TL;DR

- Investors are currently exhibiting their most optimistic sentiment in over two years, buoyed by an improved macroeconomic outlook and a diminished perception of risk (concerns of recession and growth scare may have been overstated).

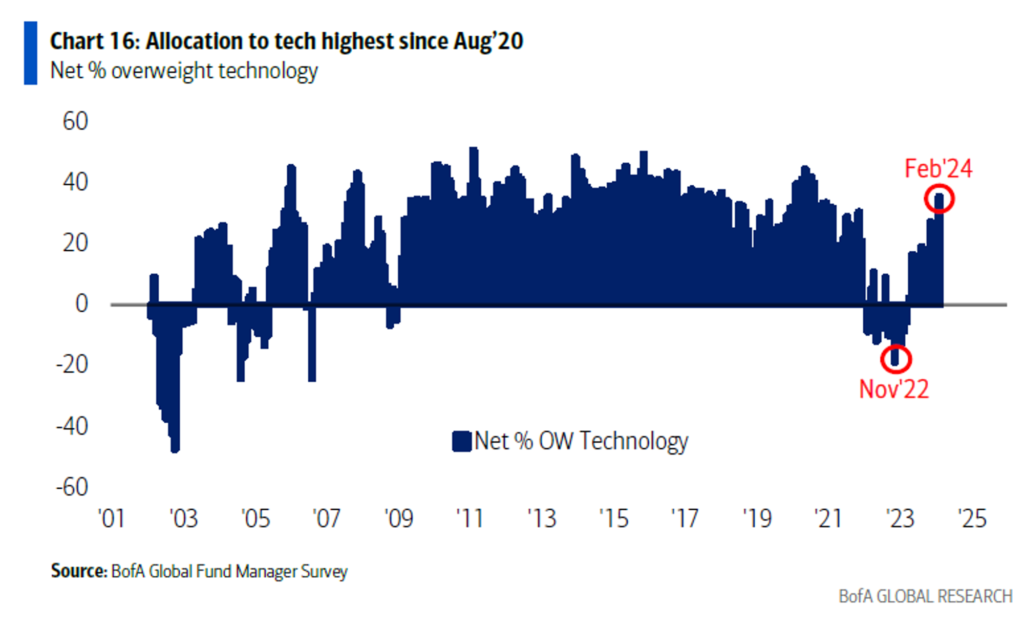

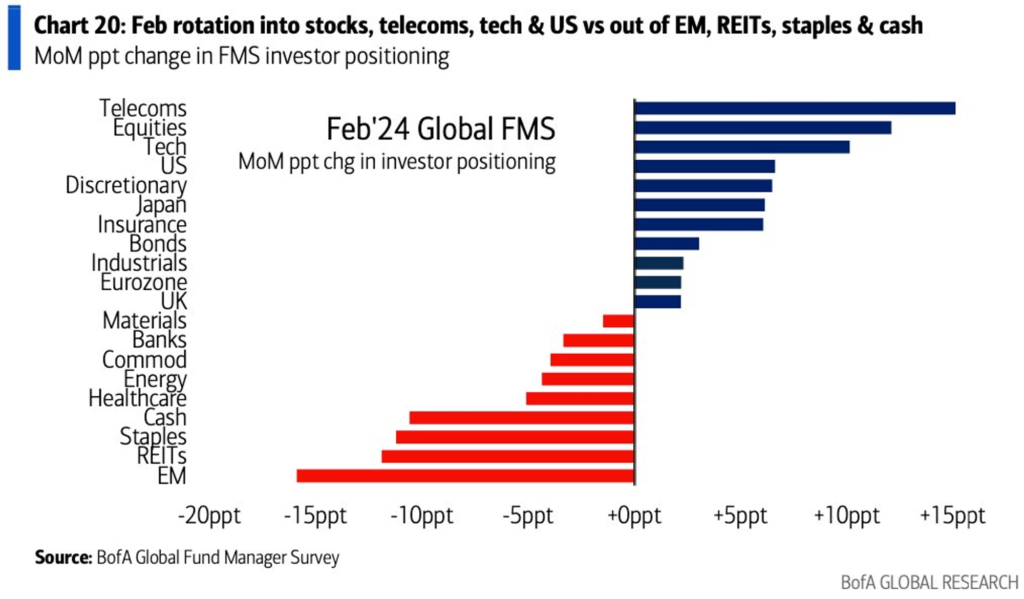

- Allocations by investors to US stocks have reached their highest point since November 2021, while allocations to tech stocks have peaked since August 2021. This shift comes as investors progressively move away from cash positions.

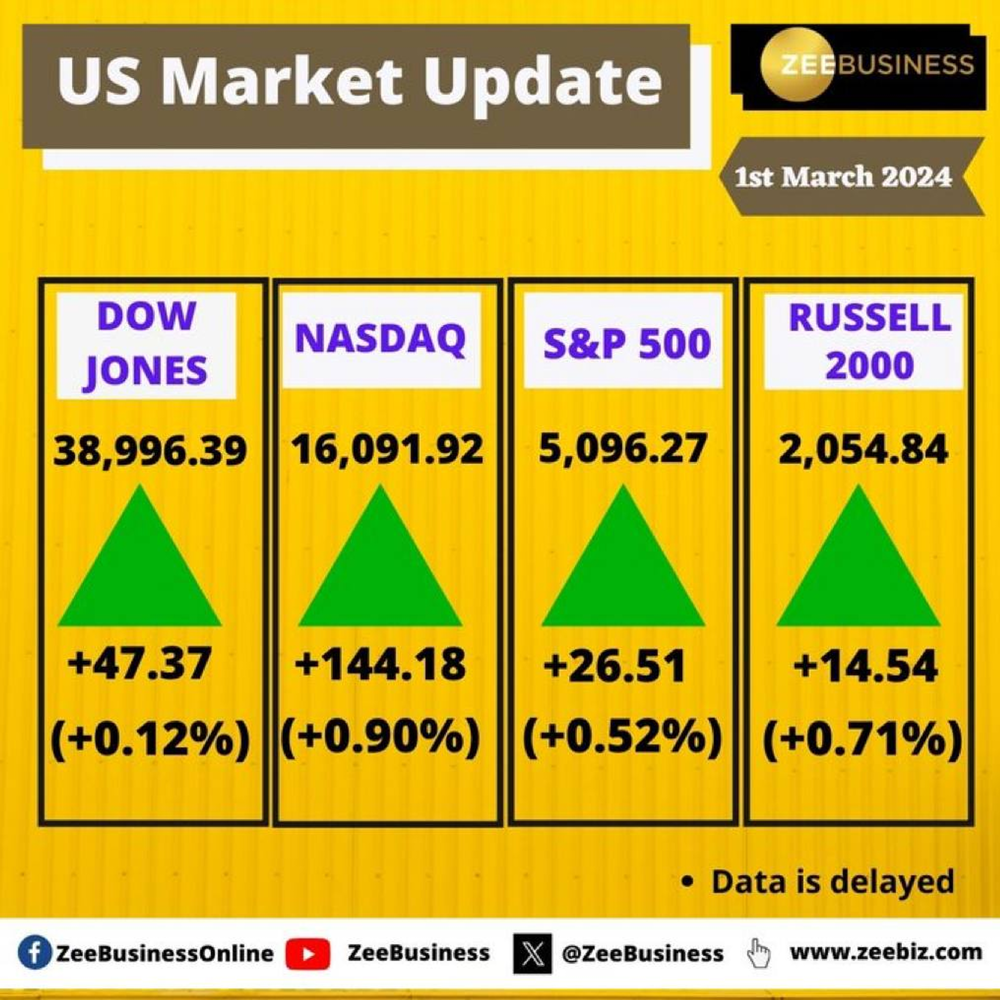

- The S&P 500 and Nasdaq Composite have just recorded their best February performances since 2015, concluding the month at all-time highs. This achievement is supported by several outstanding earnings reports from major tech companies and a more optimistic outlook for the US economy.

