I. AUCTION

1. Key catalyst

Bounce Finance offers auction-as-a-service tools, recently focusing on Private Launchpad and enhancing the utility of the $AUCTION token.

Bouncebit, a project by the Bounce Finance team, is building a BTC restaking CeDeFi infrastructure. This project is the first to launch on Binance megadrop following the announcement of an investment by Binance Labs.

=> The $AUCTION token will play a pivotal role in the Bouncebit Ecosystem.

2. Onchain movement

2.1. Buying pressure

A cluster of fresh wallets similarly accumulated heavily on Binance when BTC prices dropped sharply, in the price range of about $13-16. These all appear to be fresh wallets, with transactions starting on April 13 and withdrawing from Binance:

- 0xc3b77df833e088ad300e01e17b7d3394f91dc0c8 – nearly 34k AUCTION ($550k)

- 0x3f382e785a9160dec672261b23927c4cfbe6442c – nearly 27.7k AUCTION ($444k)

- 0x8a7232d428ed2512ad14d29cdecb13de03b2401e – 21.8k AUCTION ($348k)

- 0x8e87c54c47679a6dd3db6289dfd4f832da3c51ef – 21.2k AUCTION ($339k)

- 0xf3c89b372f0f3e3c0c5be582a28cf3e186da4b42 – 20.8k AUCTION ($333k)

- 0xe35eb17d7454e9d18bb2de3305cba08779860547 – 20.6k AUCTION ($329k)

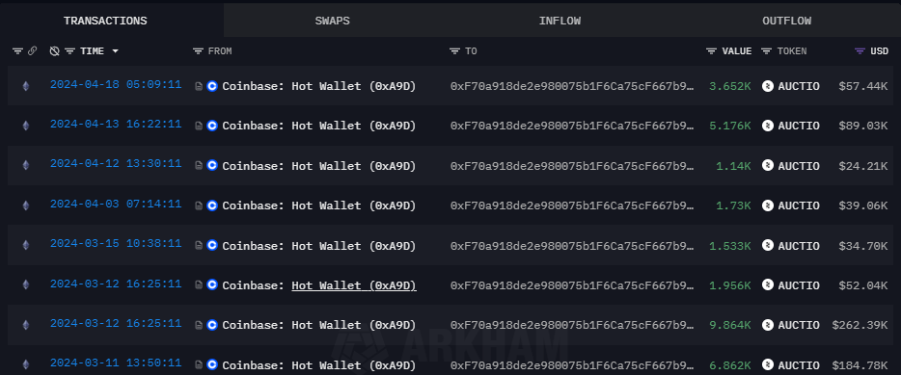

Additionally, there were withdrawals from Coinbase starting early March, possibly from another distributing wallet.

Fresh wallets began accumulating from March 11 at various prices – $25, $20, $21, $15, indicating a strategic accumulation.

- Currently holding nearly 32k AUCTION ($513k)

- Wallet address: 0xF70a918de2e980075b1F6Ca75cF667b981cE0f9C

2.2. Selling pressure

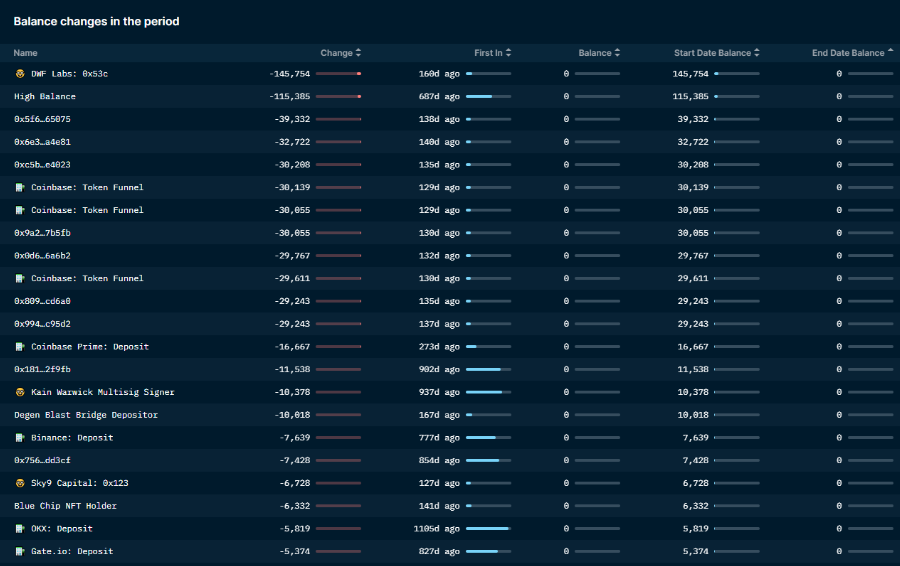

Some funds that participated sold out between December 14-25, at peak prices.

