Zeus Network is a pioneering project at the intersection of the Solana and Bitcoin ecosystems, aiming to enhance cross-chain communication and liquidity in the decentralized finance (DeFi) space. Built on the Solana Virtual Machine (SVM), Zeus enables seamless interactions between Bitcoin and Solana assets, offering users the ability to utilize Bitcoin (BTC) to purchase Solana Primary Library (SPL) tokens directly on the platform without the need for intermediary bridges.

1. Overview Zeus Network

- It’s a cross-chain communication layer built on the Solana Virtual Machine (SVM).

- It can connect many different blockchains, currently focusing on Bitcoin, which has the biggest liquidity in the market.

- Specifically, Bitcoin and Solana assets can interact with each other. Users can use BTC to buy SPL tokens (a token standard on Solana) on Zeus without needing a bridge.

2. Key highlights

- It’s the first communication layer that interacts between Bitcoin and Solana, attracting the biggest liquidity in the market. It also aims to interact with Bitcoin Layer 2 solutions like the Lightning Network, Stacks, etc.

- Apollo, the first dapp built on Zeus, aims to bring millions of Bitcoin to Solana as zBTC through DeFi activities like staking, lending & borrowing, NFT bridges. This increases network security, Total Value Locked (TVL), and helps potentially outperform Ethereum.

- Furthermore, built on SVM, it will attract many developers currently on Solana, the fastest blockchain, much cheaper than Ethereum, and has a rapidly developing ecosystem.

3. Backers & Fundraising

- Angel investors include Anatoly Yakovenko (Co-Founder of Solana), Andrew Kang (Founder of Mechanism Capital), and Muneeb Ali (Co-Creator of Stacks).

- Led by Andrew Kang (Mechanism Capital), Zeus raised an additional $8M from investors like OKX Ventures, Animoca Ventures, and more, valuing the project at $100M.

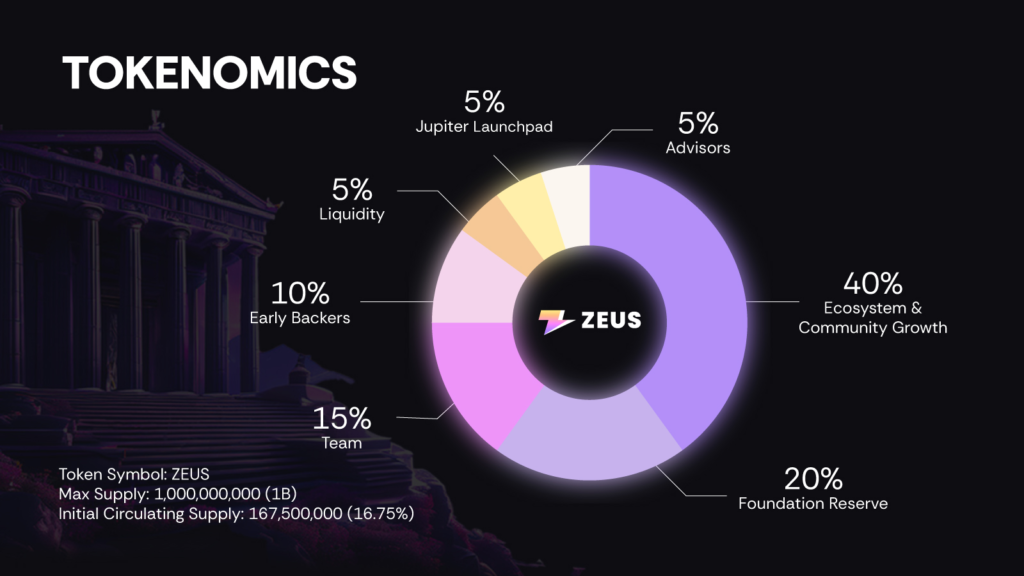

4. Tokenomics

- Total token supply: 1 Billion, with an initial circulating supply of 167.5 Million.

- Token allocation & Token Generation Event (TGE):

- Ecosystem and Community Growth: 40%, TGE 10%

- Foundation Reserve: 20%, TGE 10%

- Team: 15%, TGE 0%

- Early Backers: 10%, TGE 5%

- Launchpad: 5%, TGE 100%

- Advisors: 5%, TGE 5%

- Liquidity: 5%, TGE 100%

- Token use cases include governance, utility (like gas, fuel, service access), and incentives.

5. Final Thoughts

- Since launching, the number of Zeus holders has more than doubled from 46k to nearly 96k. Along with this, the $ZEUS token maintains a trading volume of $160M with a total market cap of $130M.

- The project has great potential as the community of Jupiter Exchange voted it as the first launchpad on Jupiter. It is also attracting attention due to the Solana & Bitcoin ecosystem narrative.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.