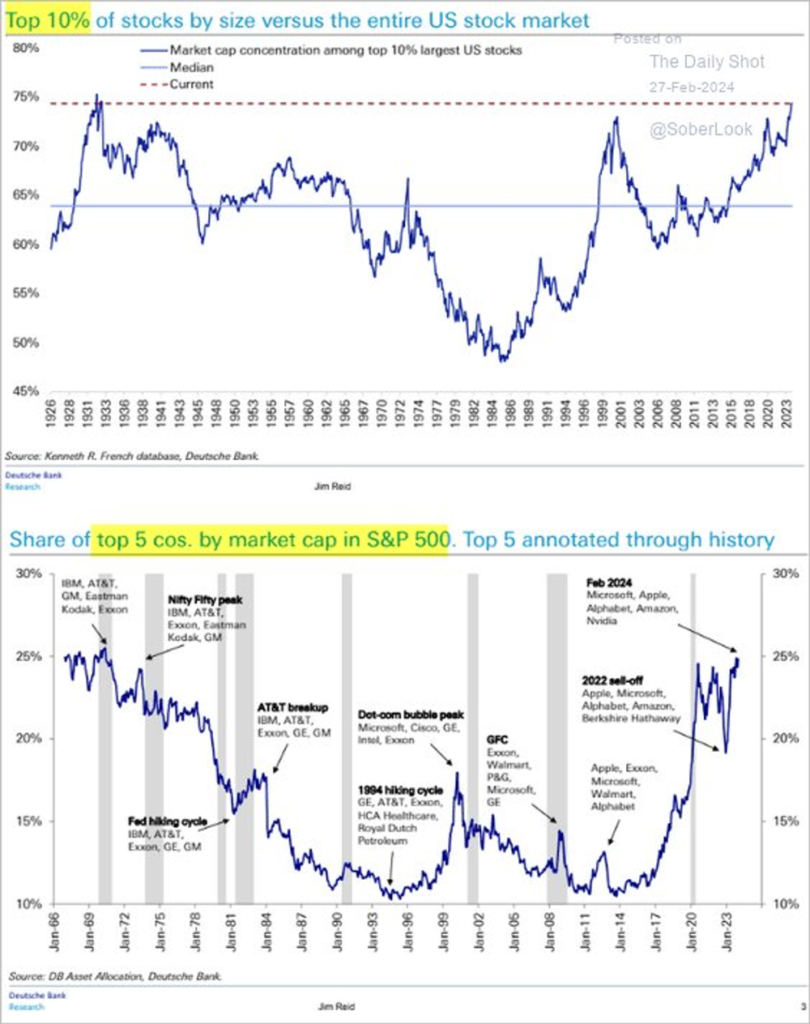

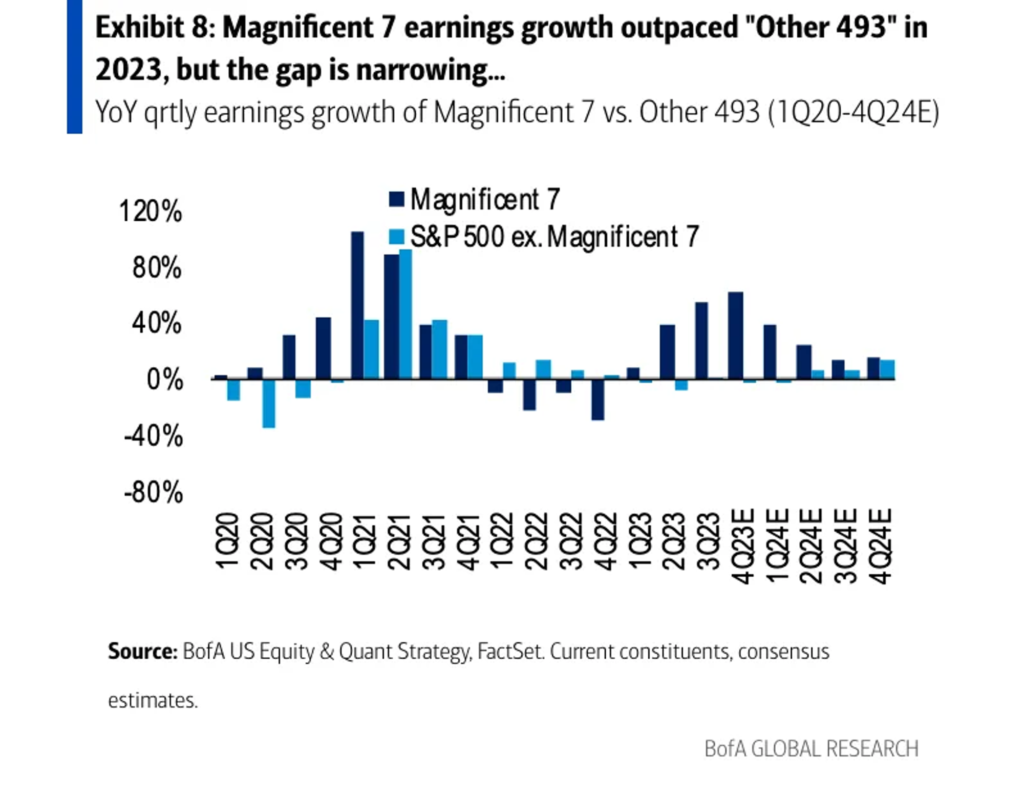

- The top 10% of stocks in the US currently reflect ~75% of the entire market. Bank of America expects leadership to broaden as the gap between earnings growth of the Magnificent 7 and the rest of the S&P 500 begins to narrow.

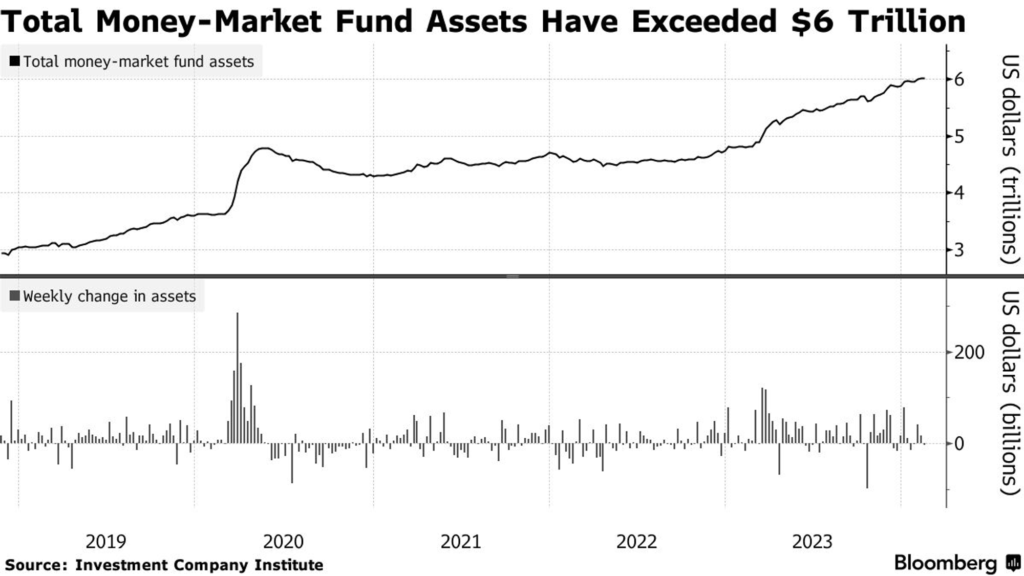

- If the US avoids recession, the stock market is expected to outperform the bond market, and any market dips are unlikely to be deep with a massive amount of cash ($6 trillion in money markets) sitting on the sidelines, waiting.

- Retail traders re-entered the crypto markets in February, driven by the anticipation of three major crypto catalysts in the upcoming months: the Bitcoin Halving event, the next major upgrade of the Ethereum network, and the potential approval of Spot Ethereum ETFs by the SEC in May. At this point, the first two catalysts are largely factored into prices.

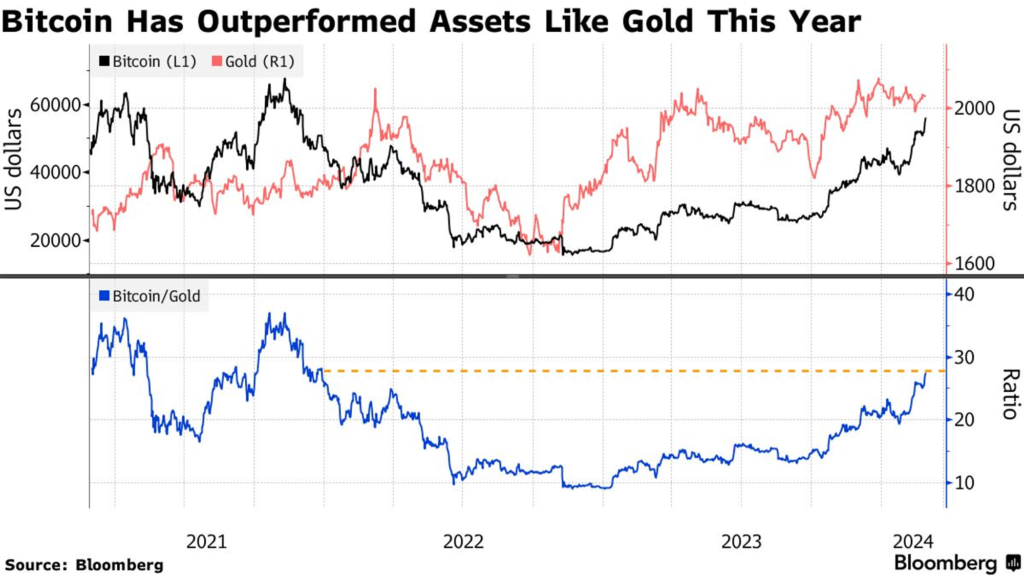

- Bitcoin has surpassed traditional assets such as stocks and gold this year, bolstered by significant inflows into global bitcoin exchange-traded products and additional acquisitions by MicroStrategy. Notably, Ethereum, which surged 47% during the month, benefited from the upcoming Dencun upgrade and the prospects for regulatory approval of an ETH ETF in May.

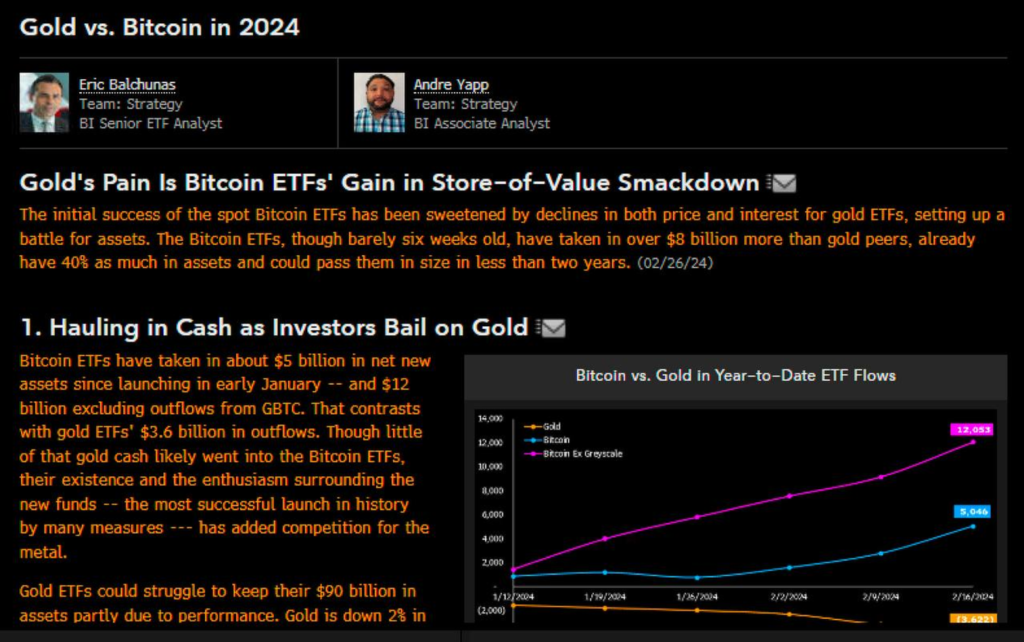

- Gold ETFs have seen net outflows since the introduction of spot Bitcoin ETFs. Over the long term, increased inflows into bitcoin ETFs could pose a threat to gold’s status as a primary store of value.

- Investors have invested more than $7.4 billion into nine ETFs that commenced trading last month. The fixed supply, robust demand, and an impending reduction in Bitcoin’s supply growth (the halving event) are expected to lead to rapidly increasing price levels in the medium and long term.

- Ethereum still has significant room for growth this year, and even a 10-15% downturn would be insignificant compared to the potential upside of 50% or more (well risk-reward ratio).

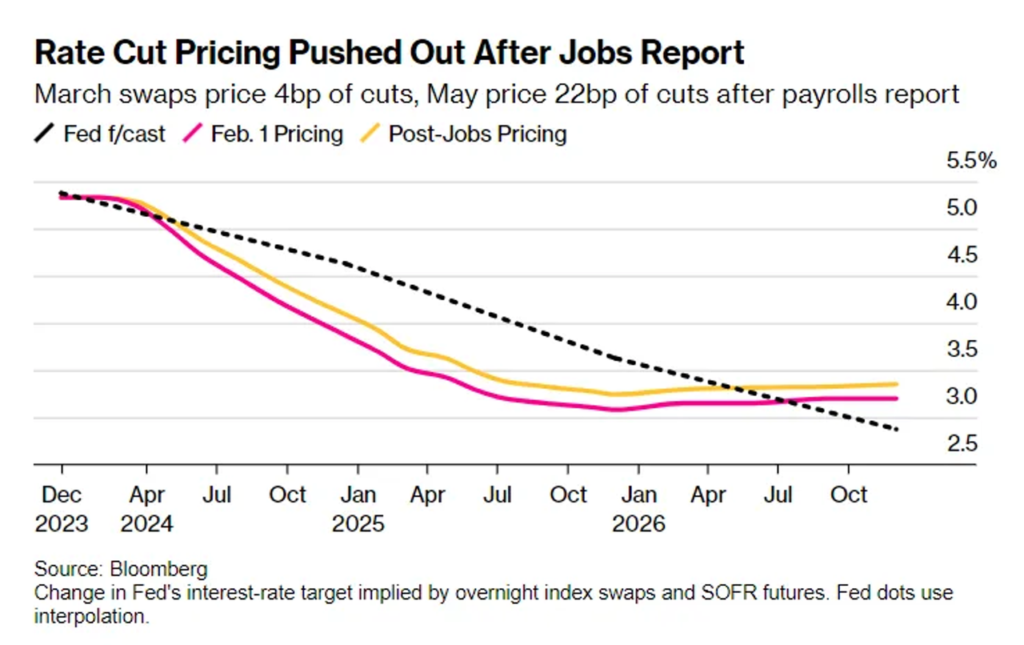

- The current uncertainty lies with the Federal Reserve. If the Fed decides to pause interest rate hikes in March, then the bulls might attempt to push the market up once again. However, the possibility that the Fed delays interest rate cuts beyond investor expectations, leading to a financial market adjustment, cannot be ruled out.