The project also involved DWF Labs, which also sold out around the $20 range after heavy accumulation around $9.

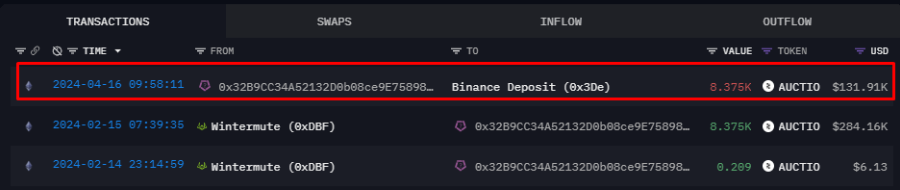

The most recent selling pressure is from a wallet cutting losses over 50%, which had OTC transactions from WIntermute.

- Wallet address: 0x32B9CC34A52132D0b08ce9E75898286a93d6eAA4

3. Conclusion

There is strong accumulation on Binance as the project is part of btc-fi, and Bouncebit is soon to have a launchpool on Binance.

Selling pressure is coming from some funds taking profits and also from loss cutting due to FOMO.

Upbit was a significant influence on the price increase of AUCTION at the end of last year; currently, there is no strong accumulation observed.

II. ETHERFI

1. Key catalyst

While EigenLayer has not yet had its TGE, Etherfi is a liquid restaking project that has been gaining community attention following its airdrop and TGE.

Recently, it has expanded across multiple Layer 2 networks such as Blast and Mode. Additionally, the project has adopted the OFT standard with LayerZero, thus enabling users to restake assets across chains seamlessly.

Note: Currently, the use case for the $ETHFI token is limited. The project needs to introduce more use cases to substantially enhance buying demand.

2. Onchain movement

2.1. Buying pressure

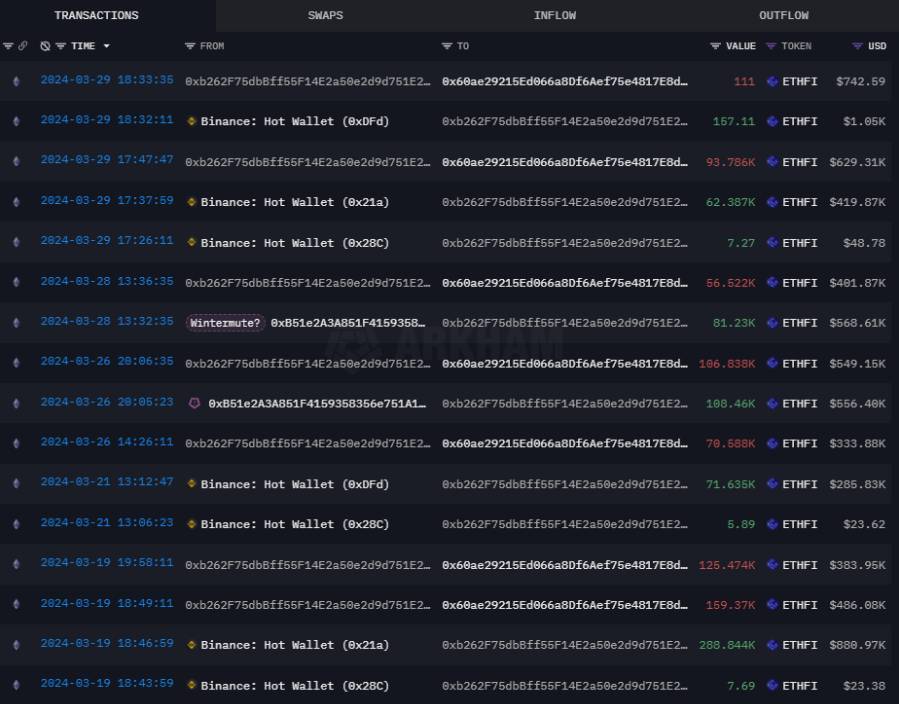

A wallet accumulated over 600k $ETHFI through an intermediary address on March 19-21, with interactions suggesting potential OTC purchases from Wintermute, followed by a significant price increase. Notably, on March 28-29, tokens were withdrawn despite being at a peak price region. This wallet interacts frequently with major market makers like Galaxy Digital and Wintermute, indicating it could be an unidentified fund or market maker wallet. Its portfolio is notably bullish on the Base ecosystem, including Aero, Degen, Virtual, etc.

