TL;DR:

- The pressures from U.S. bond yields and high short-term USD interest rates have diminished significantly.

- The primary risks include re-accelerating inflation, somewhat softer growth, and risk assets remaining largely unscathed. Moreover, the pressure to lock in profits due to overly bullish investor positioning is increasingly becoming a contrarian headwind for risk assets.

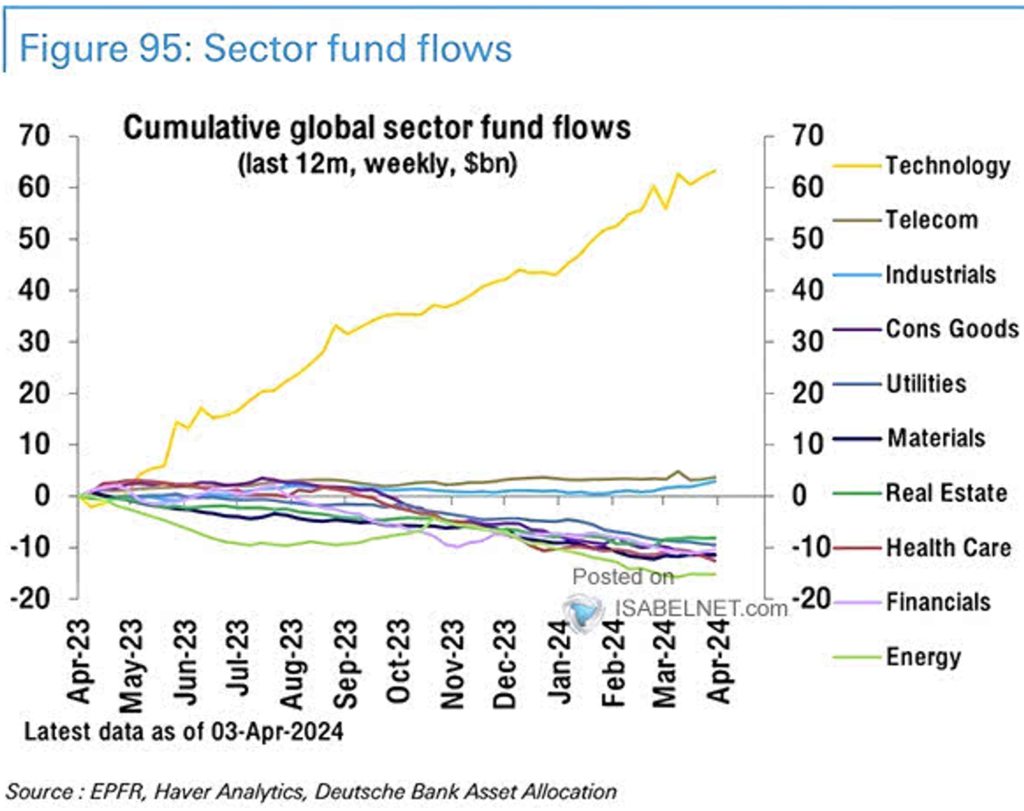

- Technology continues to attract significant inflows but should reallocate investments from high-performing technology shares to more economically priced sectors like energy, telecom and industrial to manage risk effectively.

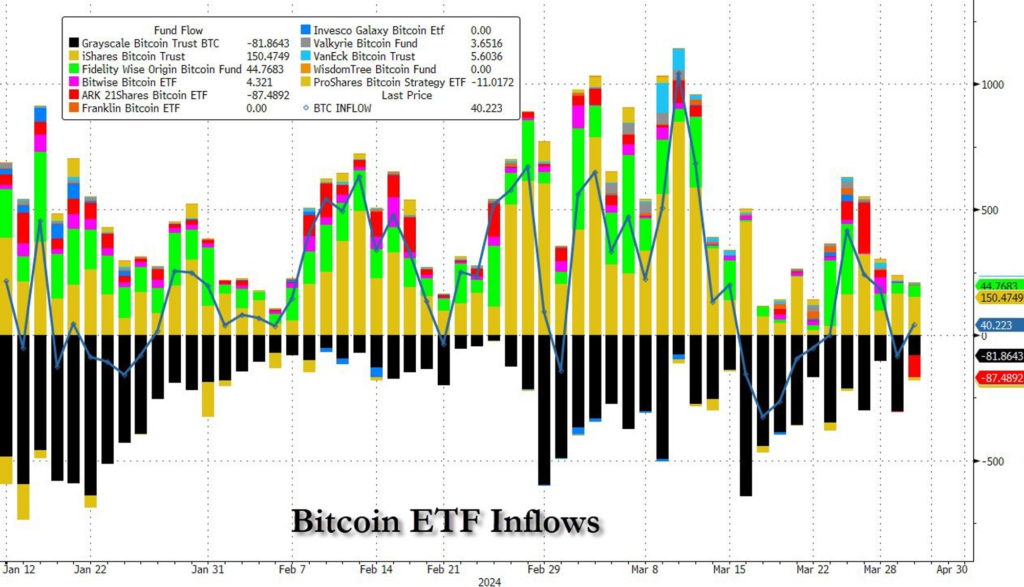

- A significant price catalyst for Bitcoin has been the strong inflows into U.S. Spot Bitcoin funds, introducing crypto to a new class of investors. However, Grayscale’s GBTC has experienced outflows of more than $12 billion due to high fees. This divestment exerts downward pressure on Bitcoin’s price.

- Bitcoin is approaching a pivotal moment with a halving scheduled for April 2024, which will result in a 50% reduction in Bitcoin mining speed. Historically, this event has catalyzed value growth and attracted investor attention. However, Bitcoin could face significant retracement after seven months of continuous growth and a potential “Sell-the-News” moment post-April as the euphoria induced by the Bitcoin halving subsides.

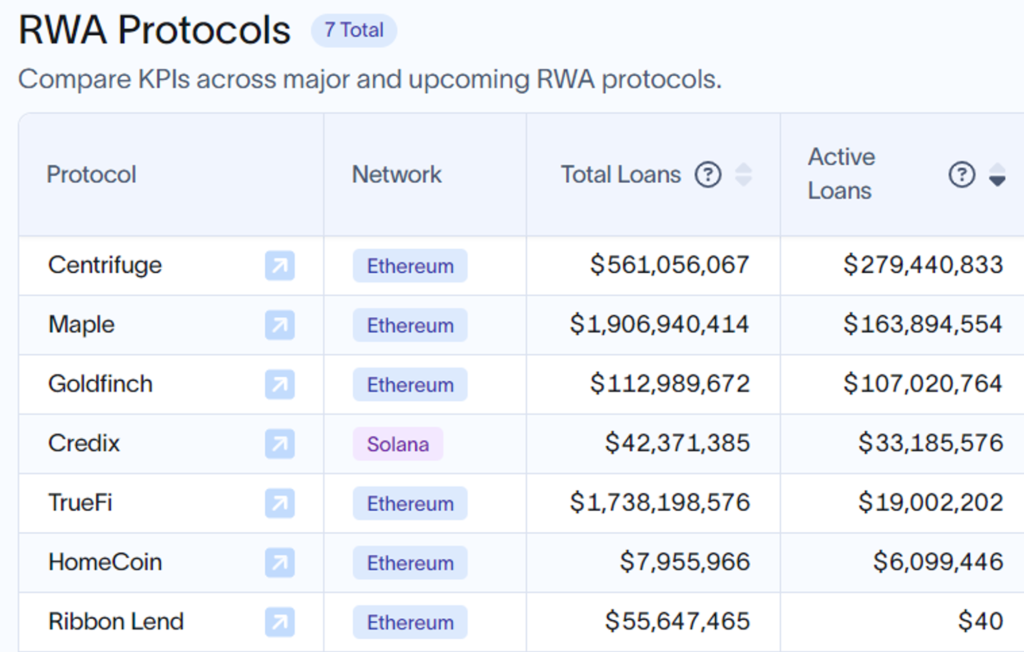

- The key narrative to monitor currently is that of Real-World Assets (RWAs). Presently, the RWA narrative is propelled by BlackRock’s tokenization fund. Major RWA projects providing users with on-chain data suggest they are conducting business correctly.

