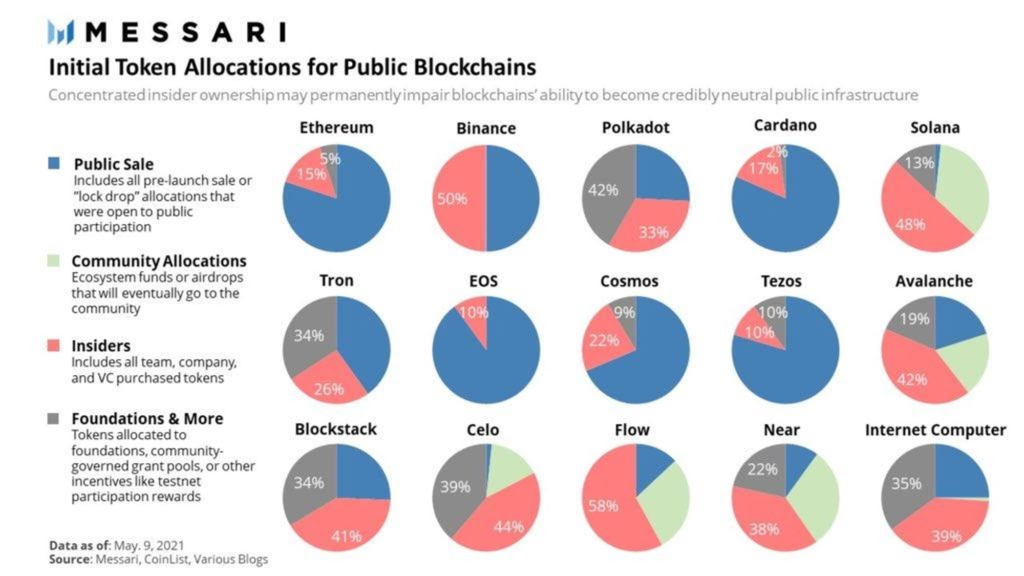

As we have seen, the allocation design for participants in each stage can vary. For blockchain projects built during the 2017-2018 period, public sales accounted for over 50% of the token allocation. However, for projects from 2019 onwards, public sales typically account for only 20-30%, with the remaining portions allocated to ecosystem participants.

This can be explained by the fact that in the past, most tokens/coins of projects were not extensively utilized within the ecosystem, resulting in limited regular usage demand. Additionally, VC participation in the market was relatively low and less professional during that time. However, after the 2019 period, token use cases significantly improved, leading to increased participation from ecosystem or product stakeholders.

Furthermore, the allocation ratio of tokens for each participant is now carefully calculated by projects. They must ensure a reasonable allocation of resources for their ecosystem, while still providing sufficient incentives for active users. The allocation must also strike a balance to ensure the development team has enough funding to sustain operations and maintain motivation.

Token Release / Vesting

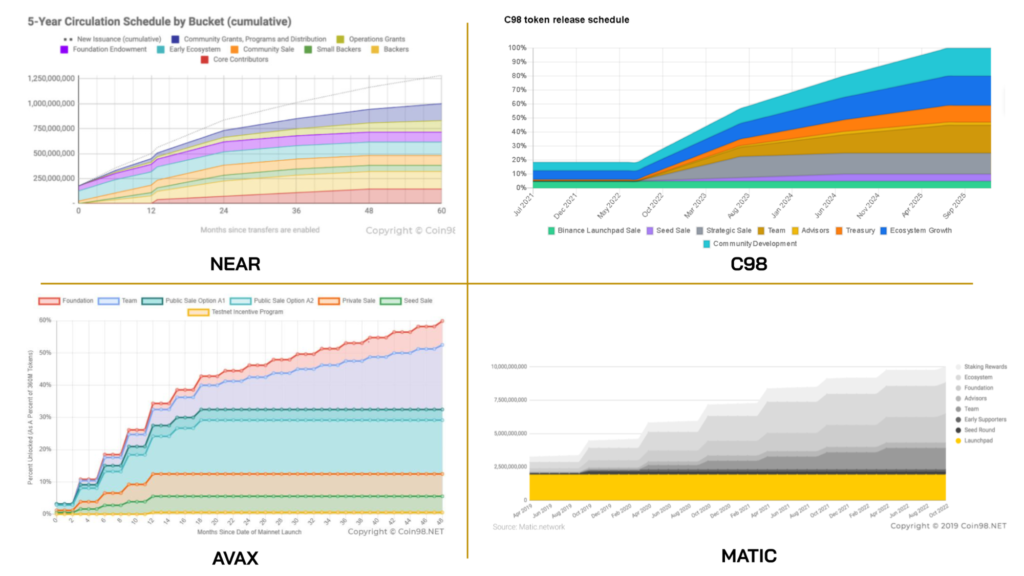

This is a crucial metric for analyzing a project. Understanding token distribution helps token holders know when token releases will occur, and the duration of vesting periods, and, in many cases, token distribution can influence their investment decisions based on market conditions and data analysis.