I. U.S Macro Market Overview:

1.1. Key Macro indexes:

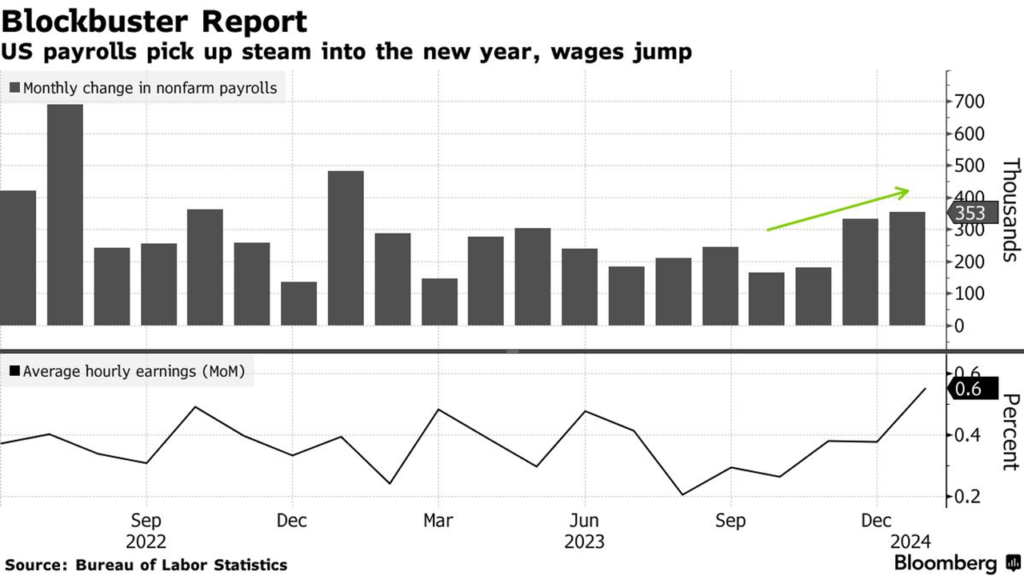

- The US labour market remains robust, with companies adding 353,000 jobs in January, the highest in a year. Additionally, wage growth surged, with average hourly earnings rising 0.6% month-on-month.

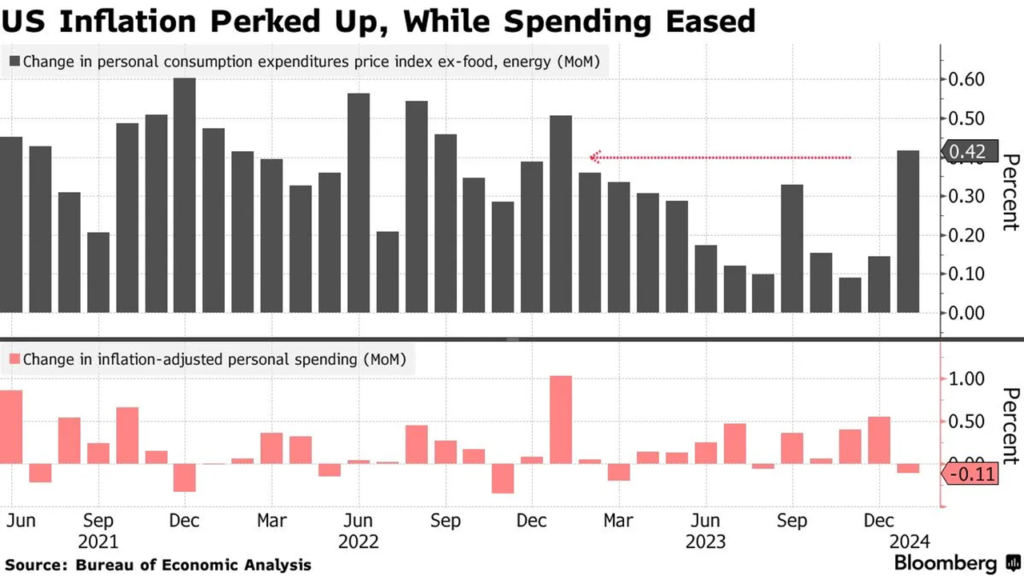

- February saw an acceleration in inflation, with the core PCE price index rising 0.4% month-on-month, indicating it may prove more persistent than hoped. Together, these figures suggest a reacceleration that is likely to postpone any rate cuts at the Fed’s next meeting in March.

- The CME FedWatch Tool reflects this sentiment, with analysts expecting rates to remain on hold at current levels. While 52.5% anticipate a 25bps cut in June, over 35% believe rates will remain unchanged even then.

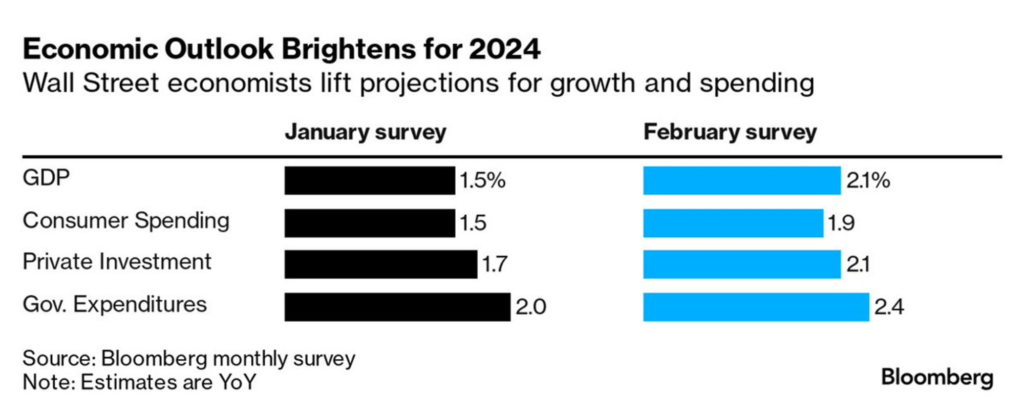

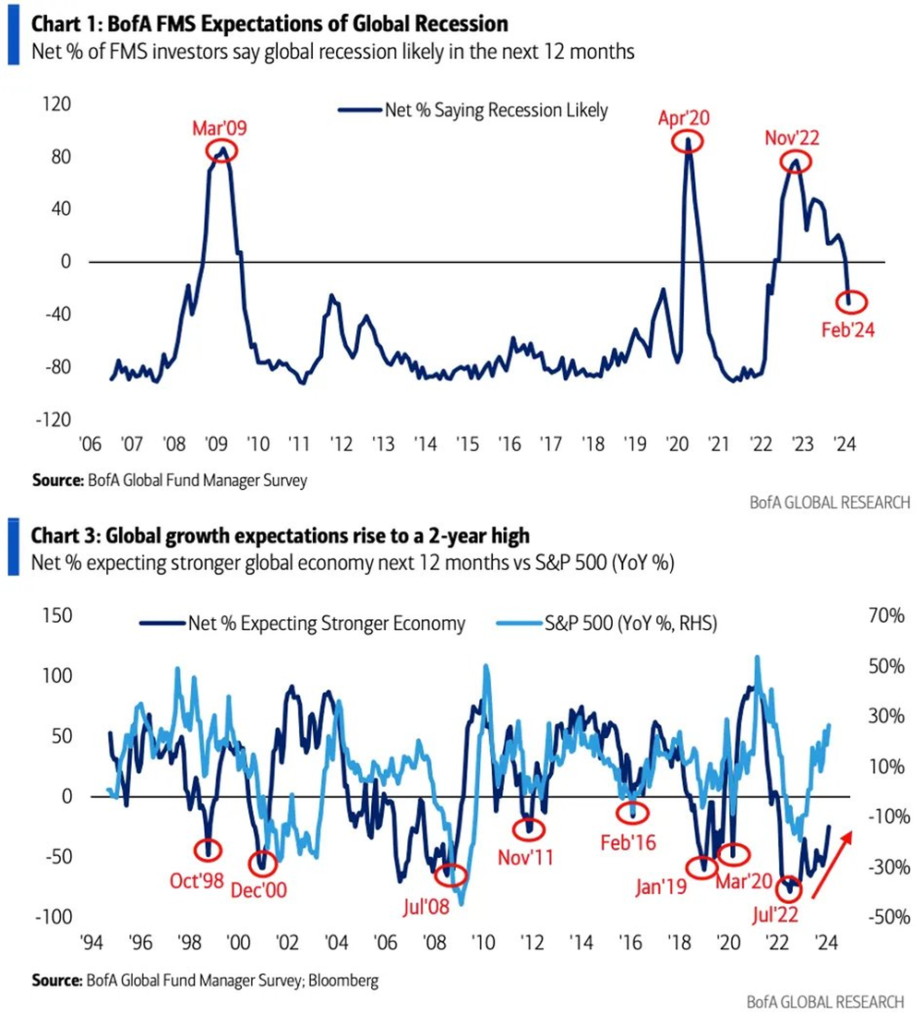

- Economists have downgraded recession forecasts for the US, based on expectations that a strong labour market and robust consumer spending will support economic growth soon. This, combined with indications of interest rate cuts from the Fed, has led to a sharp decline in US Treasury yields as markets anticipate lower rates. This has also spurred a recovery in many financial assets, with US equities continuing to perform well (the S&P 500 recently exceeded 5,000 for the first time).

