I. Overview

1.1. February CPI report

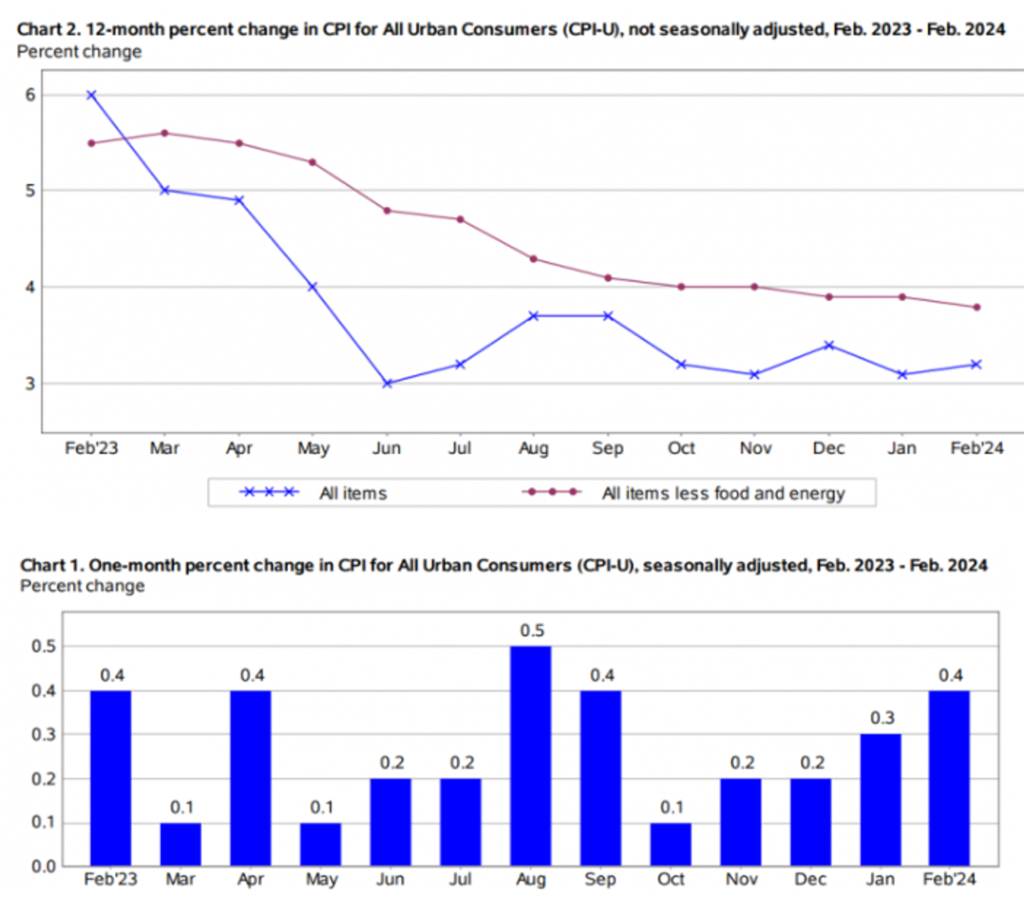

- The consumer price index, a broad measure of the costs of goods and services, rose by 0.4% for the month and 3.2% year-over-year.

- The core consumer price index, which excludes food and energy prices, increased by 0.4% over the month and was up 3.8% year-over-year. The core CPI is declining, yet not as rapidly as hoped, and remains significantly above the target of 2%.