Each project will have different rules for token release and vesting, depending on the nature of the project, token allocation, and even market timing!

The vesting period also reveals important aspects. While projects with vesting periods of less than 1 year indicate a lower commitment from the founding team, projects with vesting periods ranging from 3-5 years demonstrate a higher level of dedication and are more aligned with the rapid growth cycles of the market.

Additionally, there are projects that opt for vesting periods of 10 years or even longer. However, the market is subject to a cyclical nature, and it appears that the development motivation may not be high in such cases. Furthermore, only Bitcoin has managed to exist and thrive for over 10 years. Nevertheless, we can expect to see more names emerge due to the high utility value of tokens in recent years.

For projects with unique incentives or use cases, some choose to release tokens based on product usage demand rather than predetermined timeframes. This approach can be effective in addressing price impact concerns. However, it is crucial to use this method appropriately and in a well-considered manner.

Tokenflow

In simple terms, this is how a token circulates, either within its own ecosystem or in a different ecosystem. The smoother the token flow, the higher the buying demand, and the more valuable the project becomes. To achieve this, a token must have genuine buying demand, and one way to accomplish that is by designing a well-thought-out use case for the token.

Token Use Case

Simply put, this is how a token is circulated and used within its own ecosystem or in a different ecosystem. The better the token flow, the higher the buy demand, and the more valuable the project becomes. To achieve this, a token must have genuine buy demand, and one way to achieve that is through a well-designed token use case.

The token use case refers to the purpose of using a token. It plays a crucial role in determining the buy demand of a project’s token. Essentially, it is one of the most important factors in tokenomics.

Tokens are commonly used within an ecosystem in various ways:

- Transaction fees: For layer 1 and layer 2 solutions, users are required to hold the native token of the chain to pay for transaction fees and validator validation. This is also the strongest use case for a token, as when you participate in the ecosystem, you need the token to pay for gas fees.

- Incentive farming: This is a use case commonly used by projects to attract users during the early stages. In this case, tokens are rewarded to users when they engage in activities on the protocol. However, most projects fall into a discount loop: when the project loses its appeal, the token price drops significantly, resulting in reduced rewards. To compensate, the project may increase the token rewards, leading to further price drops due to an excessive supply in the market.

- Staking: Staking is a new concept that projects are using to reduce the circulating supply of tokens in the market. Projects allow holders to stake their native tokens and receive a portion of the earnings in return. In some cases, staking also enhances the network’s security and contributes to decentralization.

- Governance: This is a relatively new and less popular use case, as it doesn’t directly generate profits. However, its impact can bring significant changes to a project. Token holders can vote on issues, changes, and upgrades within the project, ranging from minor aspects such as interface, features, and user experience to major decisions like choosing a deployment chain or adjusting staking rewards. However, governance power usually stops at voting, and very few projects allow users to create proposals (often due to the high-cost barrier, as users need to hold a significant amount of tokens).

- Ecosystem Pass: This use case is exemplified by launchpad platforms, where holding tokens of these projects allows users to participate in early investments in newly listed projects or engage in incentivized activities with certain priority compared to non-token holders. Additionally, this use case is prominent in gamefi projects, where items sold in the marketplace are priced in the project’s native token and often do not accept other tokens.

Through the use case, founders design the token flows of the project to maximize the incentive for users to hold the token and promote its circulation. Balancing incentives and inflation is a challenging task that involves various related factors such as market conditions. However, a good project must achieve a balance between these two factors, in addition to having a sensible product.

