I. Overview:

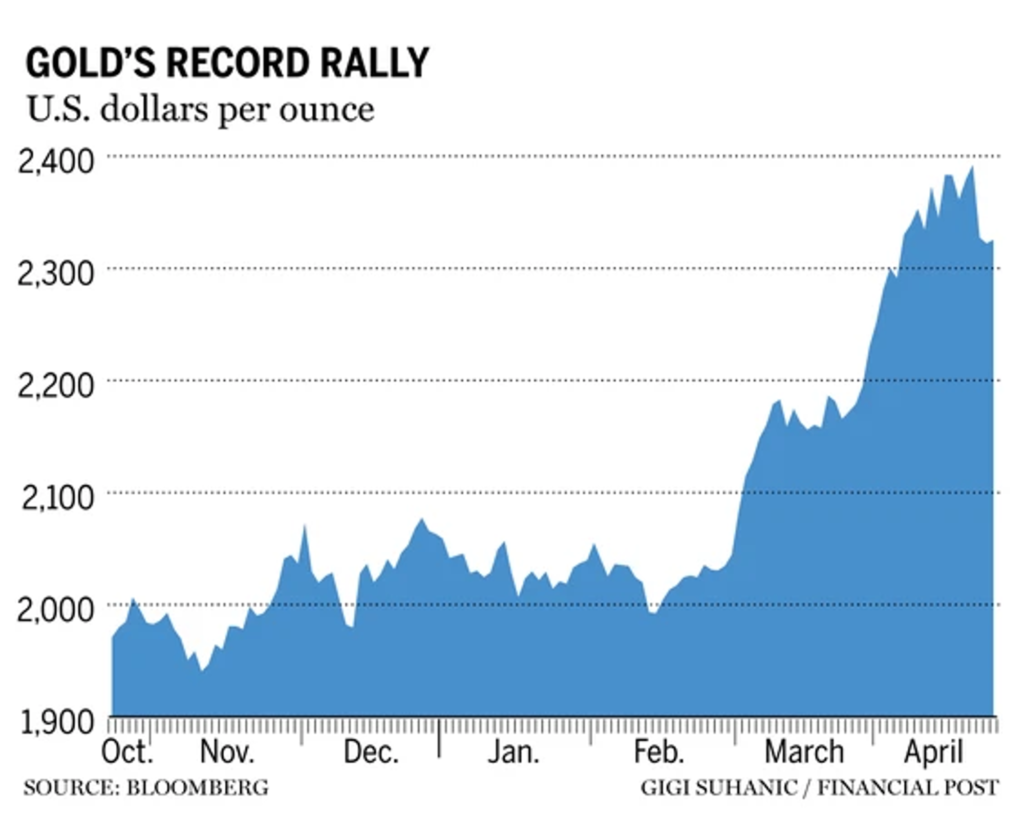

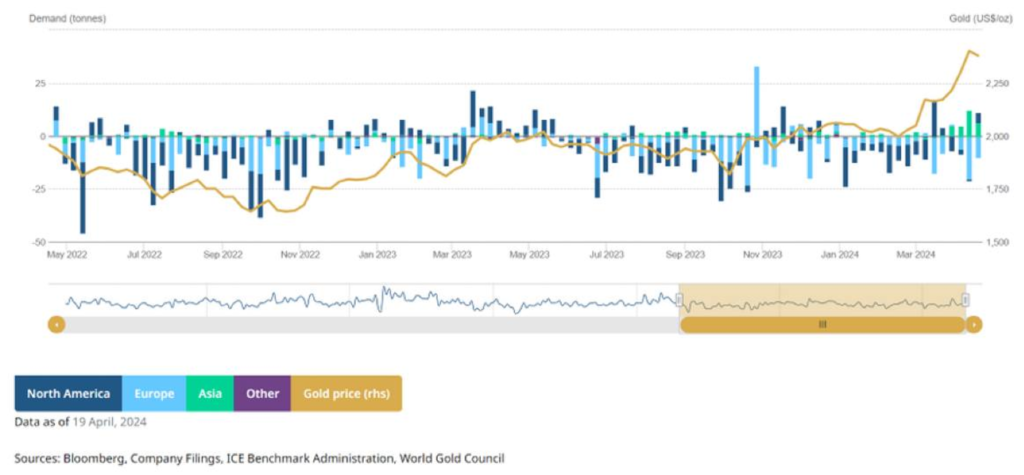

- The precious metal has experienced an unprecedented surge since mid-February, reaching an all-time high of $2,400 per ounce on April 12—an approximate 20% increase—before moderating to $2,332 per ounce at press time. With anticipation for gold prices to remain robust through 2024, investors are increasingly incorporating the precious metal into their portfolios as a hedge against economic instability.