1.2. What’s Driving Inflation Higher

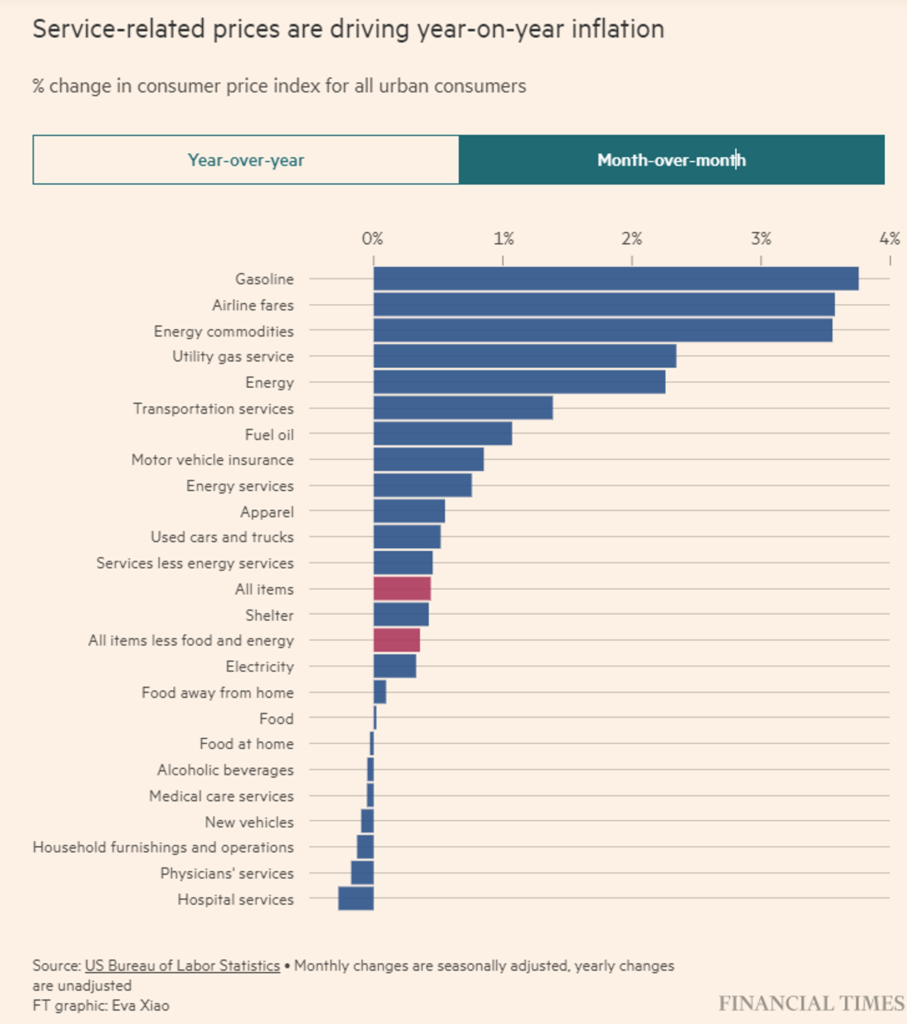

- The shelter and gasoline indices accounted for more than sixty percent of the overall increase in the index for all items. Further details are as follows:

- Energy prices surged by 2.3% month-over-month in February, with gas prices leading the increase at 3.8% month-over-month.

- Shelter prices, the largest category within services, rose by 0.4%, decelerating from 0.6% in January.

- There were also increases in prices for used vehicles (0.5%), apparel (0.6%), motor-vehicle insurance (0.8%), and airline fares (3.6%).