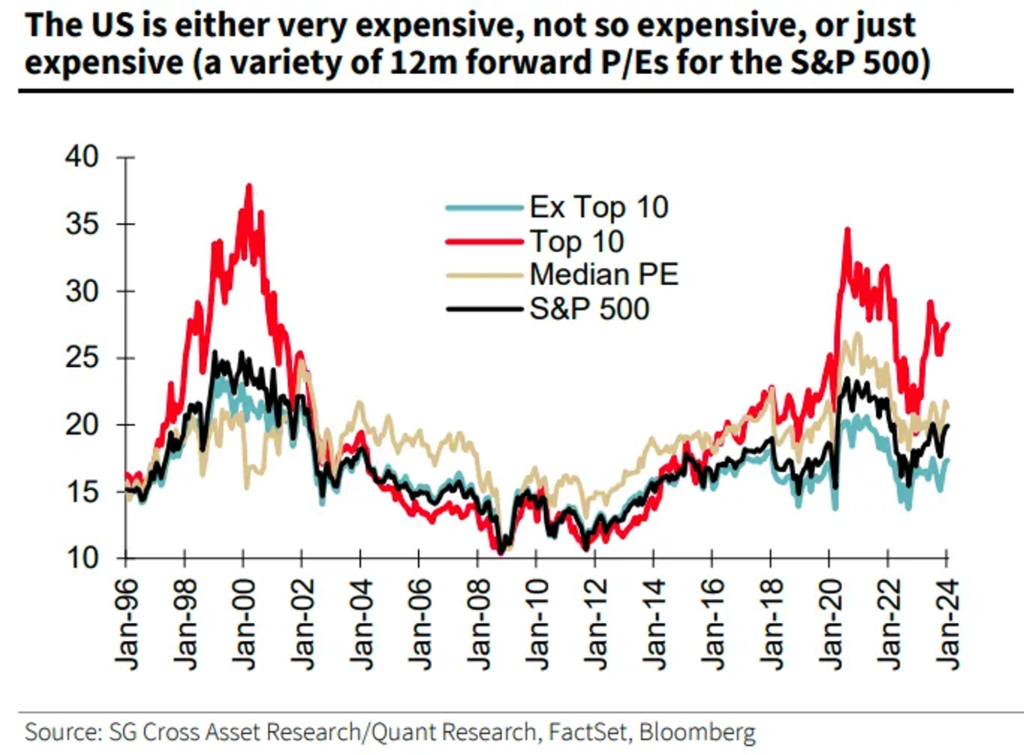

- While the S&P 500 surpassing 5,000 is good news, the US market is still predominantly driven by mega-cap tech stocks (Microsoft, Apple, Nvidia, Alphabet, & Amazon constitute 25% of the S&P 500’s market capitalization). Notably, the top 10% of stocks in the US currently reflect ~75% of the entire market (higher than during the Dot-com bubble). This time, optimists are taking a leading position, and combined with the scenario of the Fed holding interest rates steady in March, the bullish faction is likely to attempt to push the market up once more before an adjustment occurs.

1.2. Sentiment & Positioning of Investors & Money flow trend:

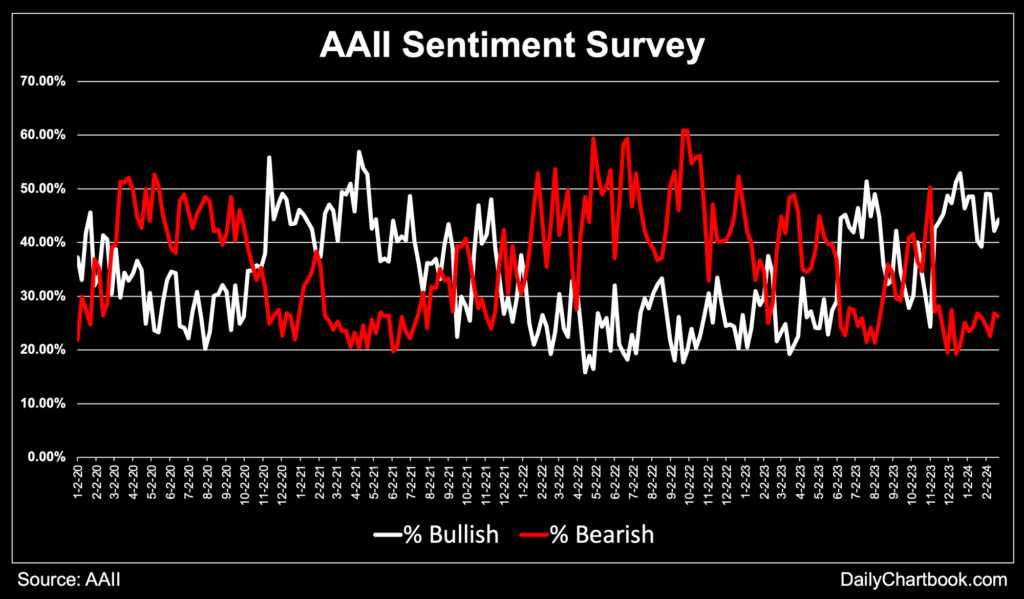

- Retail investor sentiment:

Optimism remains high following the recovery observed at the end of October 2023.

- Investment Manager Index:

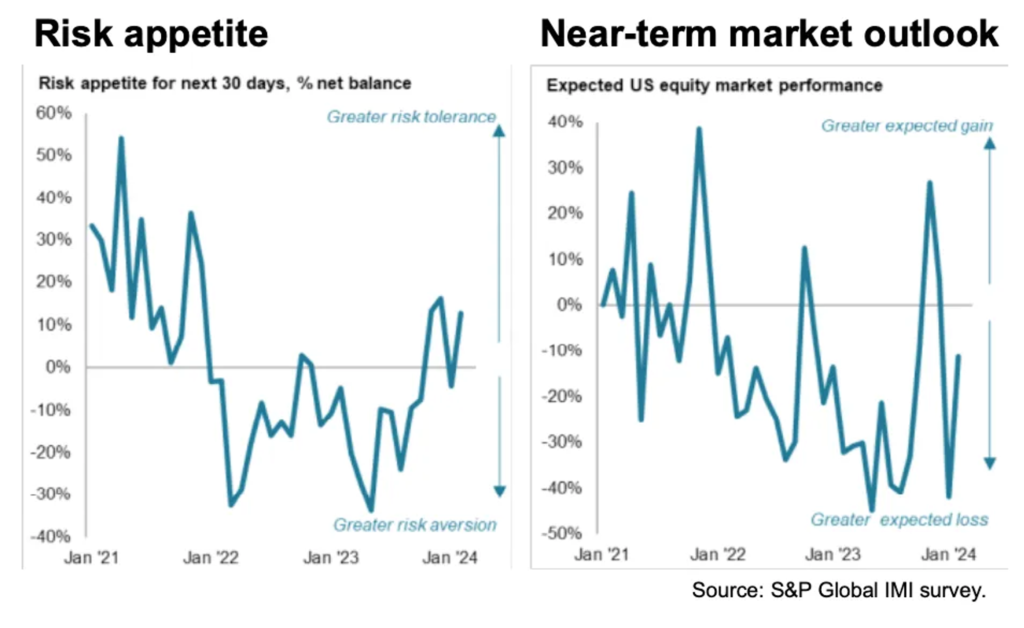

Fund managers’ appetite for risk rebounded in February, with a ‘risk-on’ mood now prevailing in three of the past four months, marking the best period for risk appetite in just over two years. Additionally, market yield expectations have recovered but are not overly positive.

- FMS global outlook:

A survey of roughly 200 participants, managing over $500 billion in assets, indicated that global asset managers are optimistic about global growth (reaching a two-year high) and are not forecasting a recession for the first time since April 2022.

- Positioning & Status of Big Players:

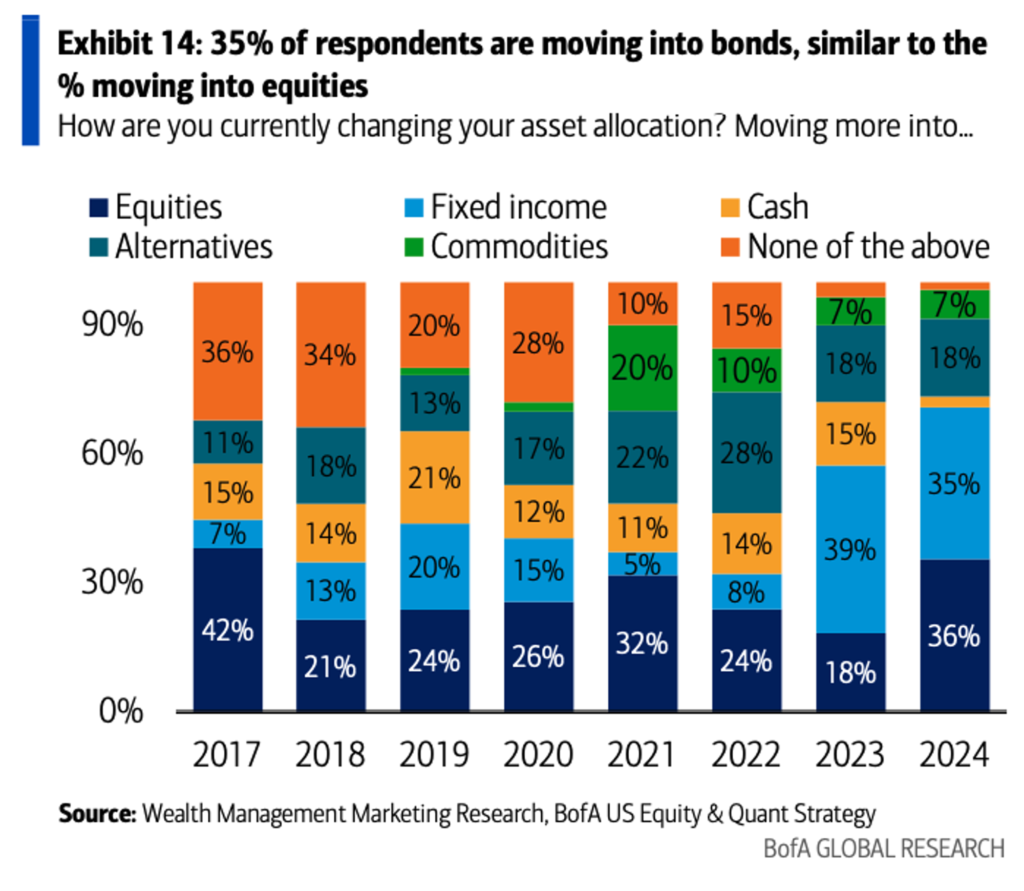

▫︎ 35% of financial advisors are shifting towards bonds, and 36% are moving into equities. Notably, cash holdings have significantly decreased compared to last year (15% → 2%).