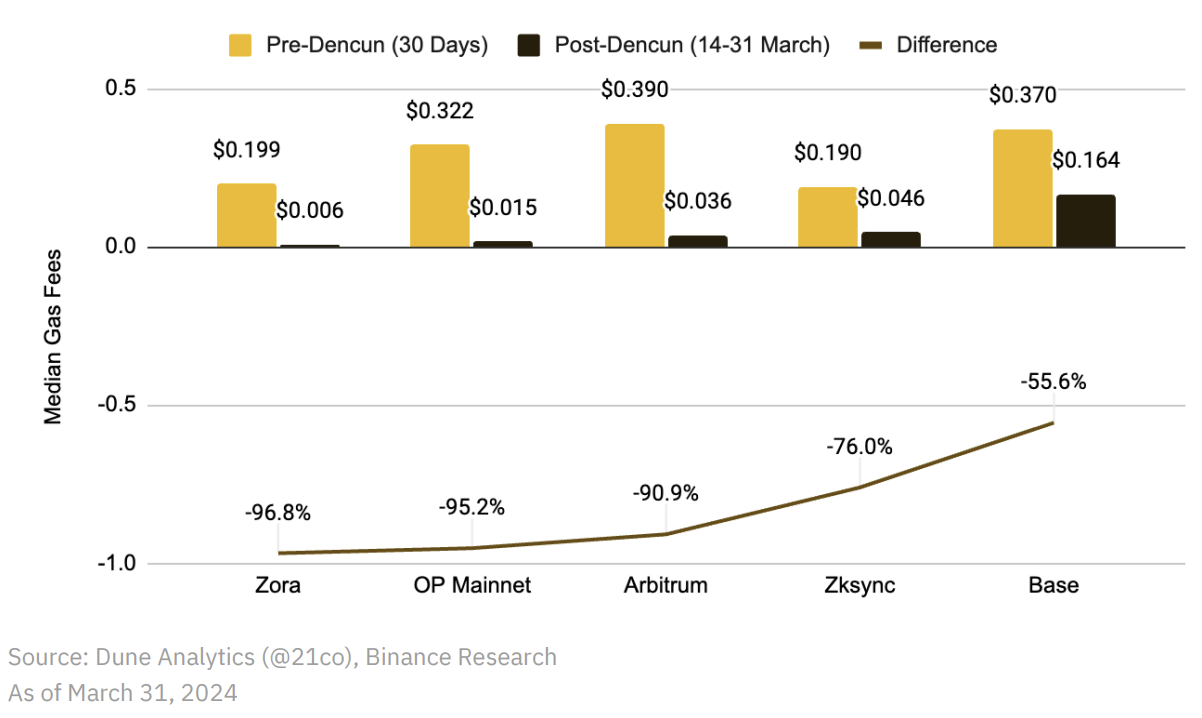

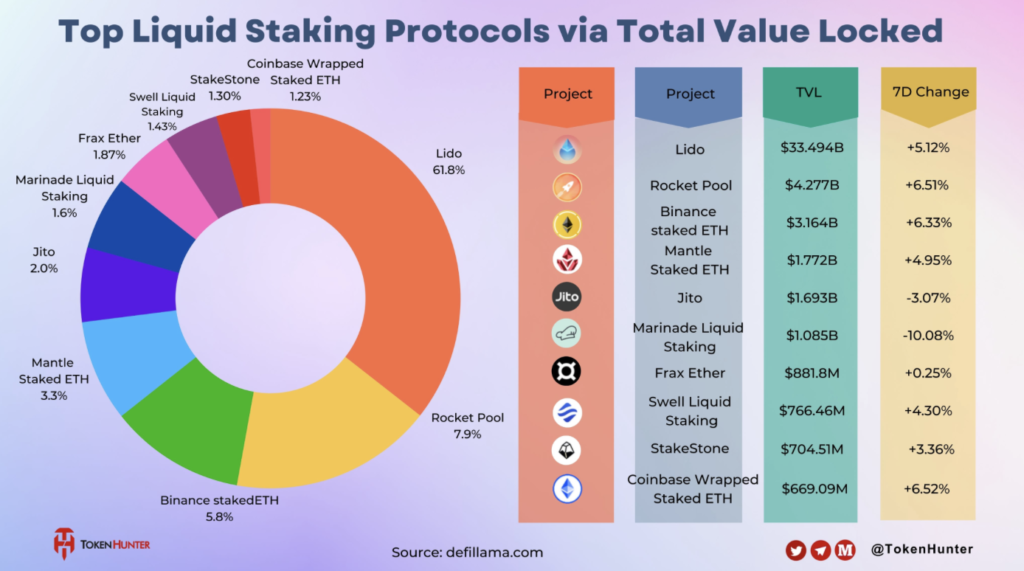

- Layer 2 transaction fees decreased by up to 96.8% after Dencun. From an investment perspective, this includes potential narratives around Layer 2, Liquidity Staking Derivatives (LSD), and re-staking.

- The growth rate in Q2 may slow down, and market volatility may increase. This could be due to a variety of factors, including shifts in investor sentiment, changes in monetary policy, geopolitical tensions in the Middle East, portfolio rebalancing, and currency fluctuations.

- Be prepared for healthy drawdowns, and maintain a focus on fundamentals when in doubt; it is prudent to remain ‘cautiously optimistic’ about the future of this bull cycle.

I. Macro Market Overview:

1.1 Economic Indicators, Statistics and News:

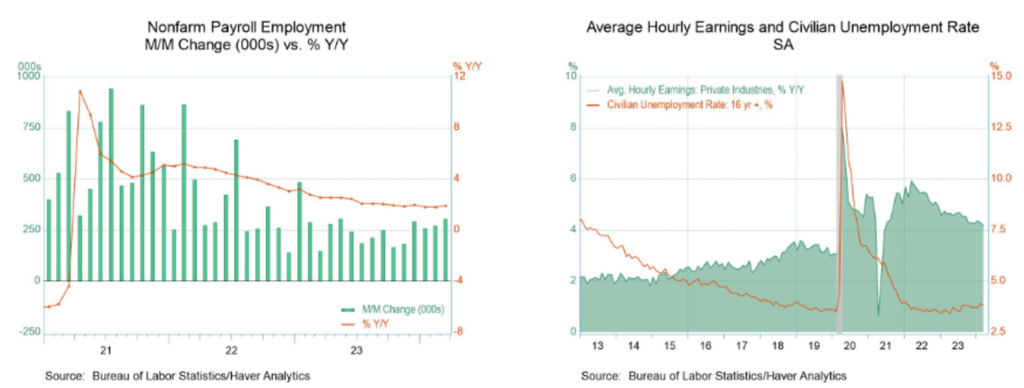

- The March jobs report substantiates the resilience of the labor market despite elevated interest rates:

- The U.S. economy saw an addition of 303,000 jobs, predominantly driven by sectors such as healthcare, government, and construction.

- Employment figures and wage growth were robust. Unemployment decreased to 3.8%, and wages increased by 0.3% for the month and 4.1% year-over-year (with payroll gains outpacing inflation).

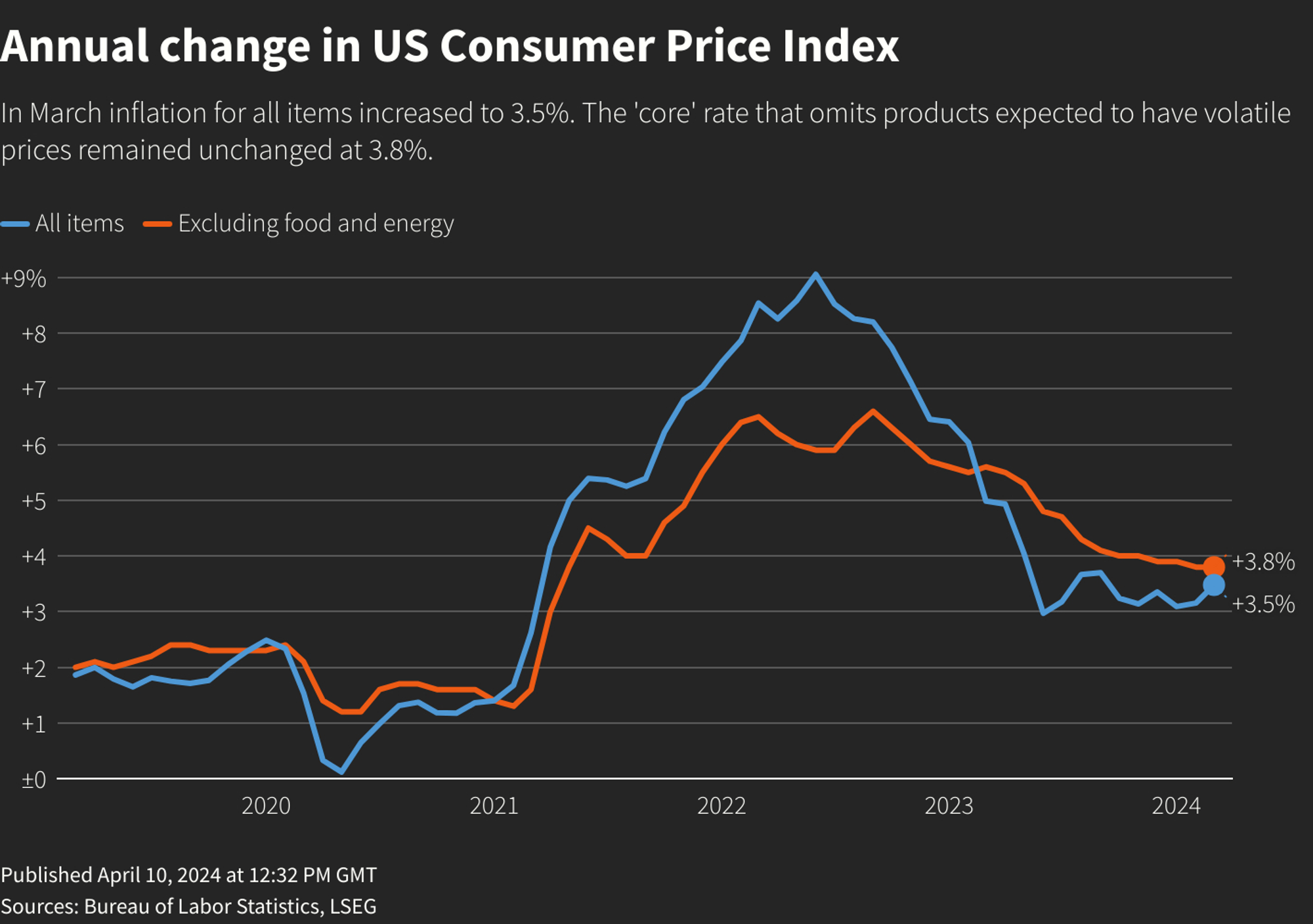

- The March inflation report indicates that the disinflationary trend has nearly plateaued in recent months:

- Both headline and core Consumer Price Index (CPI) figures edged up by 0.1 percentage point more than anticipated, each registering a 0.4% increase. Annually, headline CPI escalated to 3.5%, while the core CPI maintained a steady rate of 3.8%. Notably, over half of the CPI gains were driven by shelter and gasoline prices.