- Wallet Address: 0x278161e8807f87e256900e73e1cFb57D5E2C3604

- Intermediary Wallet Address: 0xb262F75dbBff55F14E2a50e2d9d751E213C81ED0

-> Currently, no further actions have been taken, and the wallet still holds the tokens.

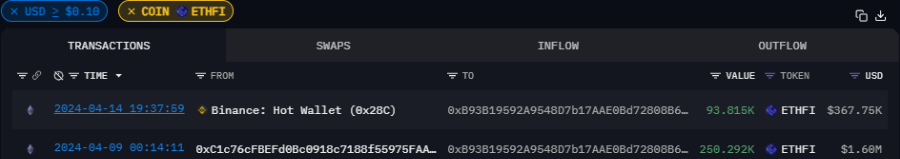

Another wallet purchased nearly 350k $ETHFI at around $5 on April 4 via an intermediary address (based on the withdrawal time). Most recently, on April 14, an additional 93k $ETHFI was withdrawn at an average price of $3.8. The wallet’s portfolio includes over $9 million in assets like RNDR, OP, MASK, MEME, SHIB, TWT, etc.

- Wallet Address: 0xB93B19592A9548D7b17AAE0Bd72808B6c22D75ba

- Intermediary Wallet Address: 0xC1c76cFBEFd0Bc0918c7188f55975FAA76DCf62e

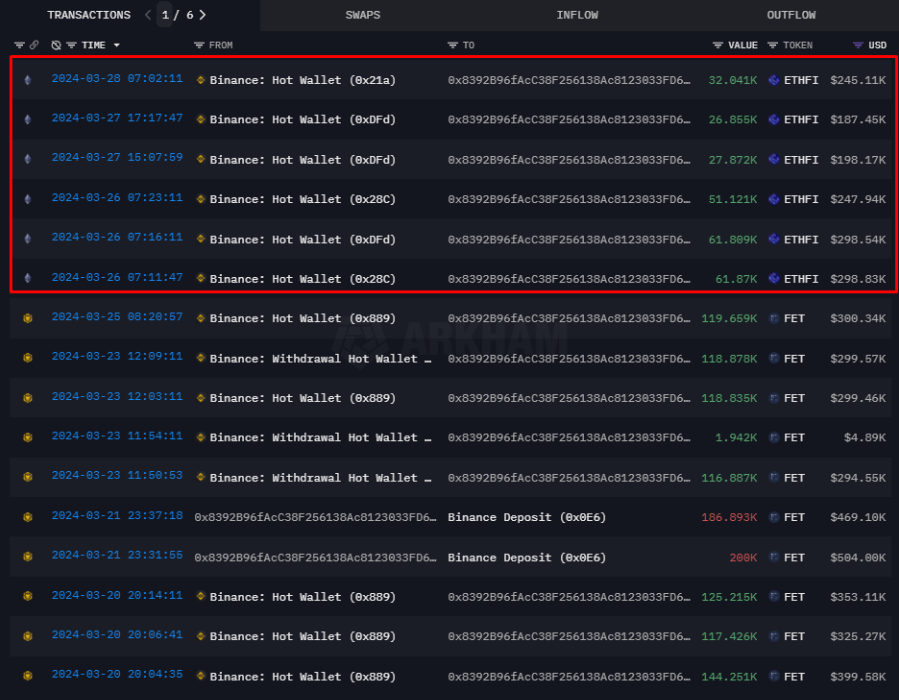

A wallet accumulated 261k $ETHFI at prices over $5 from March 26-28. The purchase was made at unattractive prices, with no further accumulation at current price levels. The wallet primarily holds leading trend projects like FET, RNDR, SOL, etc.

- Wallet Address: 0x8392B96fAcC38F256138Ac8123033FD67Aa3D455

Other wallets with portfolios of at least $1 million also accumulated, indicating strong buying interest.

2.2. Selling pressure

Selling pressure comes from retailers receiving airdrops. If considering the price drop from the peak to the current level, the selling pressure originates from high-price FOMO and moves to break-even or loss, starting from the airdrop claims by retailers.