II. The major driver behind gold’s ascent:

- Central bank buying:

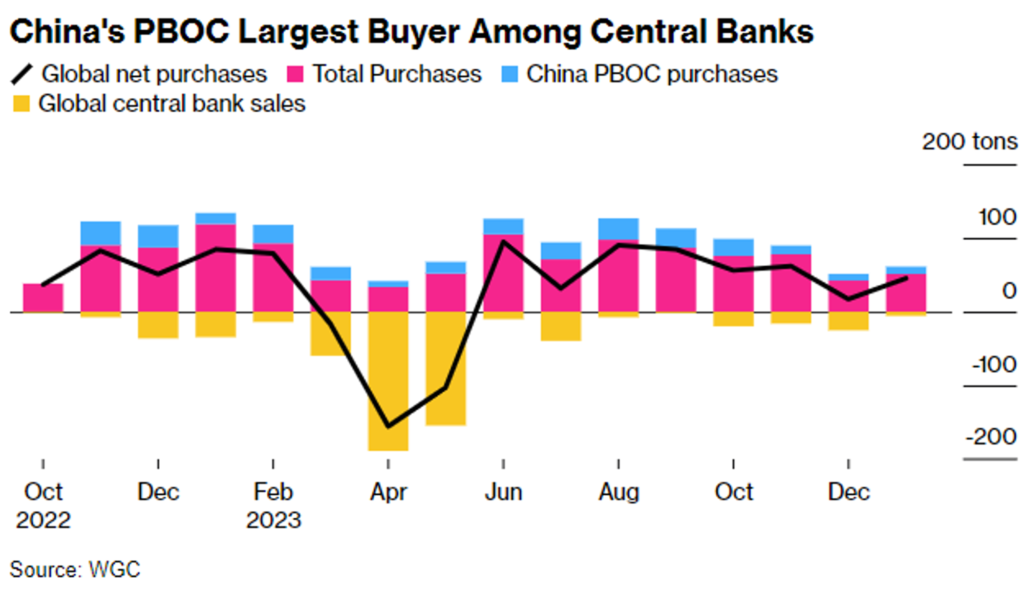

Several central banks have been incrementally increasing their gold reserves. Noteworthy is the People’s Bank of China, which extended its consecutive gold purchasing to a 17th month in March, marking its longest continuous acquisition streak. This strategic accumulation aims to diversify its reserves away from the dollar and hedge against currency depreciation.

- Demand for gold among Chinese consumers and institutional investors has intensified:

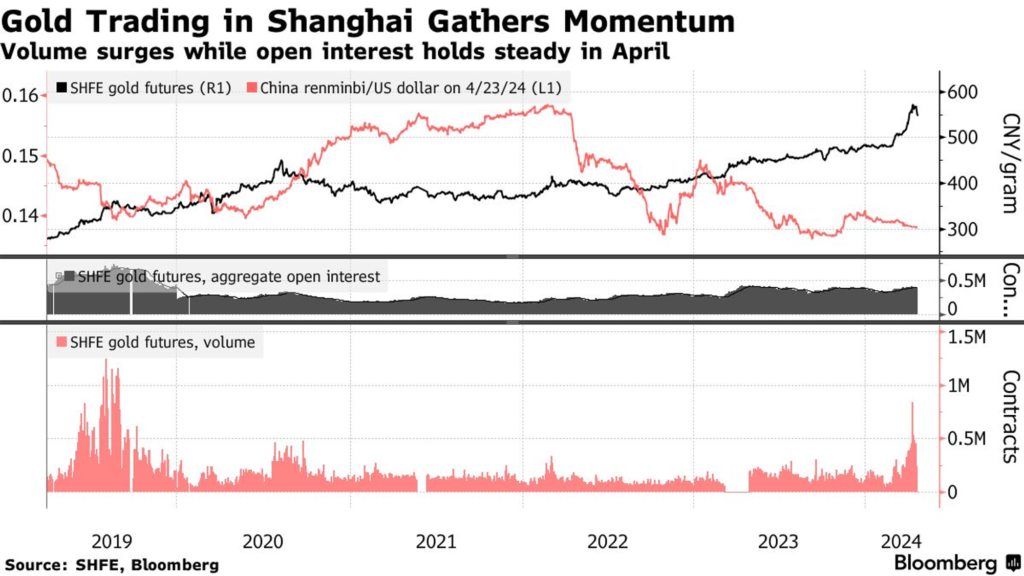

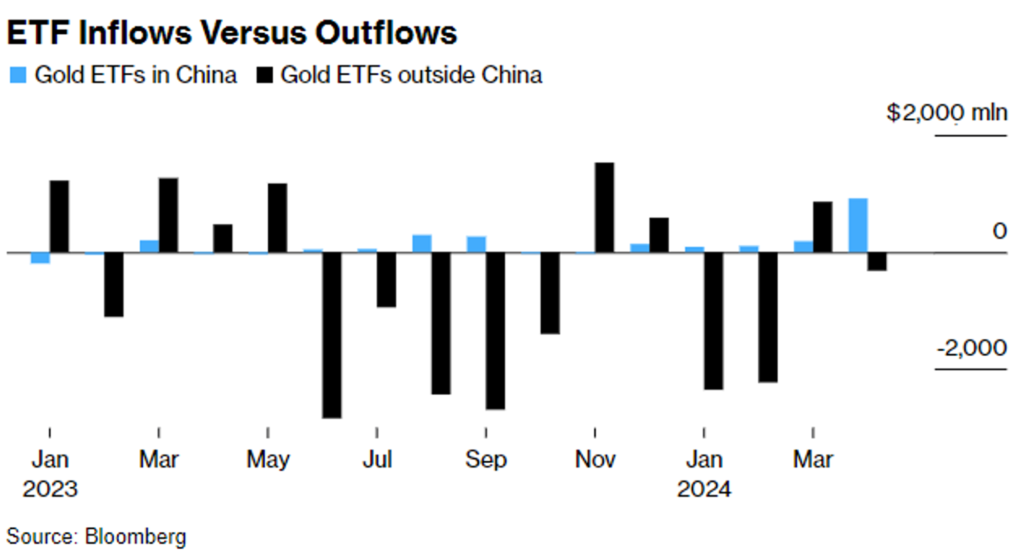

The trading on the SHFE has exploded and the influx of money has flowed into gold ETFs in China has totaled $1.3 billion so far this year, compared with $4 billion in outflows from funds overseas. This trend can be attributed to a limited array of investment alternatives within China, compounded by a lingering crisis in the real estate sector, fluctuating stock markets, a depreciating yuan, and diminishing bank deposit returns.

- Geopolitical Tensions:

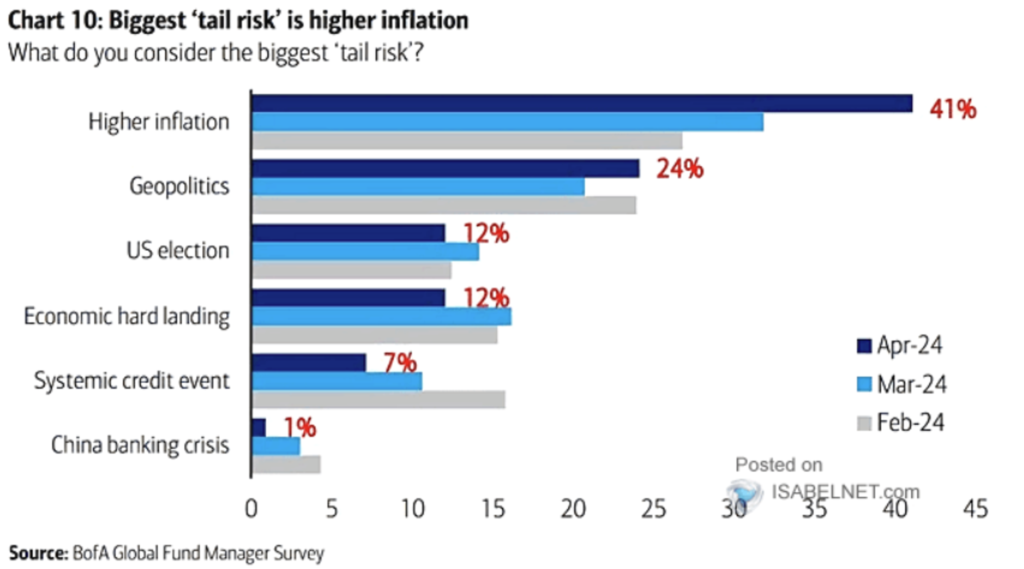

The escalating geopolitical conflicts, notably in the Middle East, are being recognized by a growing contingent of Fund Manager Survey (FMS) investors as a significant ‘tail risk’ to the global economy.

- Monetary Policy Adjustments and Inflationary Pressures:

The prospect of rate cuts by several leading global central banks, particularly the U.S. Federal Reserve, in 2024, alongside persistent high inflation rates in the United States, has prompted investors to seek strategies to hedge against the possibility of inflation exceeding forecasts. Consequently, they are reevaluating their portfolios post-equity market surge to ensure protection against the dual risks of inflationary pressures and geopolitical uncertainties.

III. Final Thoughts:

- In periods of uncertainty, gold’s appeal as a safe-haven asset often heightens. Investors increasingly turn to gold as a strategic hedge against volatile economic conditions, geopolitical tensions, and inflationary pressures.

- The longer-term outlook for gold remains optimistic. Over the next few years, many central banks will likely invest heavily in gold, which they will store directly in their home countries to avoid potential confiscation. I expect gold prices to reach $3,000 an ounce in the next 12 months as the market reacts to macro drivers, and investors seek to diversify their holdings while closely monitoring geopolitical events and Fed rate policy. Additionally, the forthcoming U.S. election, with the potential candidacy of Donald Trump, could introduce further complexities in U.S – China relations.

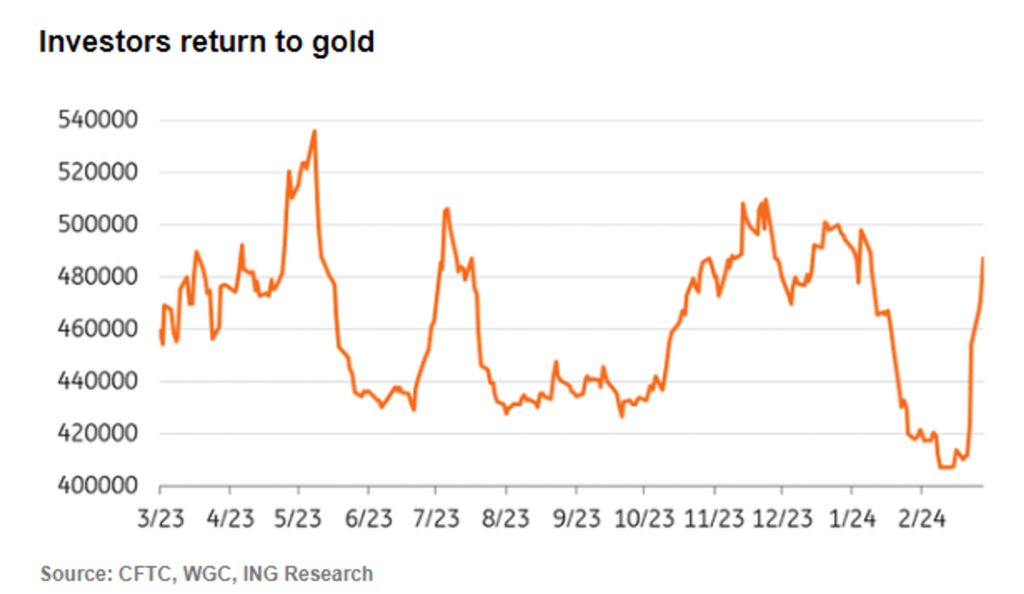

- Moreover, the recent net inflows into Global Gold ETFs, totaling $104 million last week—the first such increase since late 2023—further underscore the positive sentiment surrounding gold for the foreseeable future.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.