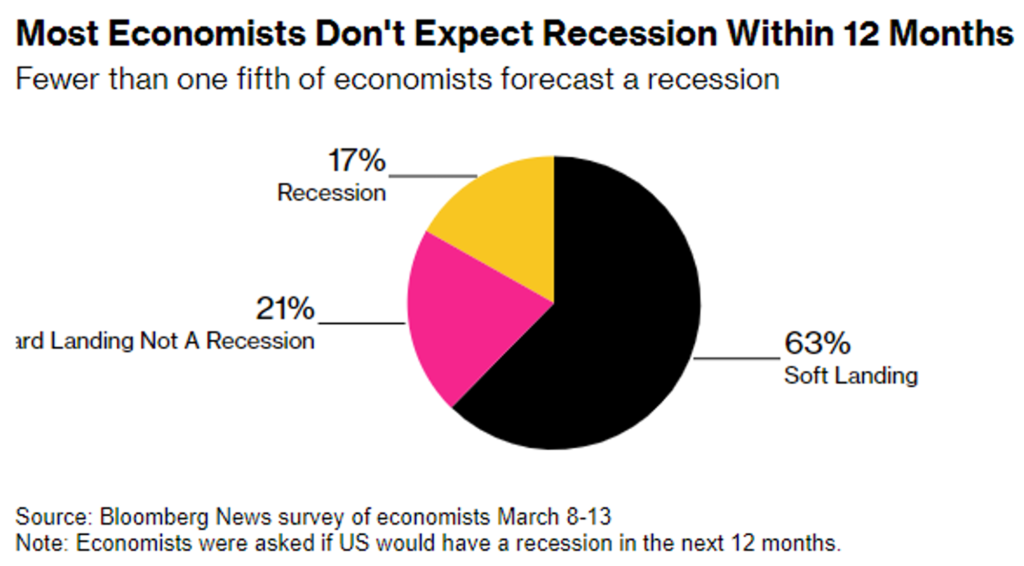

- Despite the slight uptick, the overall downtrend in inflation suggests the economy could avoid a hard economic landing. Economic sentiment among analysts has improved considerably; only 17% of surveyed economists anticipate a recession within the next 12 months, a significant decline from the 58% recorded last July.

- The dynamics of the labor market and inflation remain critical indicators for the FED’s interest rate decisions. Given the strength of the labor market and the consistent increase in consumer prices for three consecutive months, it is likely that the FED will delay any rate cuts.

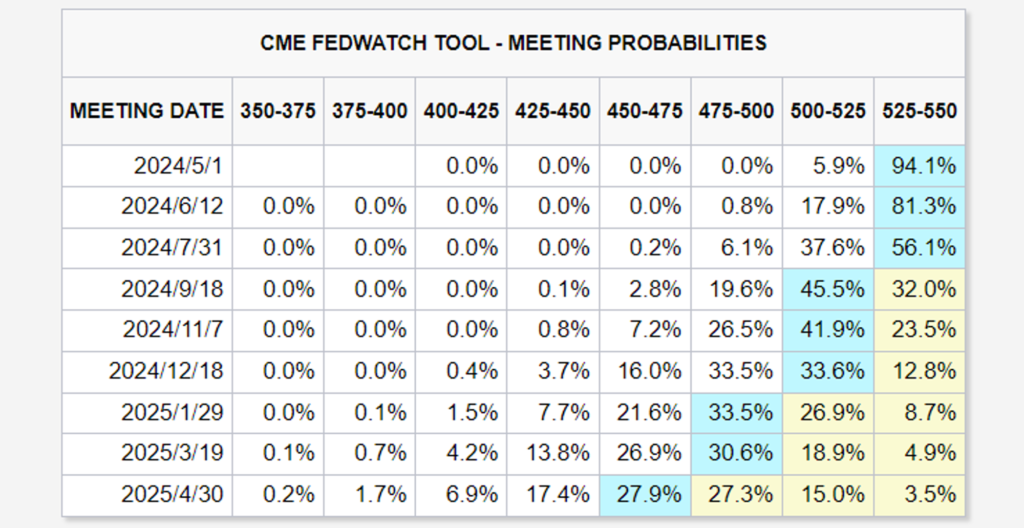

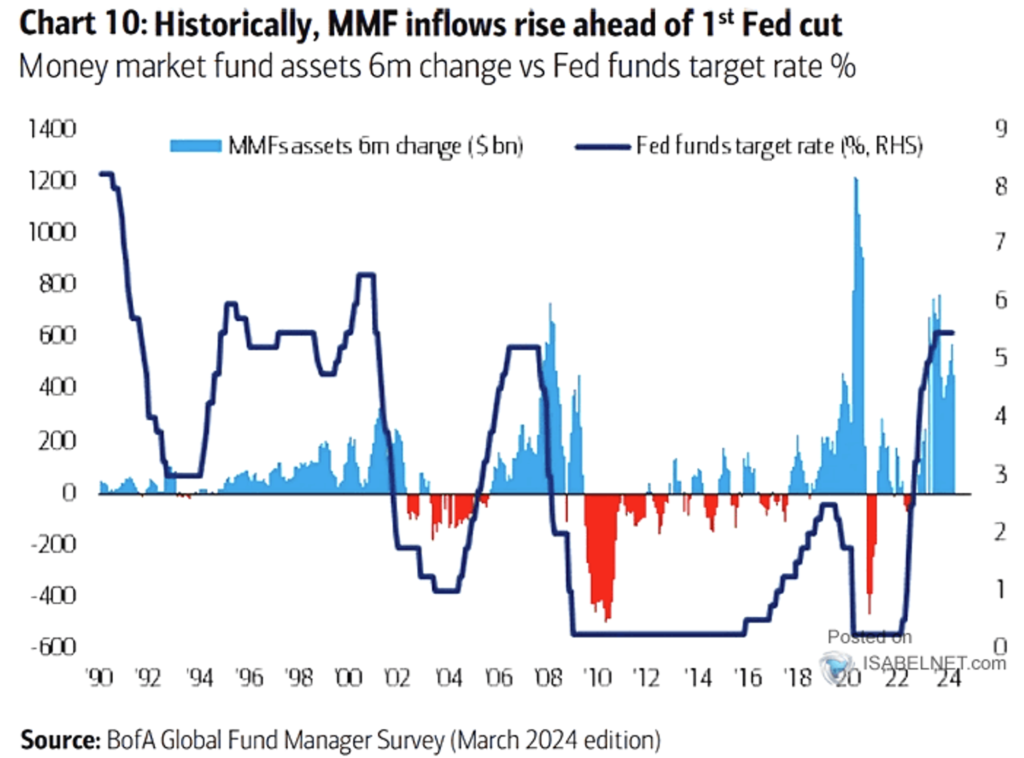

- Following these data releases, financial markets adjusted their expectations for the timing of the first rate cut, pushing it from June to September. Moreover, the market now anticipates only two rate cuts this year, as opposed to the three previously forecasted by FED officials last month.

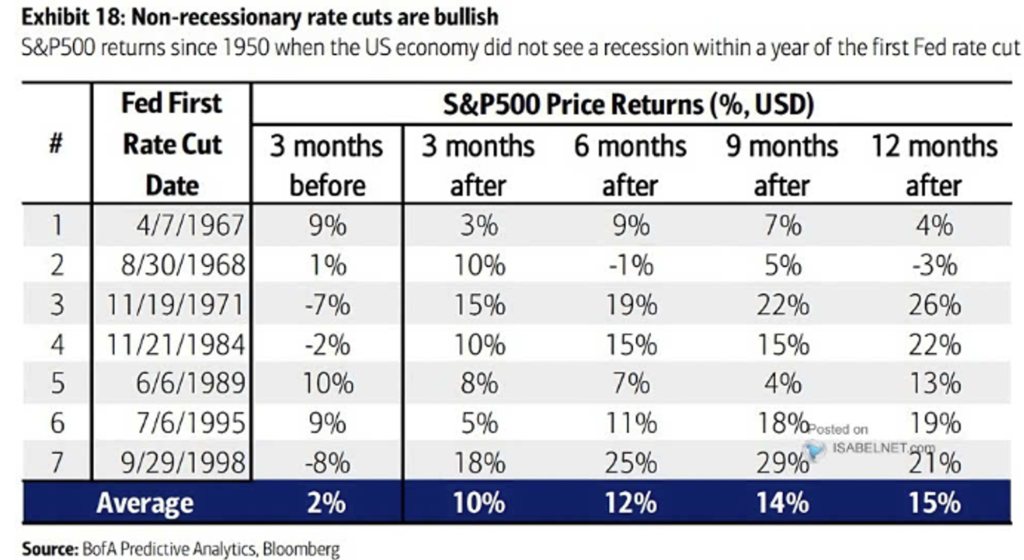

- However, a crucial consideration is the potential impact of a gradual easing of monetary policy by the FED. Such a relaxation would likely be favourable for economic expansion and could promote further gains in risk assets. Historical evidence suggests that, outside of recession periods, U.S. stocks have generally appreciated following the Fed’s first rate cut, with an average increase of 15% within the following 12 months.