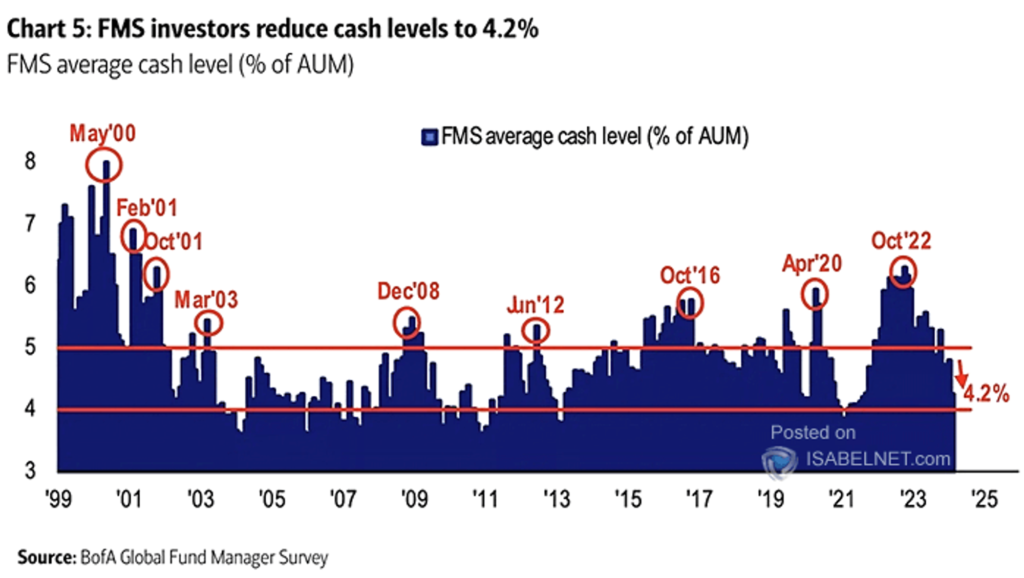

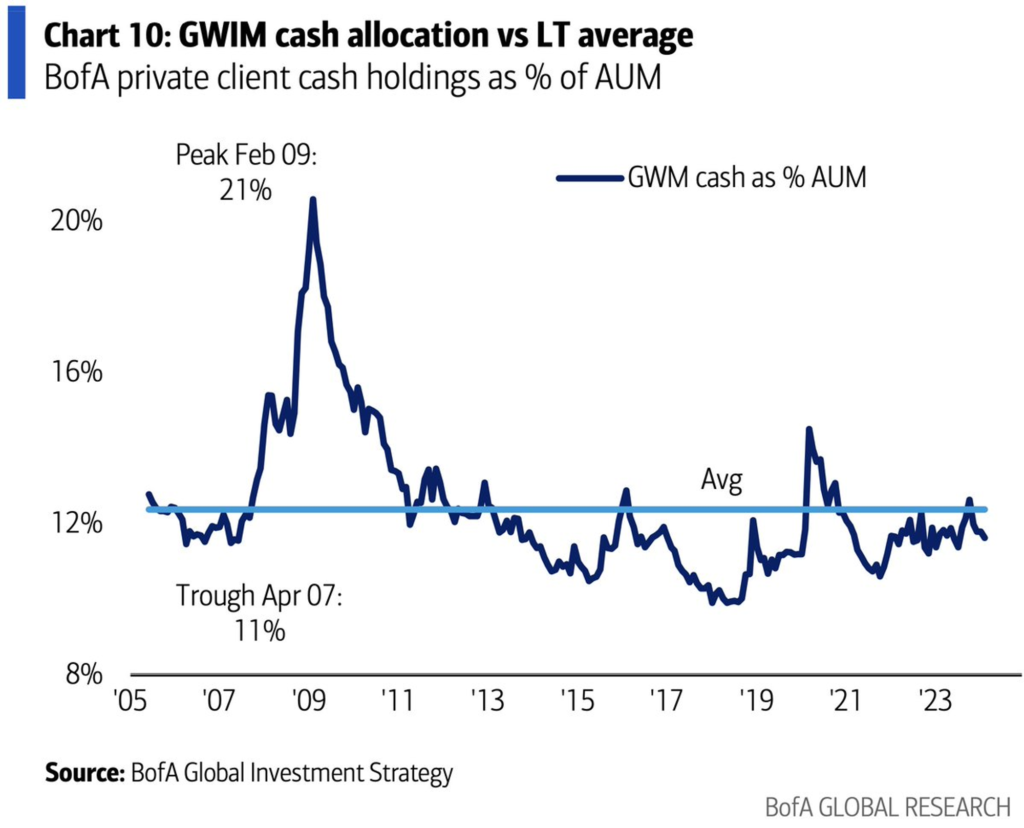

▫︎ Fund managers’ average cash level is now at 4.2%, a 55bps decrease from the January survey. Bank of America has observed that a drop in cash allocations of more than 50bps is typically followed by an average 4% return for equities over the next three months. Notably, cash allocations of 4% or lower usually trigger a “sell” signal (with the crashes in 2007 and 2011 serving as examples).

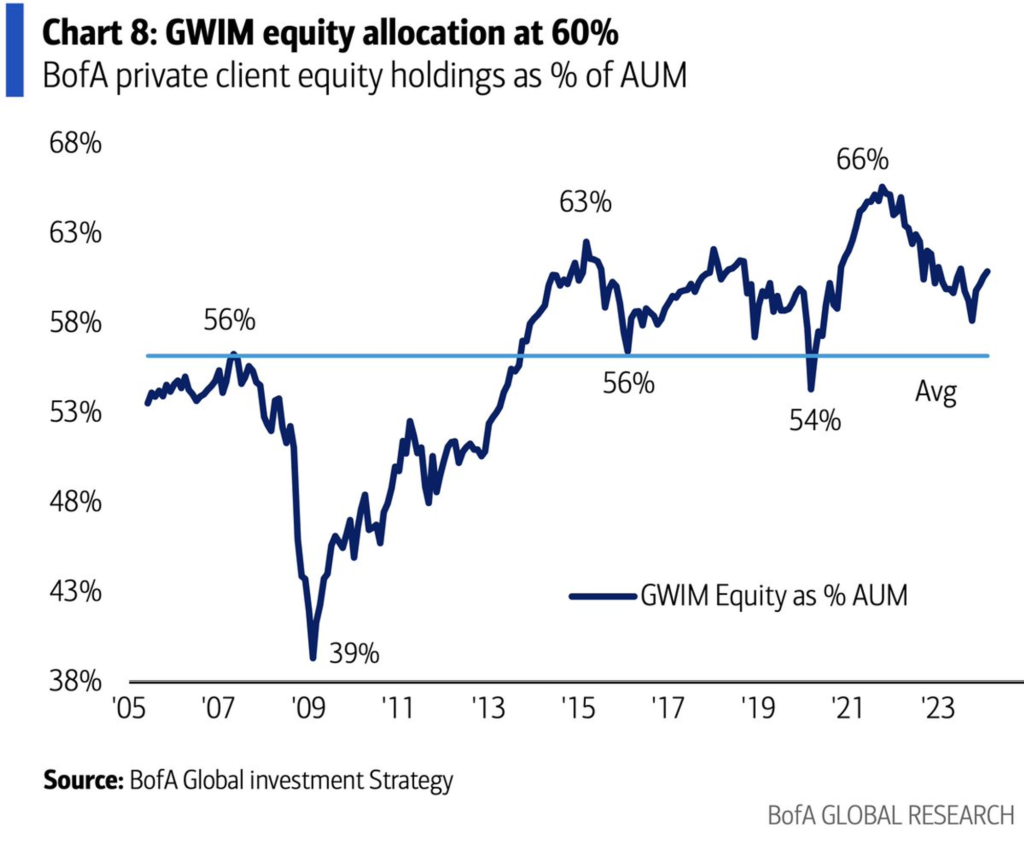

▫︎ BofA private client cash allocation is below the long-term average, and their equity allocation is increasing but still well below its peak (as of February 2024). This group includes wealthy and ultra-wealthy clients and their family offices.

▫︎ Stocks are determined by the wealthiest 9% in the US, who hold over 85% of the market’s shares. This group has started increasing their stock weight again, but not aggressively, hence there is still room for them to increase their stock holdings.

▫︎ BofA Global FMS investors’ allocation to tech stocks is at its highest since August 2020 (with a 10 10ppt MoM to net 36% overweight). Notably, investors are most bullish on the “Magnificent 7” technology stocks, which continue to be the most crowded trade.

▫︎ An improved macro-outlook and reduced risk perception have led investors to rotate into global equity allocations at a two-year high (net 21% overweight in equities, the highest since February 2022). In summary, major institutional investors are overweight on US equities, reducing cash holdings, and aggressively cutting allocations to emerging markets (likely China).

- Money Flow Trend:

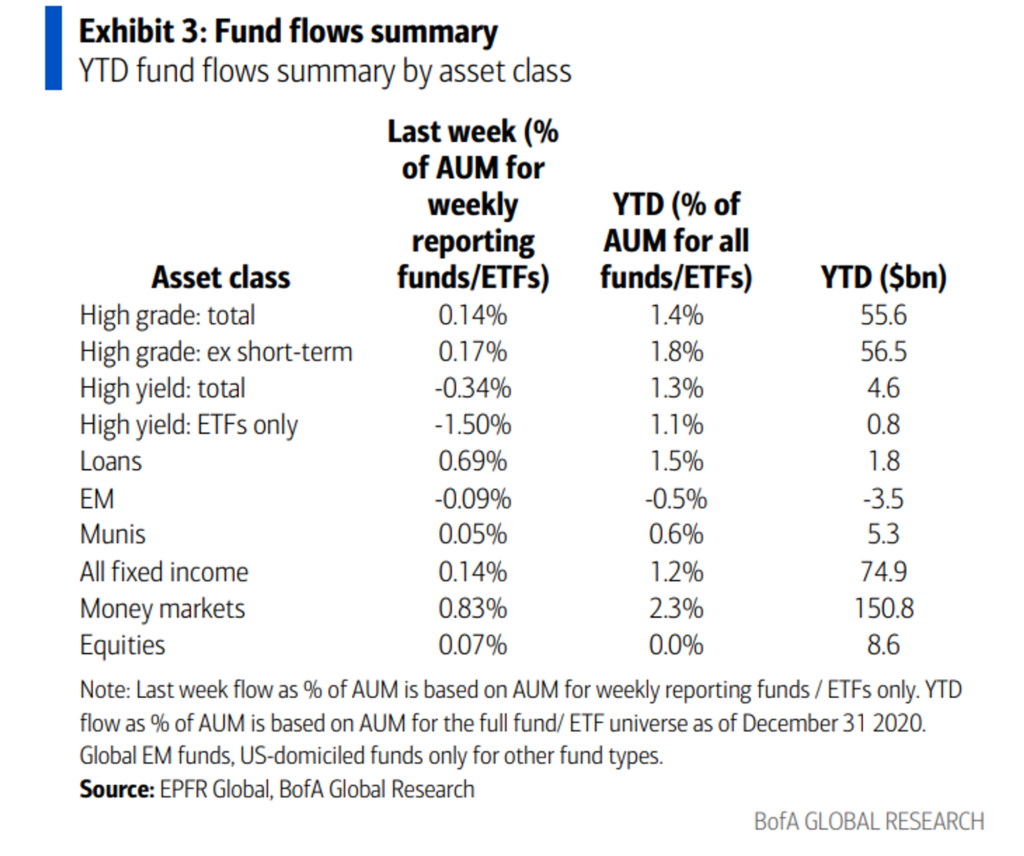

▫︎ The balance of money market funds continues to rise (+$150.8B YTD), acting as cash equivalents yielding about 4%. Notably, money market funds – where institutional investors store cash, have reached an all-time high of $6 trillion.