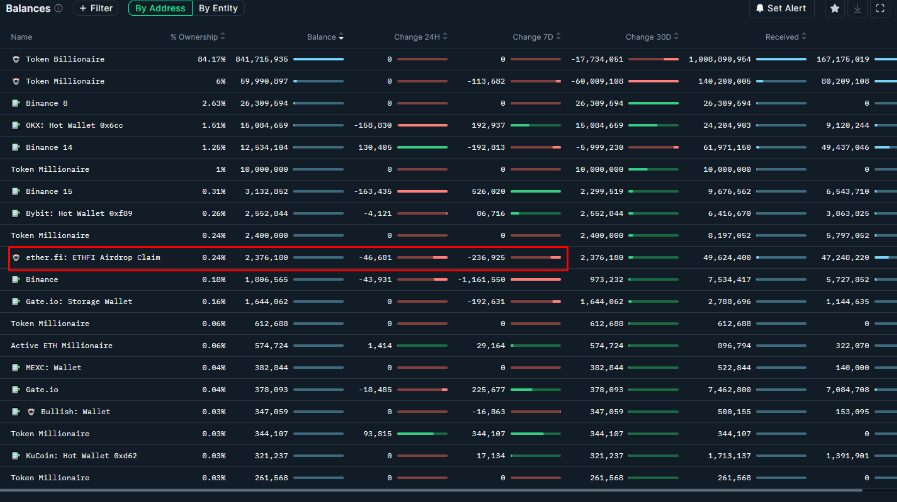

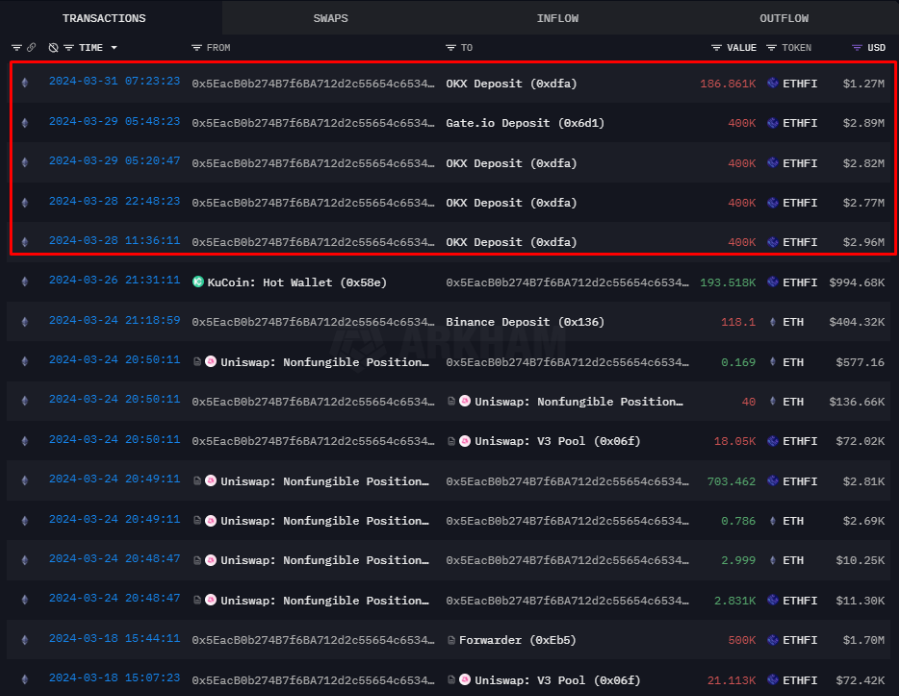

A wallet received 8m $ETHFI from the project contract and has since transferred a total of 5.6m $ETHFI to exchanges since receiving it. The most recent transfer was two weeks ago, moving nearly 1.4m $ETHFI to OKX and Gate exchanges when the price peaked at $8.5 and subsequently fell. This suggests an impact on the price.

- Wallet Address: 0x5eacb0b274b7f6ba712d2c55654c6534db7e3200

3. Conclusion

Many wallets with multi-million dollar portfolios continue to accumulate strongly in the $3 – $5 price range, and with the current price returning to around $4, some wallets are still accumulating. The trend over the past week has been primarily withdrawals, indicating strong buying interest.

Significant selling pressure only comes from the project; retailers may have absorbed much of it.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.