1.2. Sentiment, Positioning and Fund Flow:

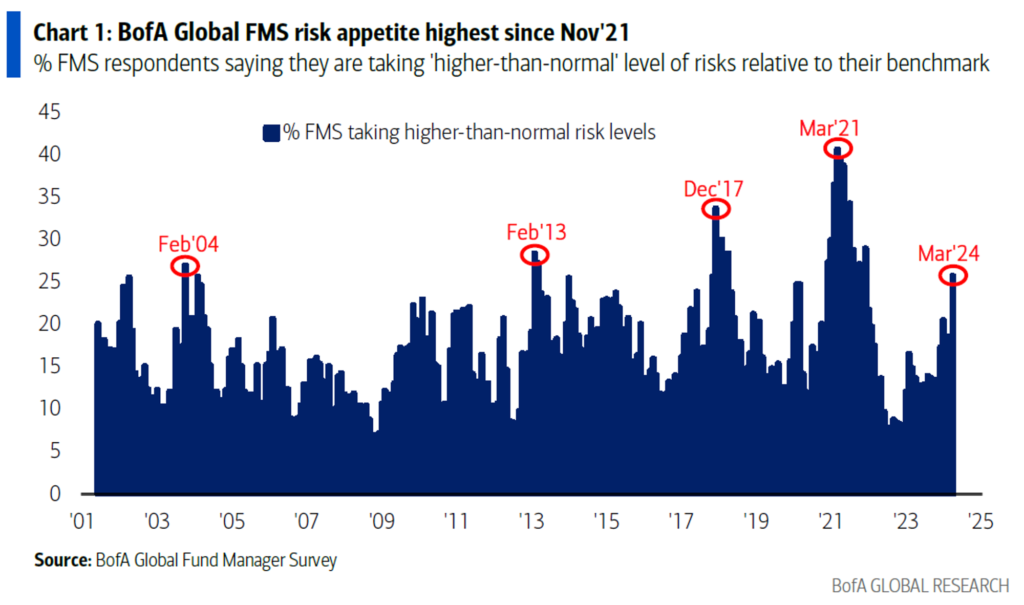

- FMS Investors Sentiment:

- Risk appetite has surged to its highest level since November 2021, with stock allocations reaching a two-year peak.

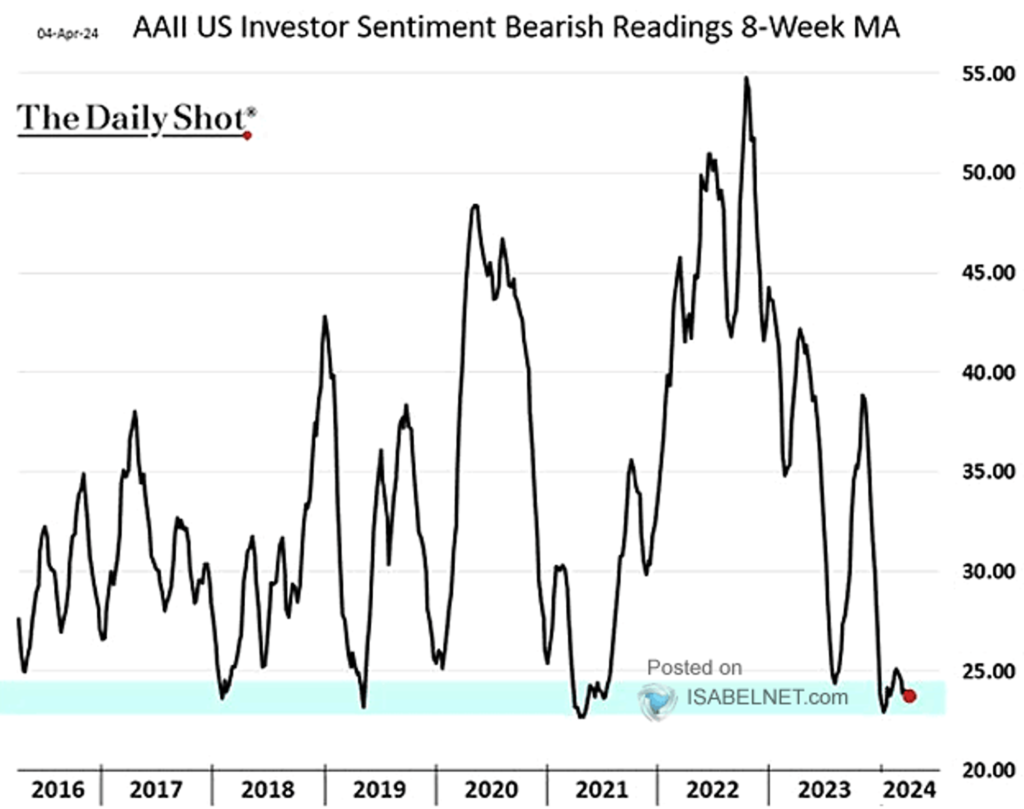

- AAII U.S. Investor Sentiment Bearish Readings:

- Bearish readings continue to linger below historical averages, indicating that AAII investors maintain an optimistic outlook on the short-term market prospects. However, given prevailing investor optimism, a short-term pullback in the markets would not be surprising.

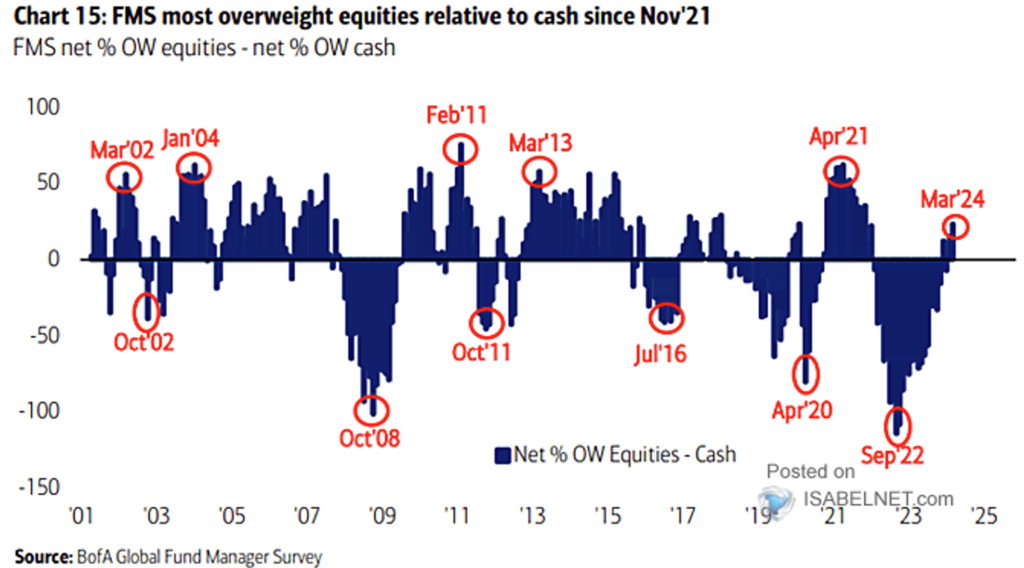

- Positioning:

- FMS investors demonstrate a pronounced preference for stock investments over holding cash, signalling strong confidence in the equity markets.