▫︎ Concurrently, funds are still flowing into risky assets: Since the start of the year, US equities have attracted new money (net inflows of $8.6B, with high yield inflows at about $4.6B).

II. Crypto Market Pulse:

2.1. Market Overview:

- Retail Traders Jump Back Into Crypto Markets in February:

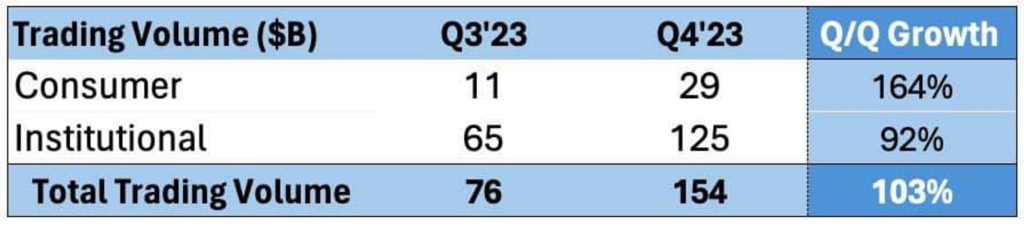

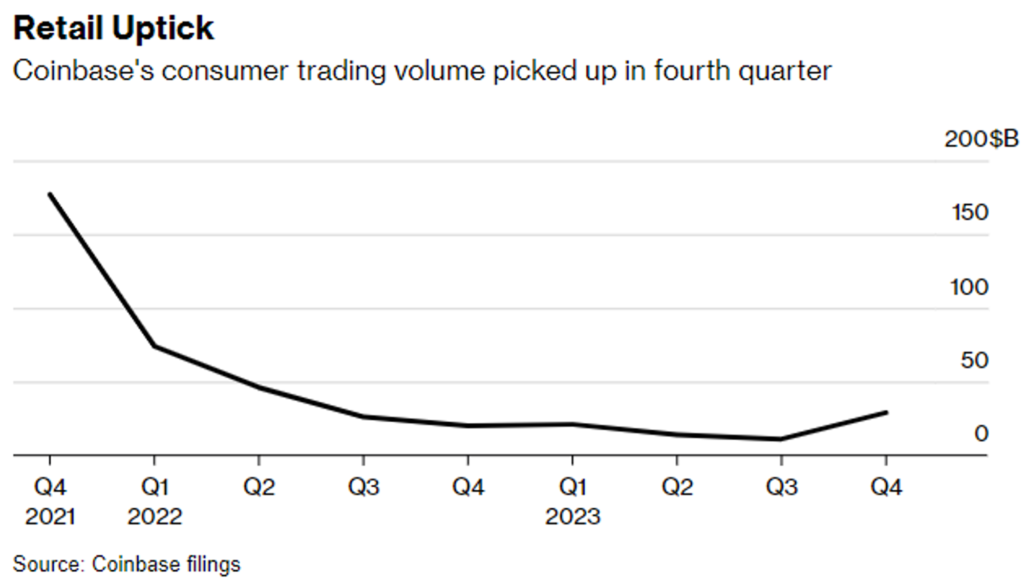

▫︎ Recent reports from Block, PayPal Holdings, and Robinhood Markets have shown net positive Bitcoin purchases by customers in the fourth quarter of 2023, marking a significant improvement from the third quarter’s negative sales. Meanwhile, earnings at Coinbase revealed the highest quarterly Bitcoin trading volume in two years.

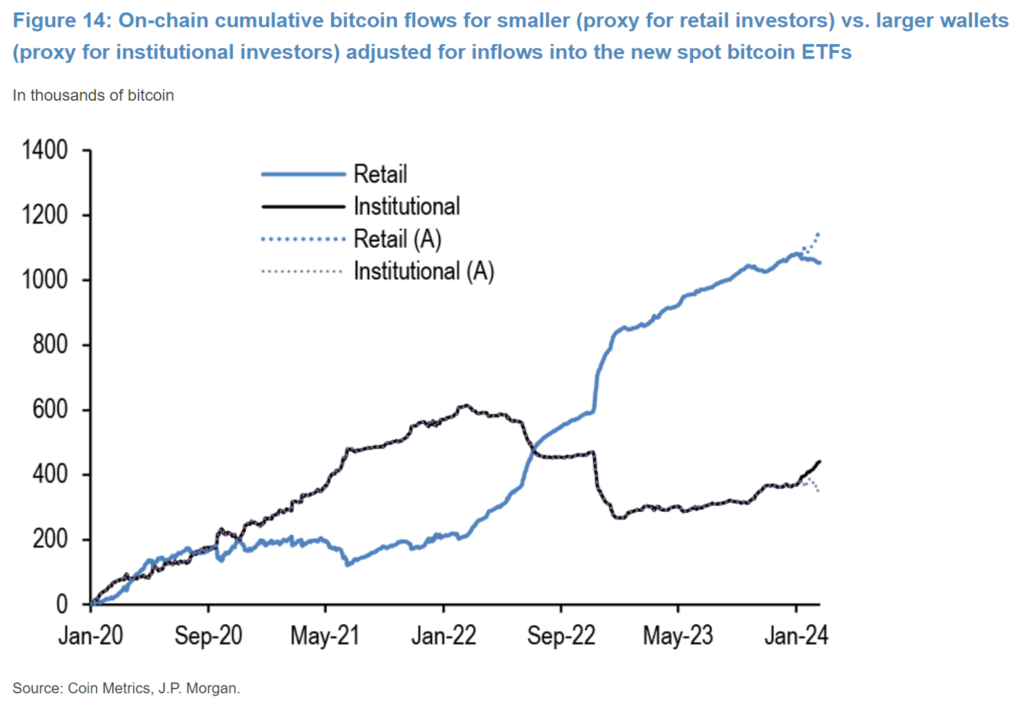

▫︎ Moreover, on-chain Bitcoin flows from small wallets — utilized as a proxy for retail traders — have significantly outpaced those of institutional investors, after adjusting for inflows into new spot Bitcoin exchange-traded funds (ETFs).

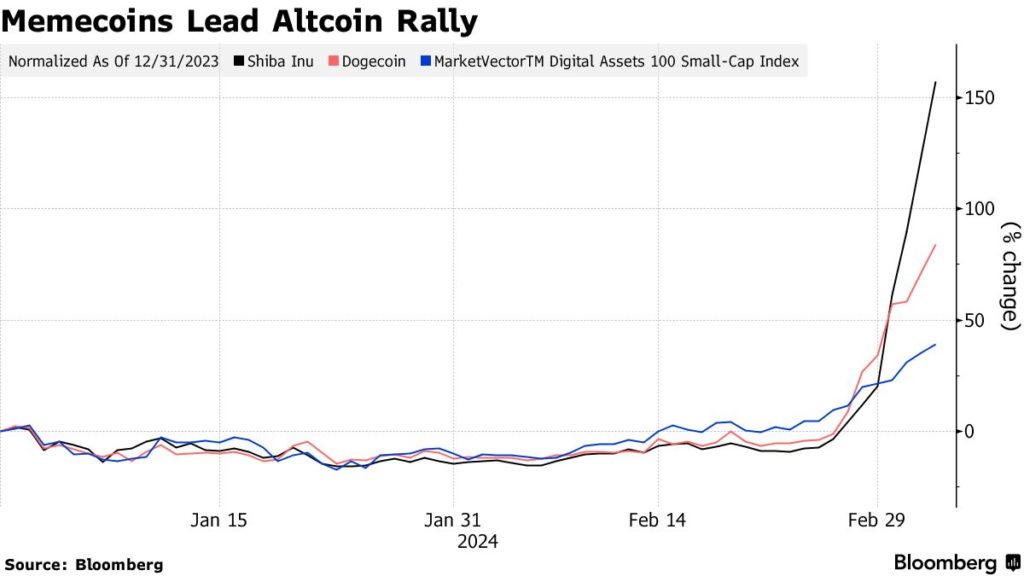

▫︎ The resurgence of retail interest in February likely reflects the anticipation of three main crypto catalysts over the coming months: the Bitcoin Halving event, the forthcoming major upgrade of the Ethereum network, and the potential approval of Spot Ethereum ETFs by the SEC in May.

- Performance:

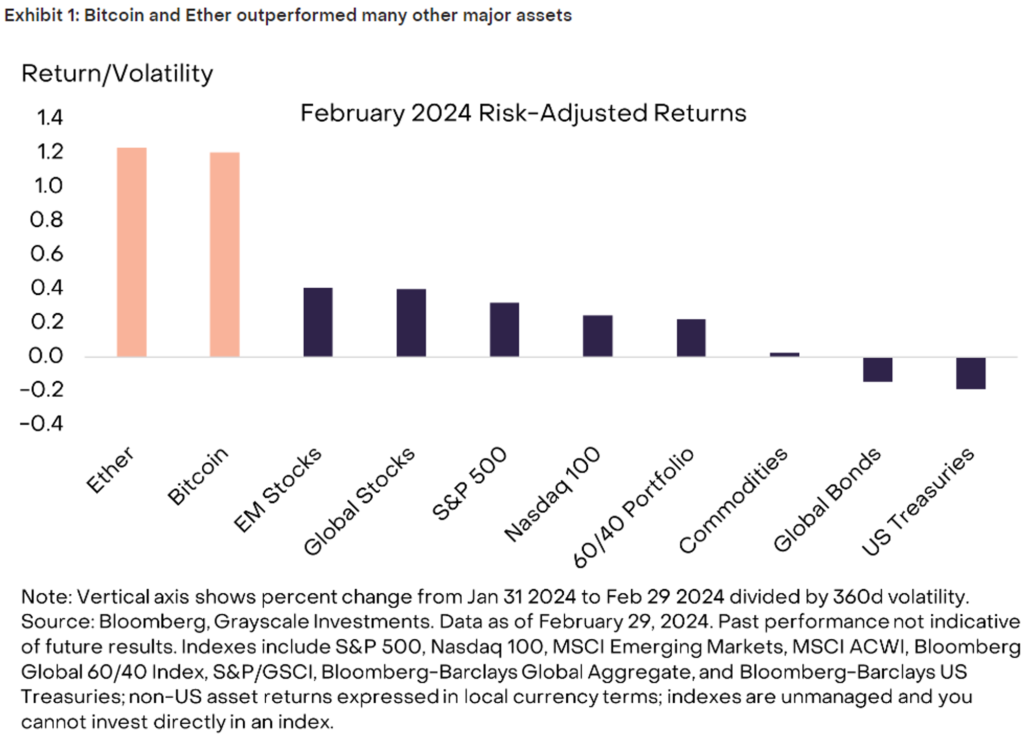

▫︎ Bitcoin and Ether ranked among the top-performing assets across both crypto and traditional finance in February, highlighting once again the diversification benefits of the crypto asset class.