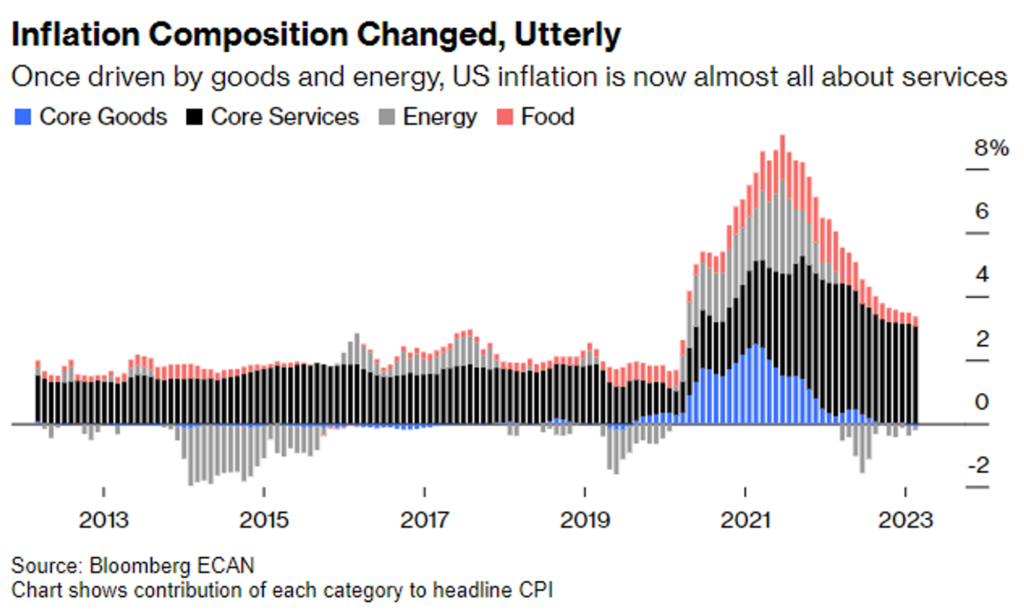

- Inflation is now almost exclusively about services.

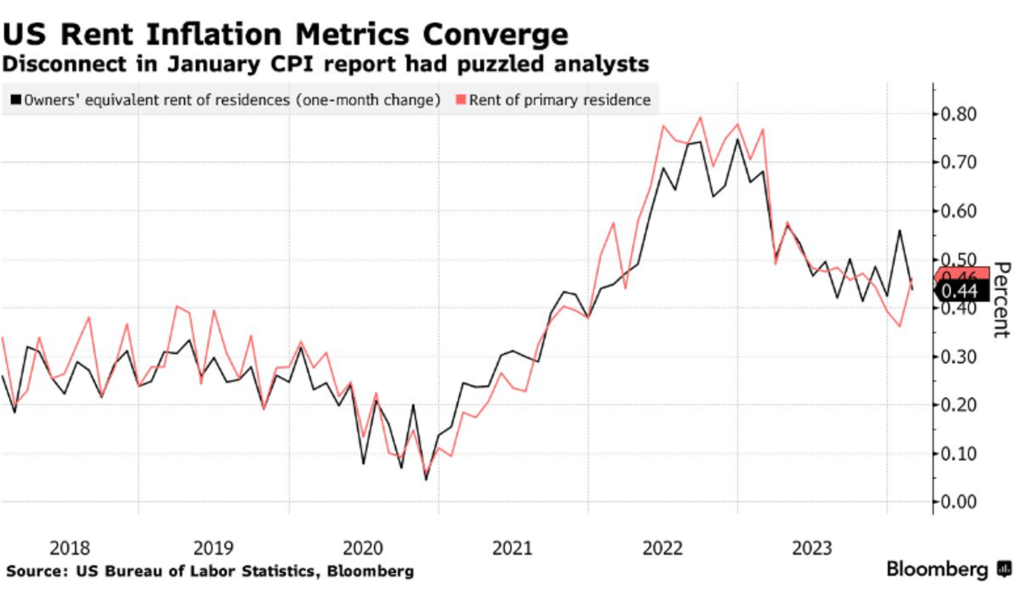

- A significant portion of services inflation derives from housing costs. Specifically, the owners’ equivalent rent — a crucial part of the shelter category, which is the largest individual component of the CPI, increased by 0.4% in February, a decrease from 0.6% in January.