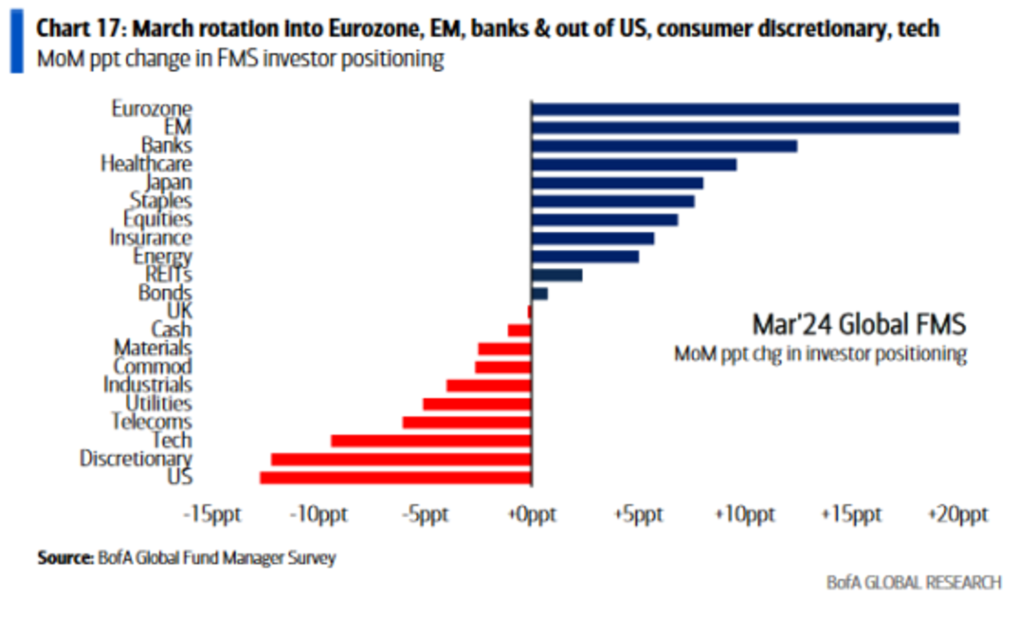

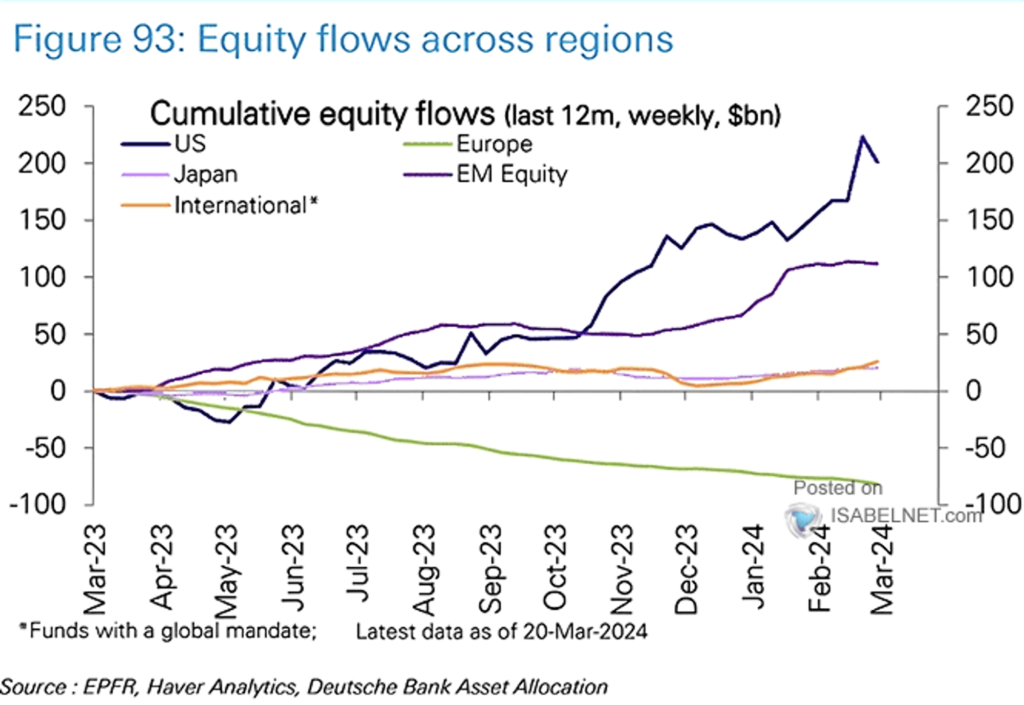

- Investors are currently in a risk-on mode, increasingly favouring stocks in Europe and emerging markets to levels not seen since May 2023. There is a notable shift towards financial sectors, with a corresponding move away from the U.S. tech and consumer discretionary sectors.

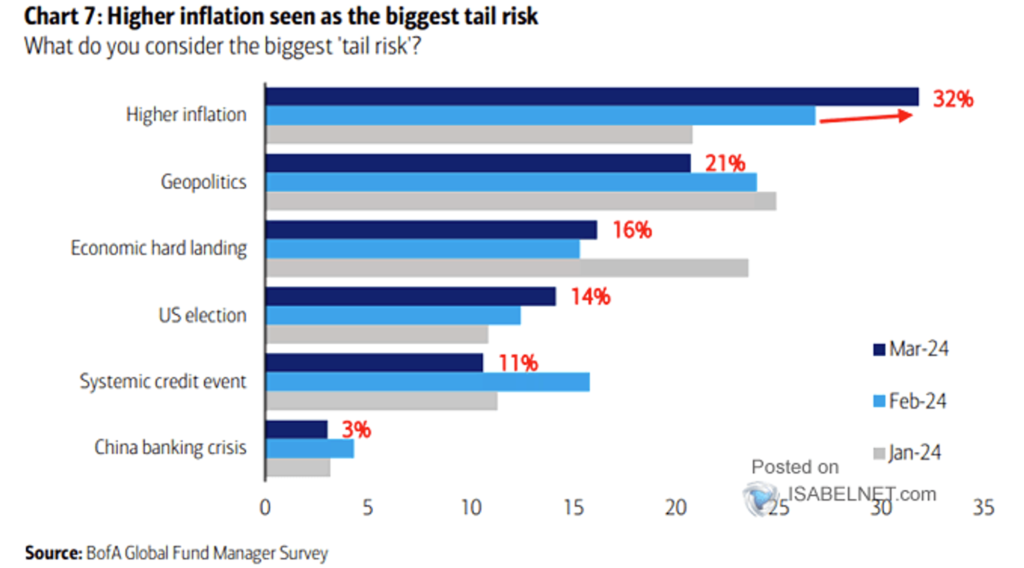

- Higher inflation and geopolitical tensions continue to pose the most significant tail risks to the global economy. Factors such as a dovish Federal Reserve, a weakening USD, escalating geopolitical conflicts, and initiatives to stimulate the Chinese economy are likely to drive up oil prices. These dynamics may precipitate a second wave of inflation, potentially yielding monthly inflation rates of 0.5% to 0.6%.

- Fund Flow:

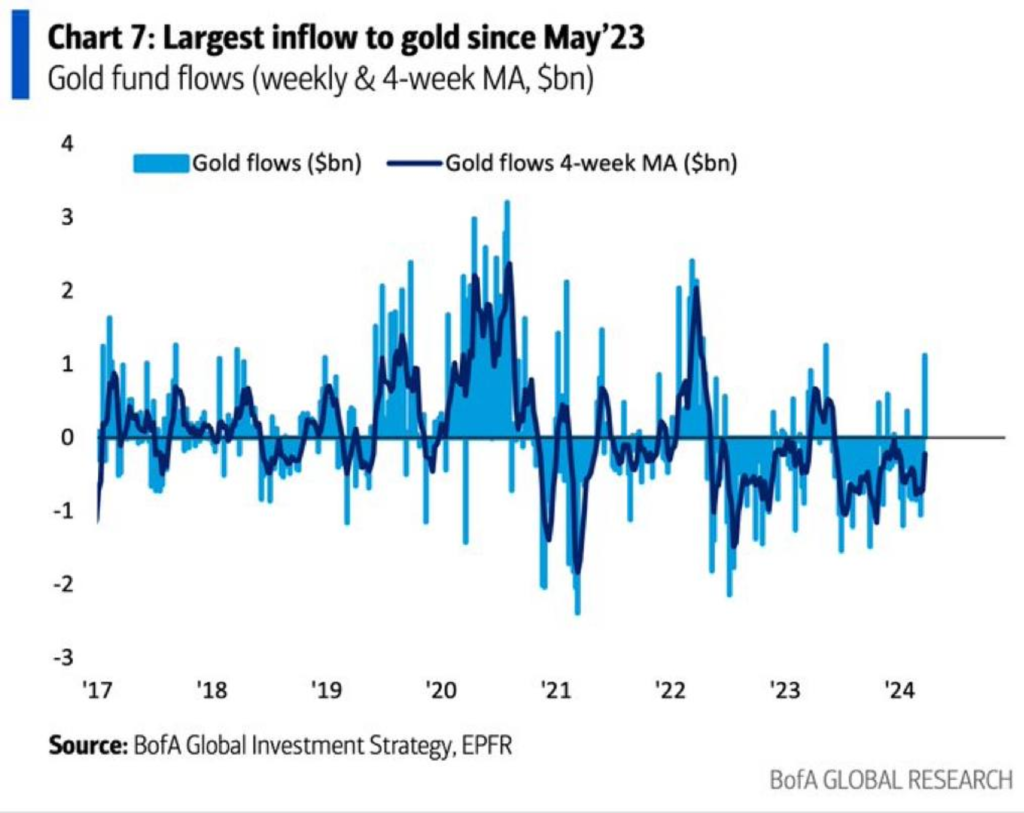

- Gold funds experienced their largest weekly inflows since May 2023, totalling $1.1 billion.

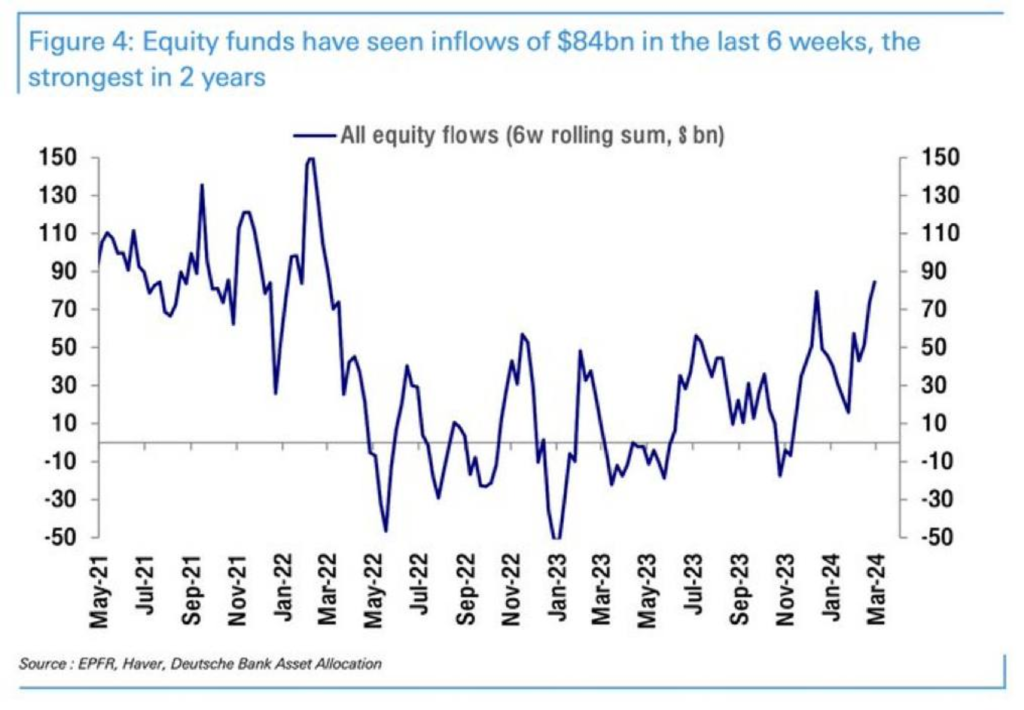

- Stock funds registered robust inflows of $10 billion for the sixth consecutive week, reaching a total of $84 billion over this period—the highest in two years.