▫︎ Investments in AI tokens (e.g., FET, ARKM) and MEME tokens (e.g., PEPE, FLOKI) have also witnessed notable interest.

- Bitcoin volatility:

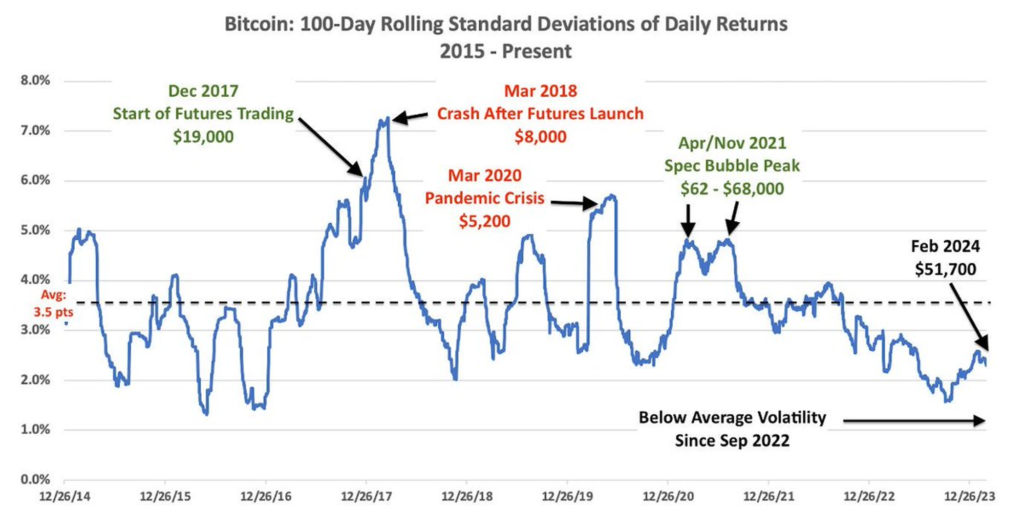

In terms of percentage change, Bitcoin has become significantly more stable. Compared to the volatility of many US mid-cap tech stocks, Bitcoin has shown less fluctuation. The chart below illustrates the standard deviation of Bitcoin’s daily returns over time, with the 100-day rolling standard deviation for mid-cap tech at approximately 3.1%, which is higher than Bitcoin’s volatility in February 2024. Lower levels of volatility may entice many asset owners to increase their weightings.

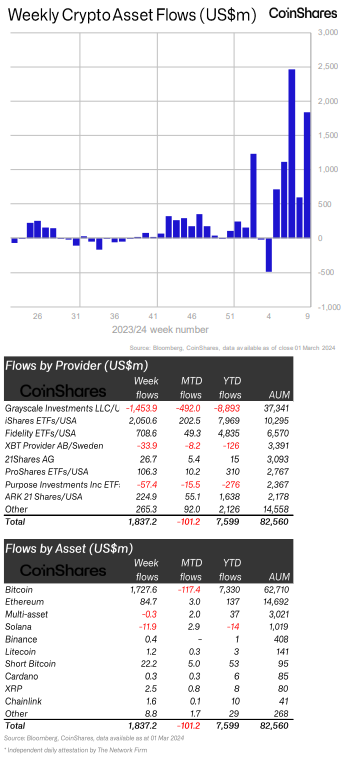

- Crypto asset flows:

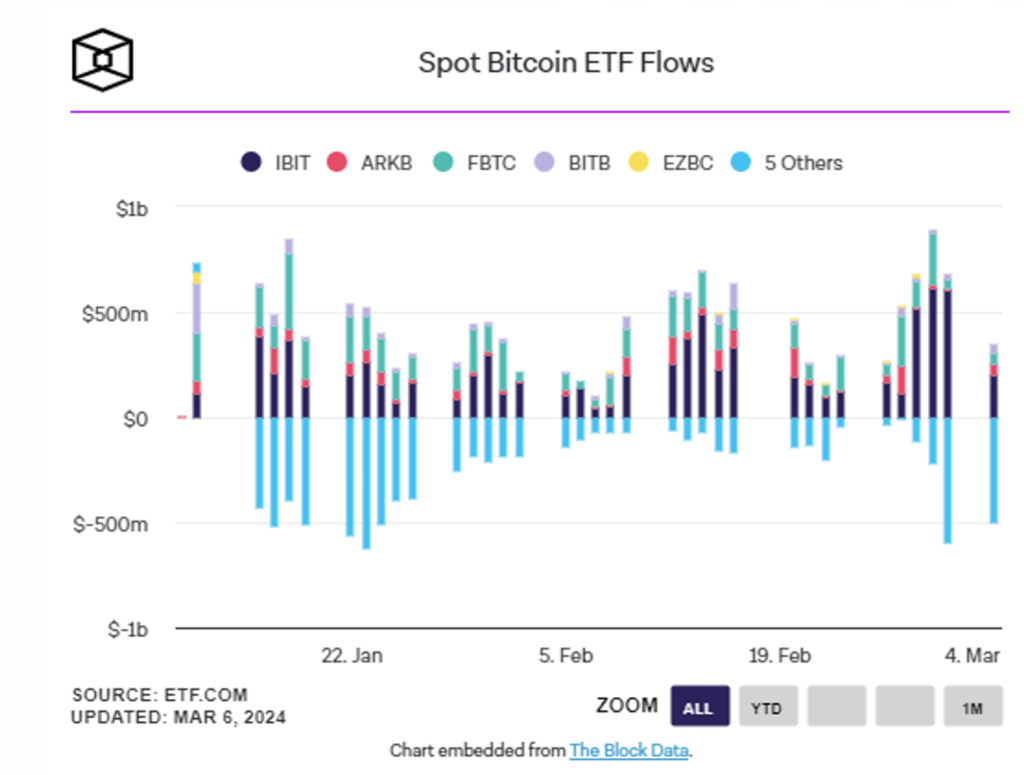

▫︎ Digital asset investment products have seen a Year-To-Date (YTD) inflow of $7.46 billion. From their launch on January 11 to the end of the month, the ten-spot Bitcoin ETFs amassed net inflows totalling $1.46 billion. During February, net inflows significantly accelerated, totalling $6 billion for the month.

▫︎ Meanwhile, global gold ETFs have seen YTD outflows of approximately $5 billion, marking the ninth consecutive month of outflows. Since the launch of spot Bitcoin ETFs, gold ETFs have experienced net outflows, possibly indicating a rotation of investment from one “store of value” asset to another.

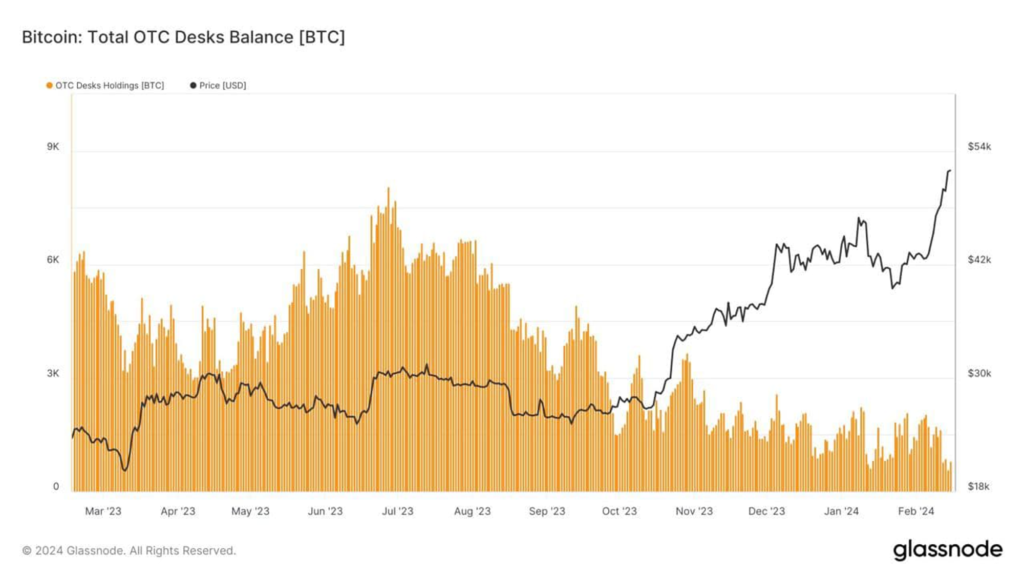

▫︎ Bitcoin ETFs are purchasing at a rate over ten times the daily new BTC issuance (900 new coins). In February, net inflows into US-listed spot Bitcoin ETFs averaged $208 million per day, contributing to a 45% jump in Bitcoin’s price. Notably, the amount of BTC on some OTC platforms has significantly decreased since July 2023 (just after BlackRock filed for a Spot ETF). Furthermore, with Bitcoin Halving in April 2024, Bitcoin issuance will halve, warning of a supply shortage due to ETF demand.

▫︎ Outflows from GBTC slowed in late January and February. However, in mid-February, bankruptcy courts allowed crypto lender Genesis to liquidate approximately $1.3 billion worth of GBTC shares as part of efforts to reimburse investors. The $22.8 billion Grayscale Bitcoin Trust has seen $7.4 billion exit over 31 trading days at press time. Meanwhile, the nine other spot Bitcoin ETFs have continued to surpass expectations amid a sustained Bitcoin rally. Notably, BlackRock’s IBIT had around $2.4 billion in daily volume, and its assets under management have now exceeded $11 billion.

2.2. Monthly Highlight News:

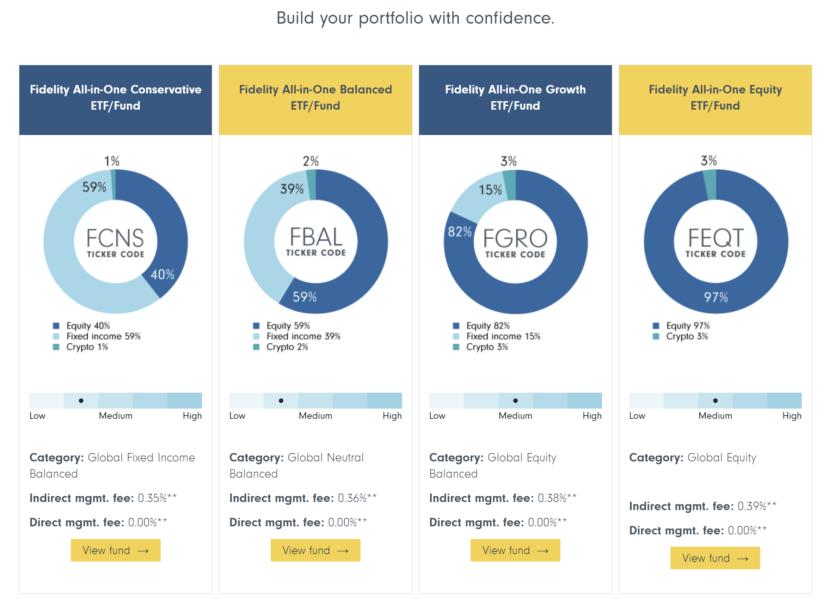

- Fidelity has incorporated Bitcoin ETFs into four asset management models, diversifying 1% to 3% of assets into Bitcoin ETFs in each model. The entry of mainstream players and funds into Crypto Space indirectly signifies that Bitcoin has now become a part of a well-diversified portfolio. It is highly probable that in the future, a wave of wealthy individuals and some traditional investment funds, including pension funds, will own Bitcoin in their Digital Asset Portfolios to diversify their holdings.