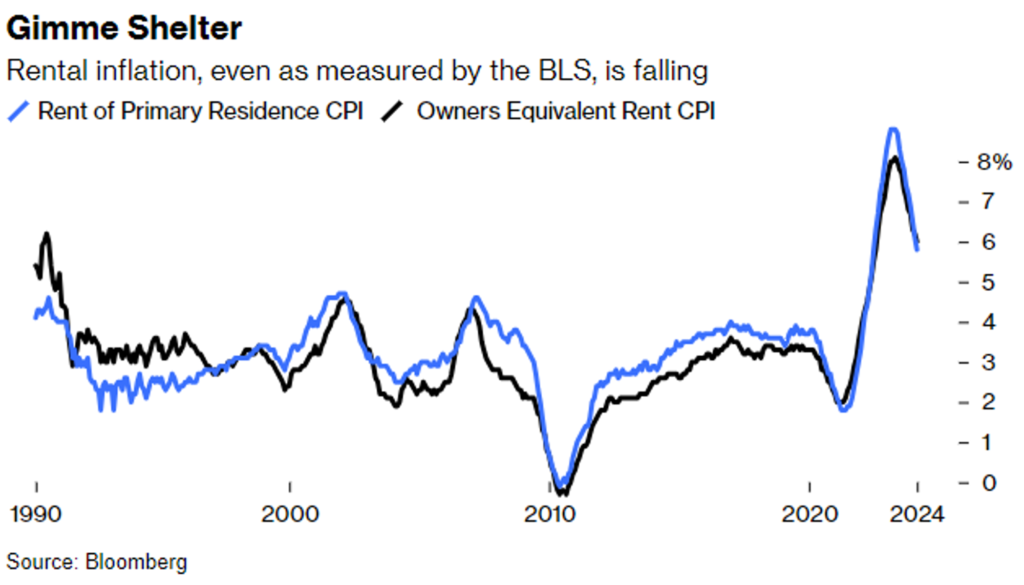

- However, the encouraging news is that both rental inflation and owners’ equivalent rent, a measure used to derive an imputed rent value for owned houses, are on the decline. Many economists expect the shelter to continue its downward trend to about 4% over the next 12 months, which should help ease inflationary pressures in the near term.

II. How the Markets Took It

- Higher inflation has led to increased bond yields, with the 10-year Treasury yield indeed rising by 5.3 basis points to 4.15%.

- However, inflation is still trending downwards. Coupled with improvements in financial conditions (thanks to bond yields, the USD index, and oil) in recent weeks, risk assets have surged to new highs.

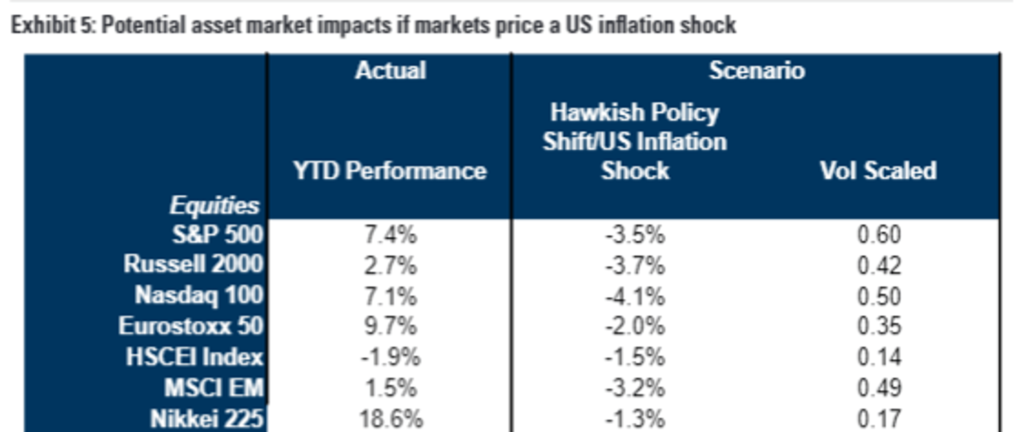

- Nonetheless, it’s prudent to always prepare for the worst. If the March CPI remains strong, it could postpone the Federal Reserve’s first rate cut to the latter half of the year – potentially leading to market disappointment.

- Moreover, overextended technicals suggest that any negative surprises could trigger a sharp market pullback. Below is an illustration from Goldman Sachs depicting potential price impacts on the market from an inflationary shock.

III. Final Thoughts

- Although the CPI data for February exceeded economists’ expectations, the trend is still strongly downward. The February inflation report is the most critical variable the Federal Reserve is monitoring before making monetary policy decisions at the next FOMC Meeting (March 19-20).

- Currently, the Fed is expected to maintain interest rates at 5.25% to 5.5% in March and plans to cut rates three times this year. Meanwhile, the market anticipates three or four cuts, starting in June or July. Thus, the uncertainty lies with the Federal Reserve. If the Fed decides to pause interest rate hikes in March, then the bulls might attempt to push the market up once again. However, the possibility that the Fed delays interest rate cuts beyond investor expectations, leading to a financial market adjustment, cannot be ruled out.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.