- Continued strong inflows into the tech sector underscore investors’ enthusiasm and confidence in the growth potential of tech companies.

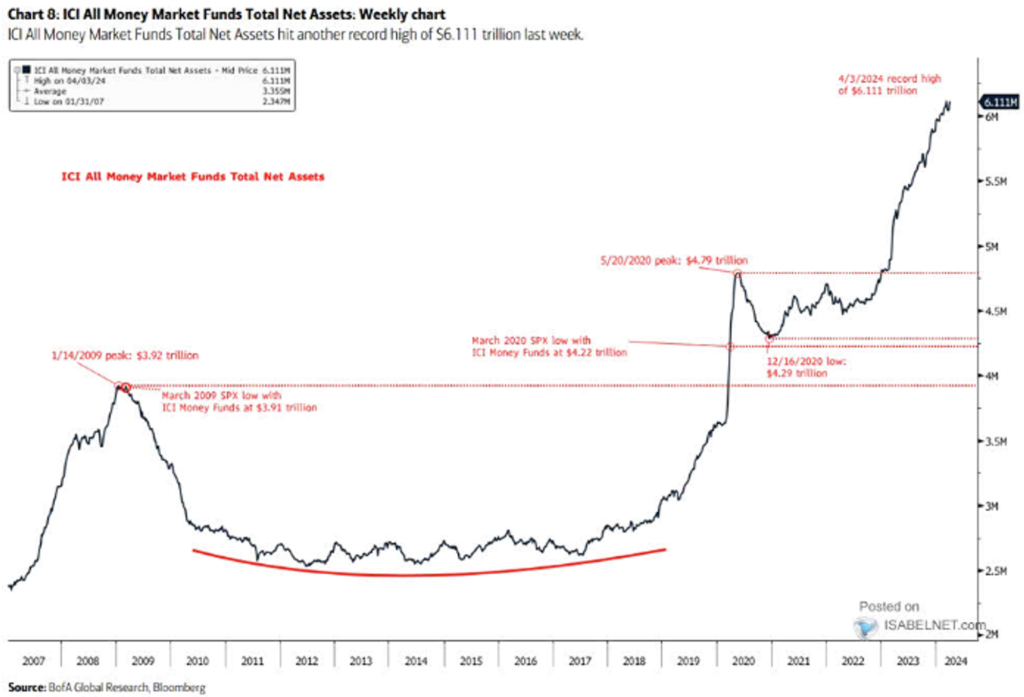

- Despite the upward trajectory of the U.S. equity market since its 2022 low, a significant preference for liquidity remains, as evidenced by money market funds reaching a new record high of $6.111 trillion. This suggests that substantial cash reserves could flow into riskier assets if a U.S. soft landing occurs.

- Typically, money market funds experience outflows 12 months following the initial rate cut, as investors begin reallocating their portfolios and adjusting their risk exposures in response to changes in interest rates and market conditions.

II. Crypto Market Pulse:

2.1. Market Movements:

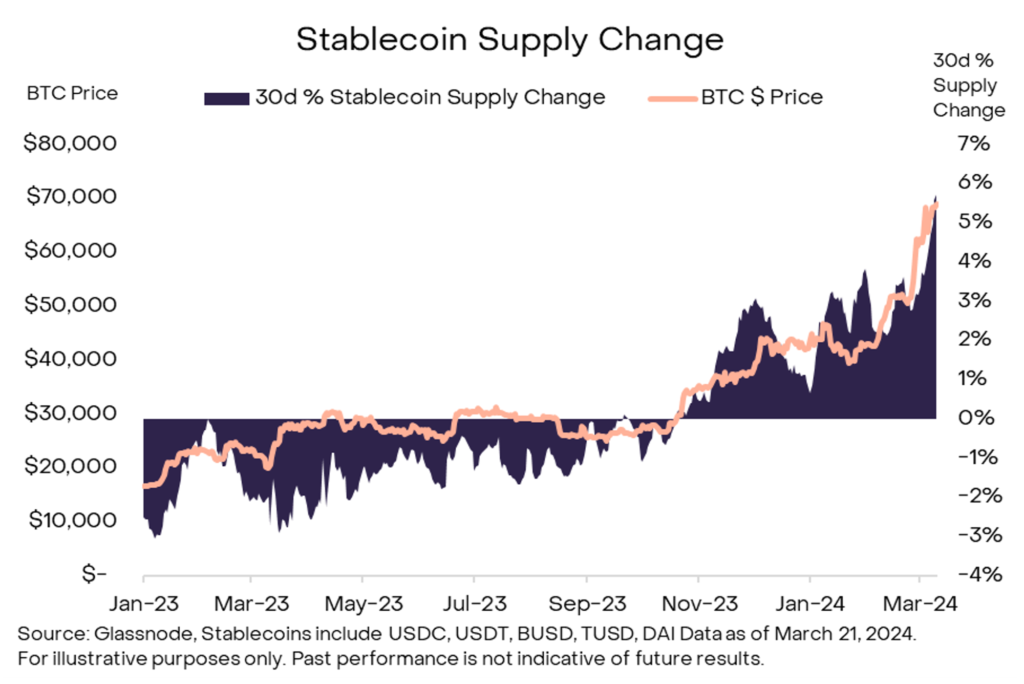

- The stablecoin supply on CEXs & DEXs has increased by ~6% between Feb & March. Increased stablecoin liquidity = more capital readily available for trading.

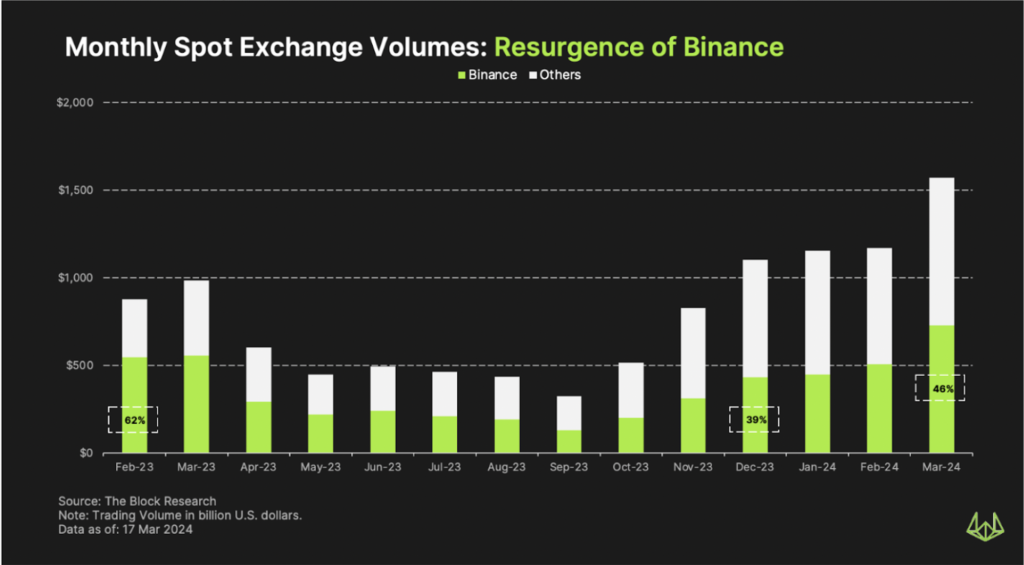

- The total volume of spot trades in March reached $1.5 trillion, marking the highest monthly volume since December 2021. This significant increase in trading volumes across the market may indicate a growing interest or enhanced liquidity in the sector.