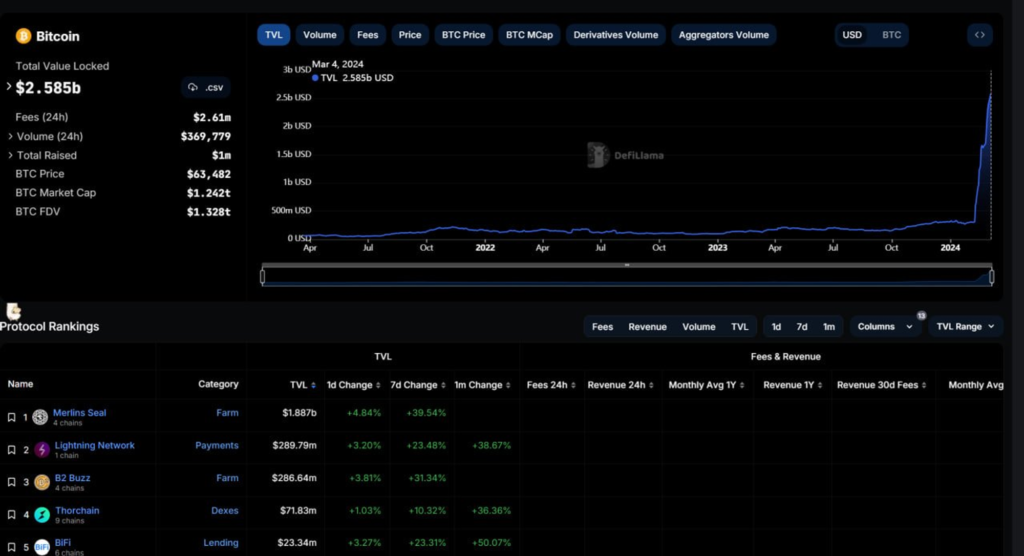

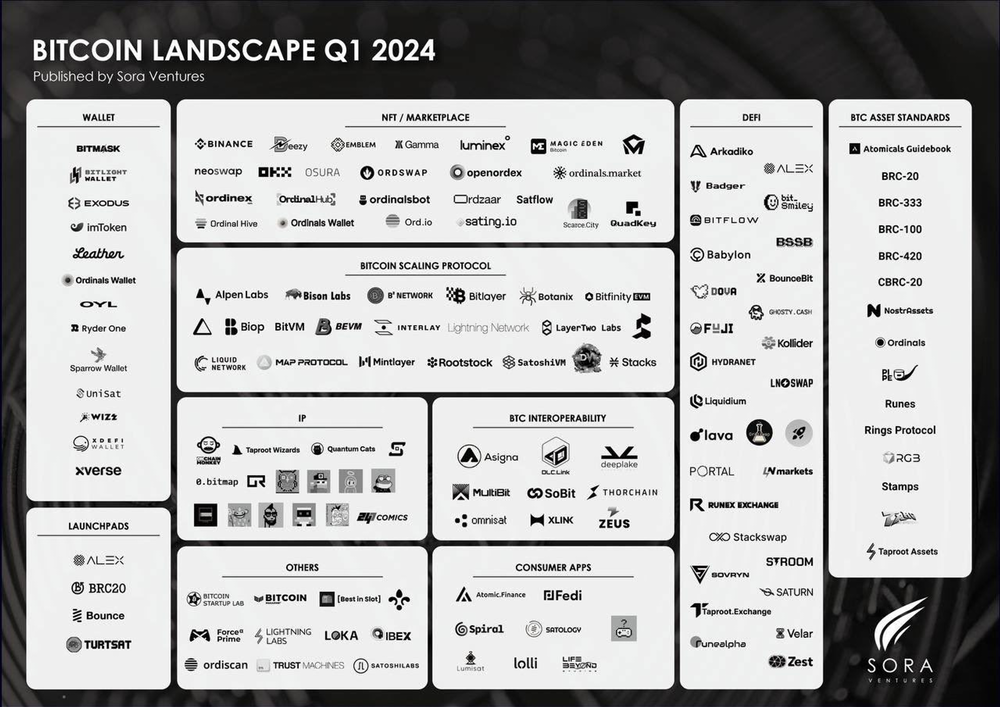

- Over the past month, the Total Value Locked (TVL) in the Bitcoin ecosystem has increased by more than 700%, with the potential for an explosion in the ecosystem on BTC (likely in preparation for further BRC20 injections).

III. Investment implications:

3.1. U.S Stocks: A multifaceted investment opportunity:

- SPX valuation:

▫︎ Remove the top 10 stocks from the equation and the rest of the stock market doesn’t look too expensive.

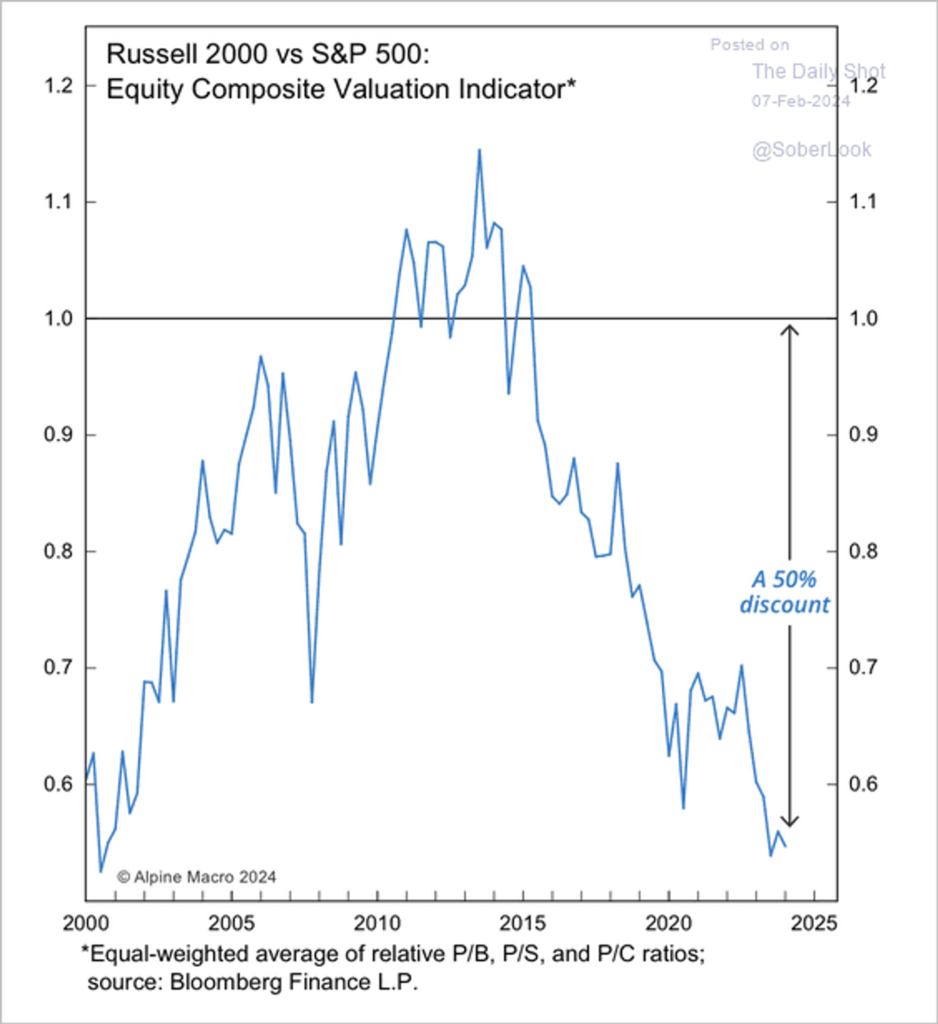

▫︎ US small-caps are extremely undervalued versus large-caps.

▫︎ The profit growth of the 493 stocks outside of the Magnificent Seven (MAg7) in the S&P 500 is expected to accelerate faster than the Mag 7 this year due to a lower base. While a significant gap is still anticipated for Q1, the earnings growth differential is expected to narrow significantly in Q2 (+20% for the Mag. 7 vs. +8% for the 493), close the gap in Q3, and reverse in favour of the 493 in Q4.

3.2. Crypto Market:

- Investor demand for Bitcoin ETFs is seen as remaining strong, with Bitcoin outshining traditional assets so far in 2024. A ratio comparing the price of the token to the precious metal is at its highest level in more than two years.

- Bloomberg predicts that the total funds in Bitcoin Spot ETFs could surpass those in Gold ETFs within two years.

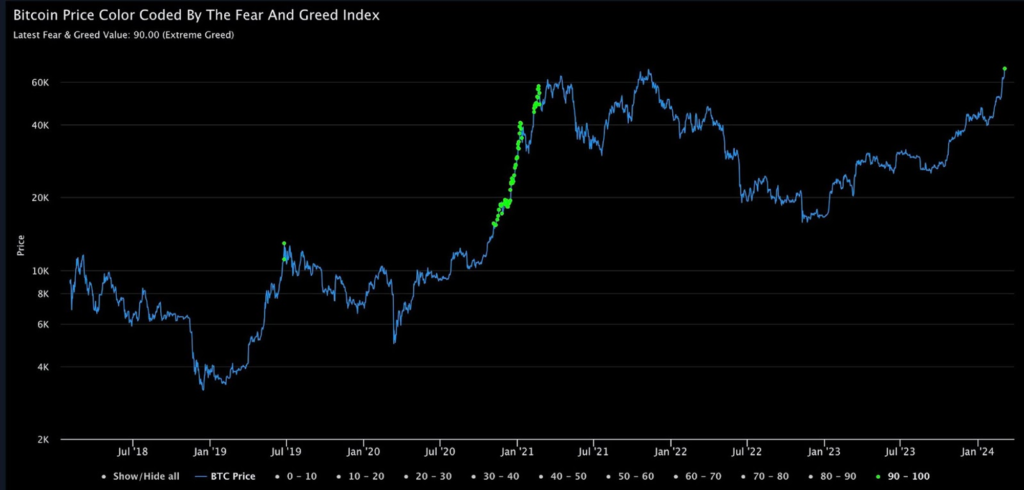

- An upcoming reduction in Bitcoin’s supply growth, the halving, is adding to the optimistic sentiment (for the first time, the Fear & Greed Index has returned to 90 since 2021). Based on the current bullish sentiment, Ethereum is likely to follow suit, with the new Dencun upgrade and ETH spot ETF narratives (including some narratives around Layer 2, LSD, Restaking).

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.