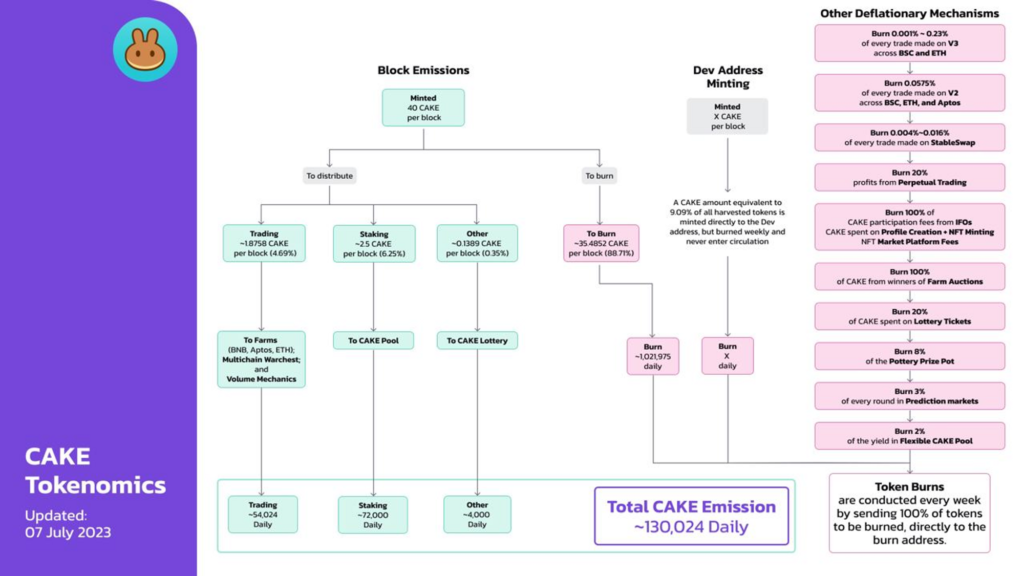

As can be seen in the table above, the $Cake token appears in each feature of PancakeSwap. Despite the daily emission, the minting and burning mechanisms are designed to overlap and run throughout the protocol. Projects with well-designed token flows can significantly reduce speculative token buying by users, thereby making the project healthier.

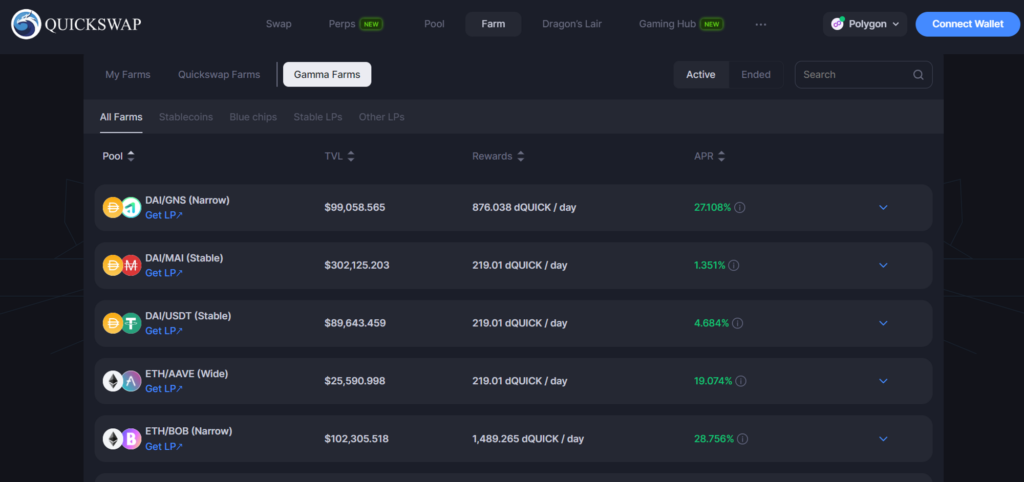

Another example is Quickswap (2021), where their token was initially used as a reward for incentivizing liquidity provision (adding liquidity). Token holders who stake their tokens also receive a share of Quickswap’s revenue based on a certain ratio. Additionally, since the platform serves as a launchpad, holders can participate by holding dQuick (Quick tokens staked). However, at the current time, the protocol has undergone several changes in how rewards are distributed to token holders.