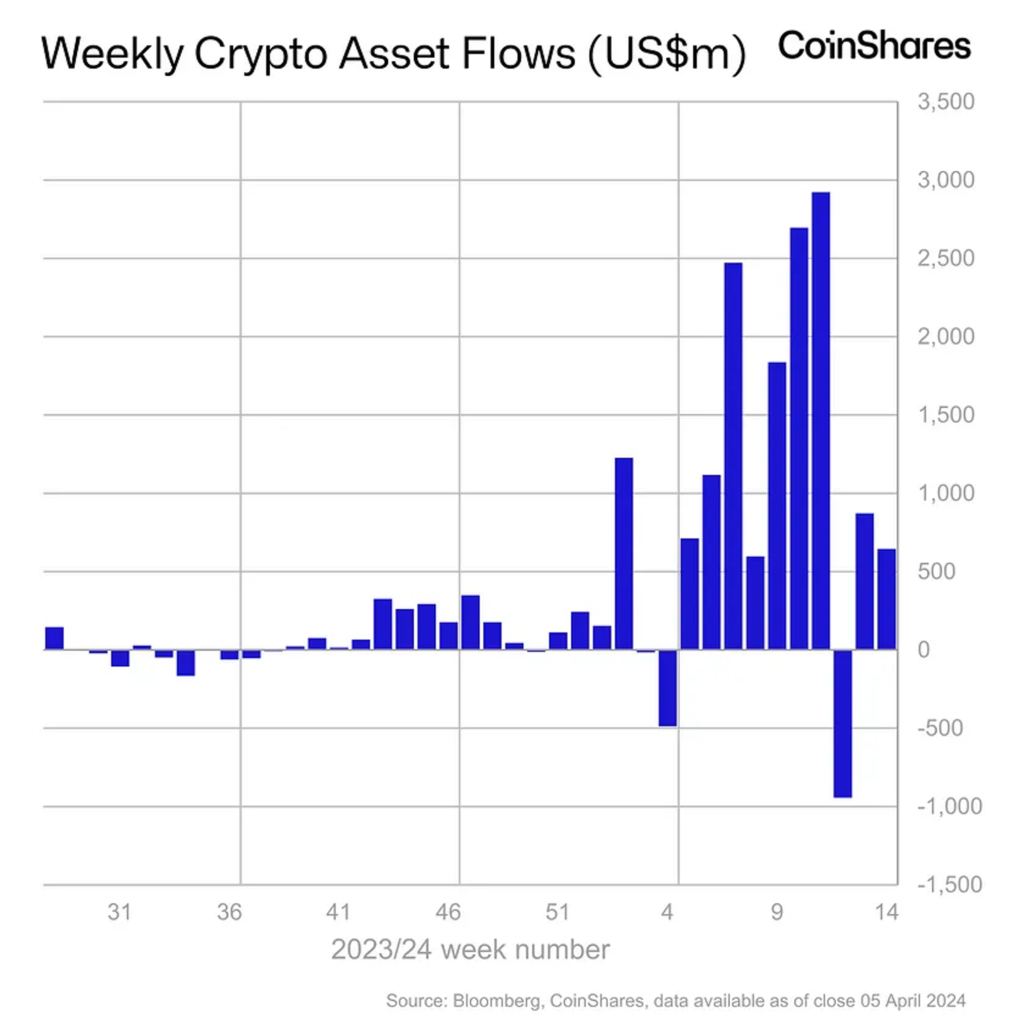

- Digital asset investment products saw inflows of $646 million, bringing the year-to-date inflows to $13.8 billion, surpassing the $10.6 billion recorded during the 2021 uptrend. However, despite a strong price rally in Q1, there are signs of market exhaustion. The decreasing appetite from ETF investors, failing to reach the weekly flow levels observed in early March, suggests that both Bitcoin and the broader crypto market may experience slower growth in Q2.

- Bitcoin has rallied about 65% this year, reaching an all-time high of $74K, driven by positive ETF inflows from prominent firms like BlackRock and Fidelity. This rally has lifted the overall market value of digital assets to approximately $2.7 trillion, contributing to the bullish sentiment.

- However, significant outflows from Grayscale’s Bitcoin Trust (GBTC), averaging $300 million per day and totalling over $12 billion in the past three months, have led to a 16% decline in Bitcoin from its ATH, particularly noted when the outflow from GBTC hit $643 million on March 18.

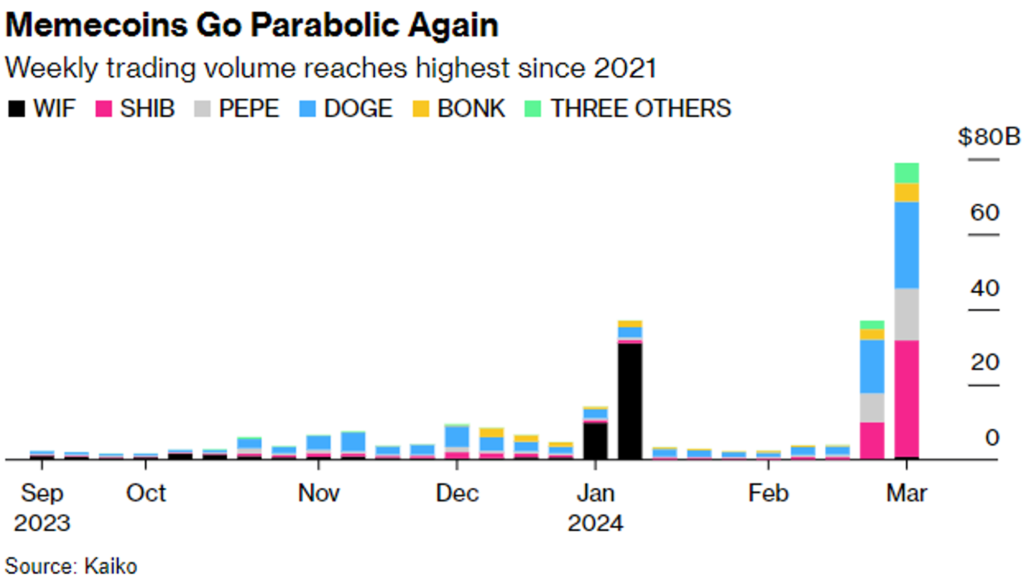

- Memecoins have resurfaced, with dog-themed tokens such as Dogecoin (DOGE) and Shiba Inu (SHIB) rising by 50% to 100%. Prices for newer meme tokens like PEPE, BONK, and Dogwifhat (WIF) have increased by 100% to 200%.

- Despite high expectations, the gaming sector and Layer 2 projects have not seen the anticipated pump in investment activity.

- This investment cycle is not predominantly focused on retail investors but rather on institutional players like BlackRock and their forthcoming actions. The Real World Assets narrative is currently driven by BlackRock’s tokenization fund. Major RWA projects are providing transparent on-chain data such as active loans, revenue, and defaults, indicating that these ventures are operating effectively and compliantly.

2.2. Monthly Highlight News:

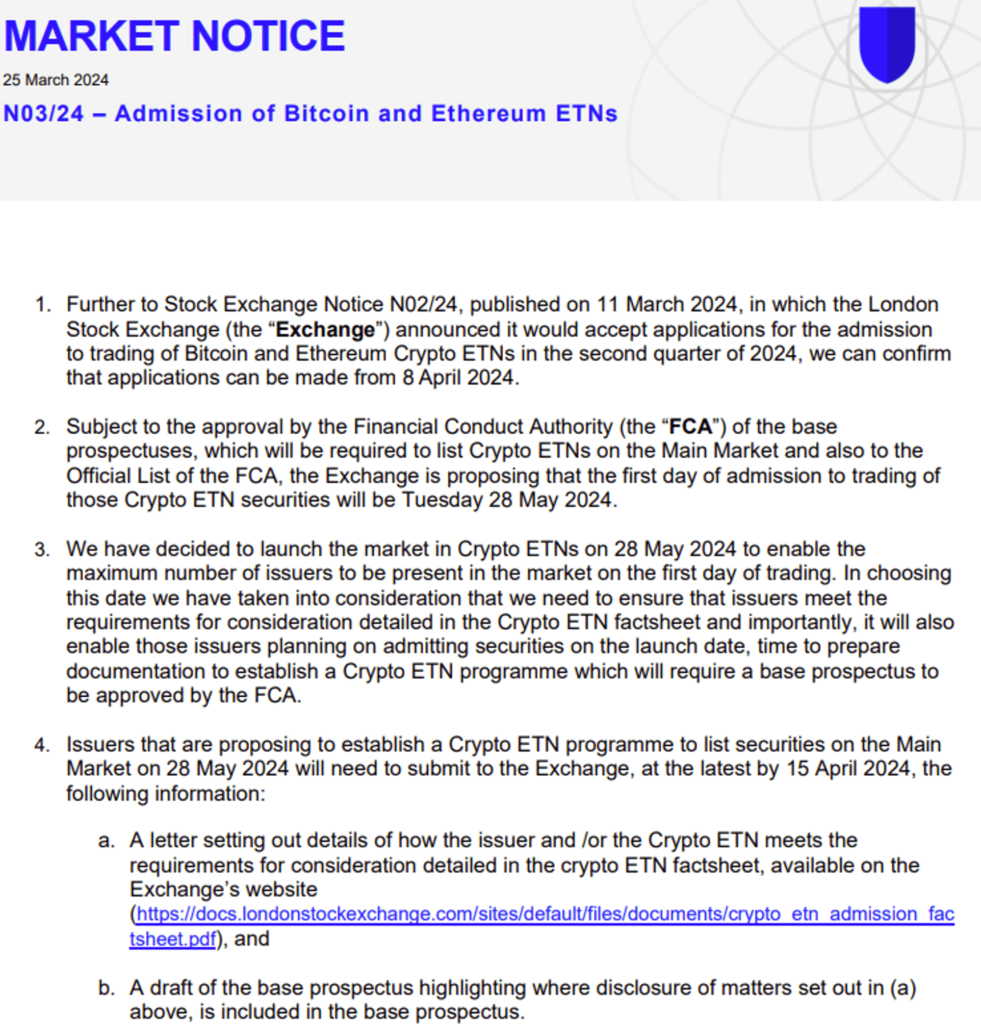

- New U.K. crypto trading products:

- The U.K.’s Financial Conduct Authority (FCA) has announced that it will permit exchanges to list cryptocurrency-linked exchange-traded products starting May 28. This regulatory change is expected to lead to increased institutional investment in Bitcoin and other cryptocurrencies, likely impacting their prices positively as more substantial capital enters the market.