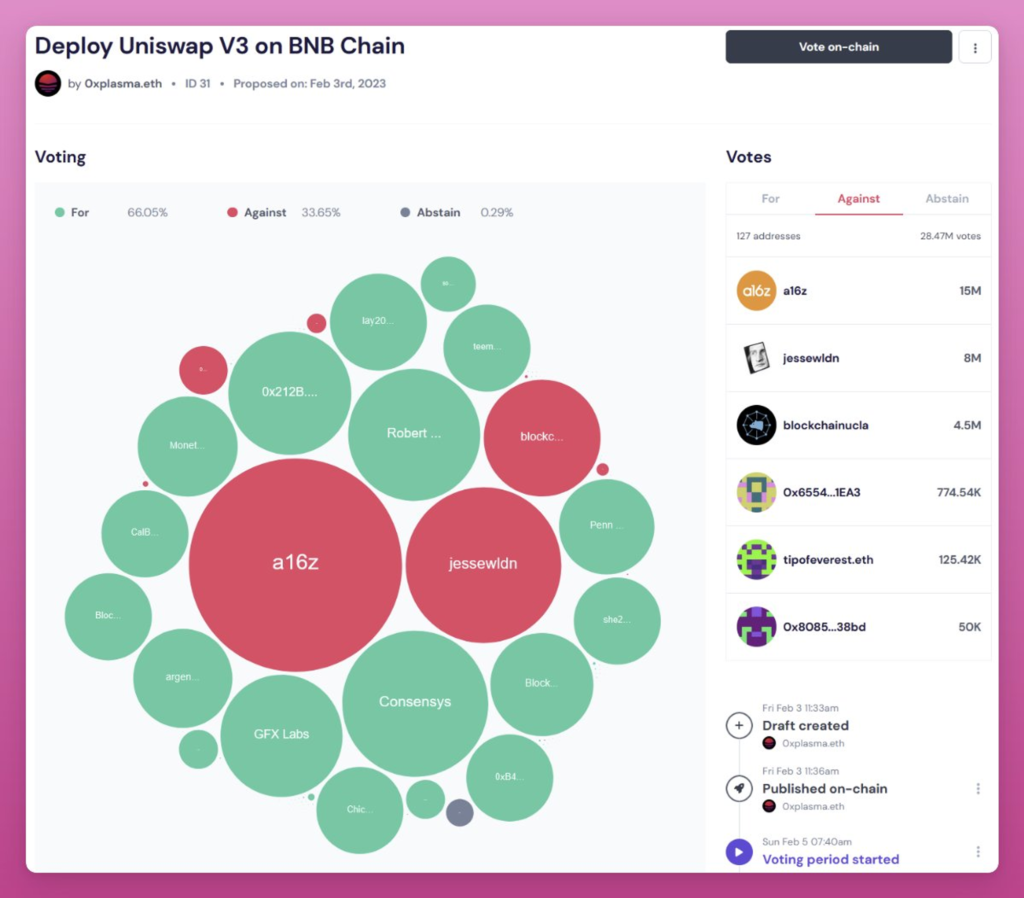

Governance as a use case does hold significant value, even though most users may not be interested in it. It was the driving force behind the famous Curve War event in DeFi, which subsequently led to the spread of Governance Wars in other ecosystems. Having a high voting power allows large players in the market to vote for proposals that benefit their interests.

Additionally, token governance creates a secondary market known as a “bribe” when smaller users begin to participate by renting out their voting rights and receiving a fee. However, governance power has received mixed opinions regarding centralization and democratic rights, as once again, power remains in the hands of wealthy and influential players.

The token use cases in the current era have become more diverse compared to the early years of the crypto age. As a result, token flows have become more dynamic, and the efficiency of capital utilization has significantly increased. When a token is used within an ecosystem, staking it to earn veTokens and then leveraging the power of voting in proposals can greatly improve the buy demand for the token. These use cases are no longer limited to a single protocol or even a single chain. Some projects now accept tokens from other projects to participate in their ecosystem. The DeFi game has started to flourish as the flow becomes smoother day by day.

The Solana ecosystem has indeed witnessed a peak Total Value Locked (TVL) of over $14.5 billion. However, one of the main reasons for the TVL increase was the excessive use of looping liquidity by protocols. In Solana, a deposited amount can be staked in up to 4 protocols. The numbers could not tell a lie, Solana had a vibrant summer in 2021!

Conclusion

The use of tokens to govern economies within protocols and ecosystems has become increasingly popular. Depending on the project’s objectives, user approach, or even manipulation, different implementations may occur. However, the importance of tokenomics and token flow for a project is undeniable. This aspect is often scrutinized by VCs and retail investors alike.

Designing strong tokenomics with appropriate use cases and flows can bring long-term success to a project. Conversely, poor tokenomics can lead to a volatile and crumbling economy. We have seen numerous projects collapse due to excessive inflation. The blockchain market in general, and crypto specifically, are continuously evolving and introducing new models at a rapid pace. We can expect an improved and healthier blockchain economy in the not-so-distant future.