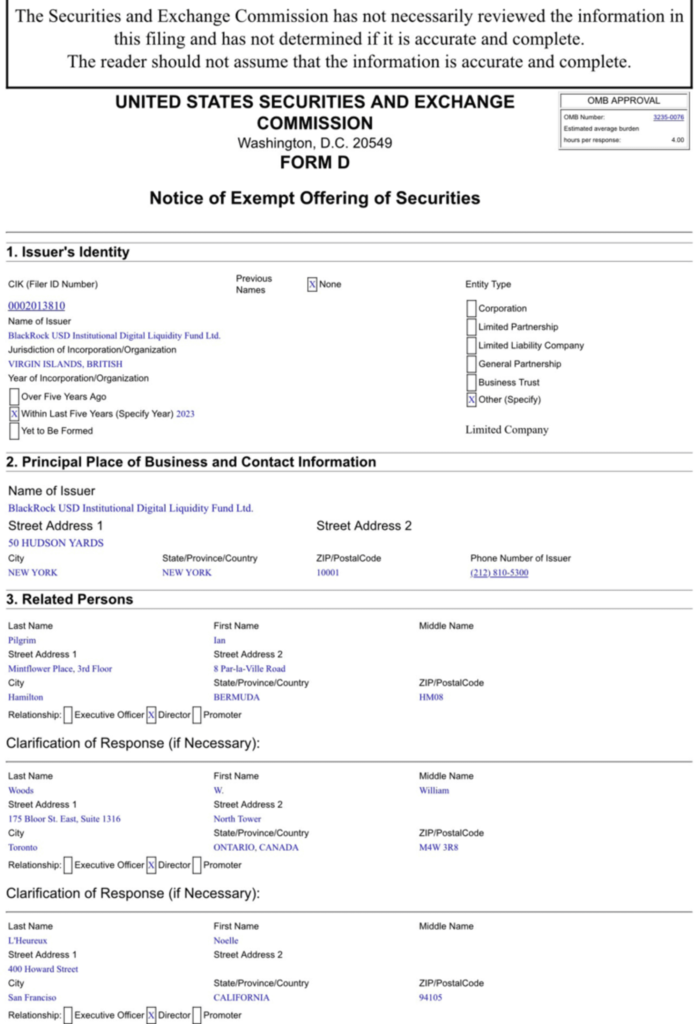

- BlackRock’s First Tokenized Mutual Fund:

- BlackRock has unveiled its first tokenized mutual fund, the BlackRock USD Institutional Digital Liquidity Fund. This fund holds assets in cash, US Treasury bills, and repurchase agreements while maintaining records on the public Ethereum blockchain. This structure enables investors to transfer their tokens 24/7 to other pre-approved investors. CEO Larry Fink believes that tokenization and exchange-traded funds (ETFs) will fundamentally transform the financial landscape.

- Japan passed new laws enabling investment funds to hold Bitcoin directly:

- Japan has passed new laws enabling investment funds to hold Bitcoin directly. The Government Pension Investment Fund (GPIF), the world’s largest pension fund managing over $1.5 trillion in assets, has announced its intention to explore diversifying a portion of its portfolio into Bitcoin. This move signifies a broader acceptance and legitimization of Bitcoin within the world’s third-largest economy.

III. Investment implications:

3.1. Stocks:

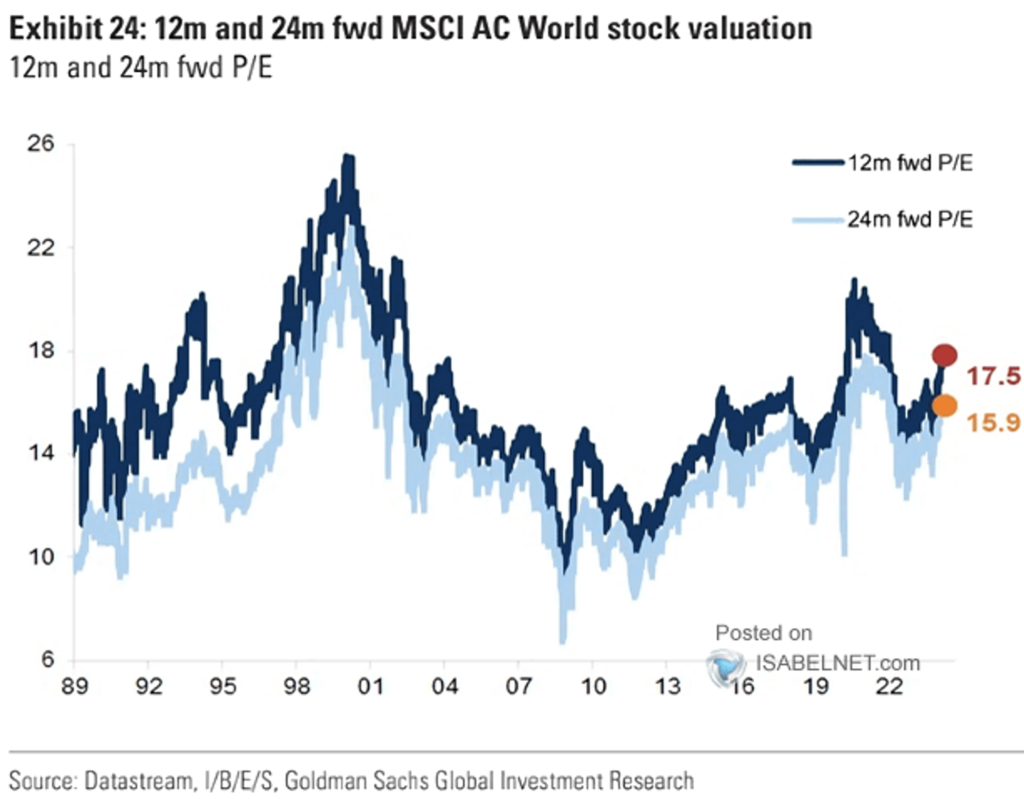

- Valuation – MSCI World 12-Month Forward PE:

- At 17.5, the current global stock’s 12-month forward P/E ratio exceeds the 20-year median, indicating a relatively high valuation of the global stock market.

- After a period of bullishness, investors have become cautious about the U.S. stock market, as evidenced by recent outflows from equity funds to Japanese stocks and EM Equity.

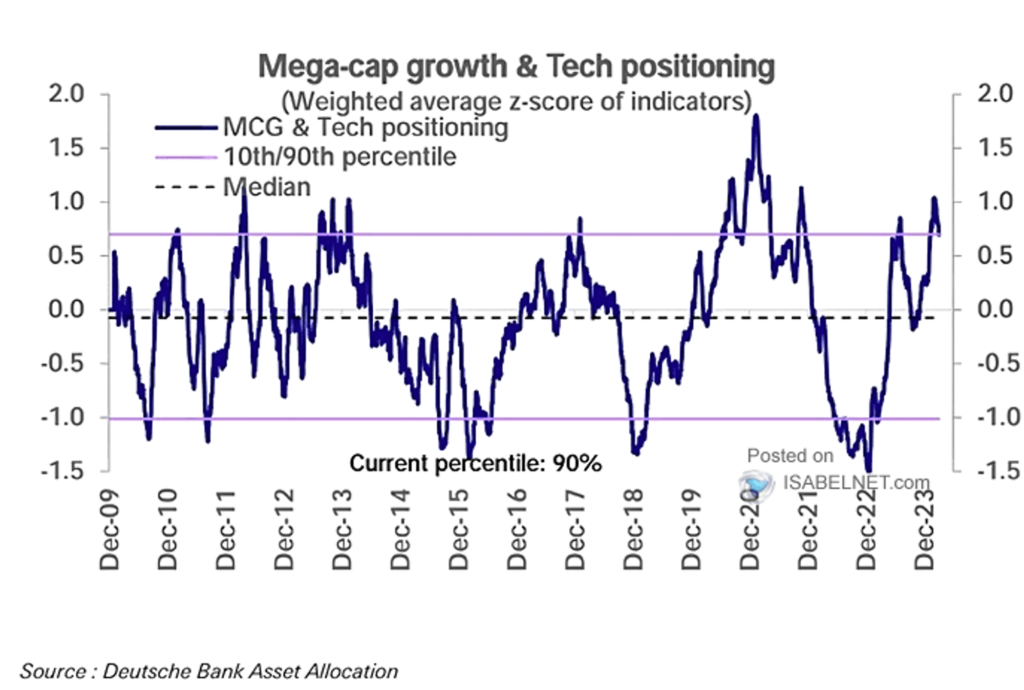

- I am concerned about excessive optimism and vulnerability to market corrections, particularly due to the overstretched positioning in mega-cap growth and tech stocks. Thus, it should be rotated into other sectors such as telecom, industrials and energy to manage risk effectively.

3.2. Crypto Market:

- Capital may shift towards Layer 2 solutions, which address issues related to speed, efficiency, and gas costs (L2 transaction fees decreased by up to 96.8% after Dencun). From an investment perspective, this includes potential narratives around Layer 2, Liquidity Staking Derivatives (LSD), and re-staking.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.