I. Overview:

1.1 Definition and Mechanism:

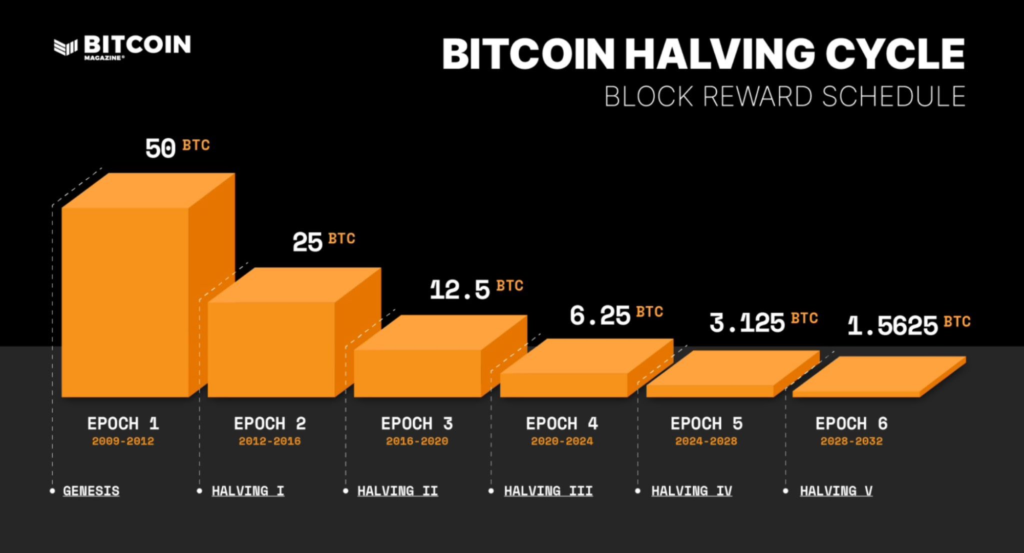

- Bitcoin halving is a quadrennial event that cuts the block reward given to Bitcoin miners by half. The halving is theoretically positioned to impact the supply side of Bitcoin by reducing the flow of new Bitcoins (as a deflationary mechanism), thus potentially increasing scarcity and driving up prices if demand remains constant or increases.

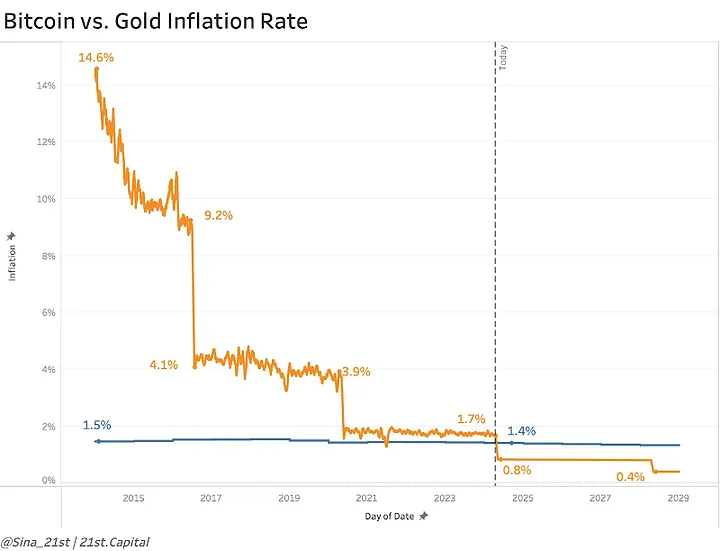

- After the halving, Bitcoin’s inflation rate will halve to 0.8%, which is lower than gold’s rate of 1.4%.

- Every 210,000 blocks, the mining reward is halved. Starting with 50 BTC per block at the genesis block, the reward was reduced to 25 BTC per block in the 2012 halving and has continued to decrease, leading to the 2024 halving where the reward will be 3.125 BTC per block. After the year 2140, when the block rewards end, the network will shift to rely solely on transaction fees as the incentive for miners.

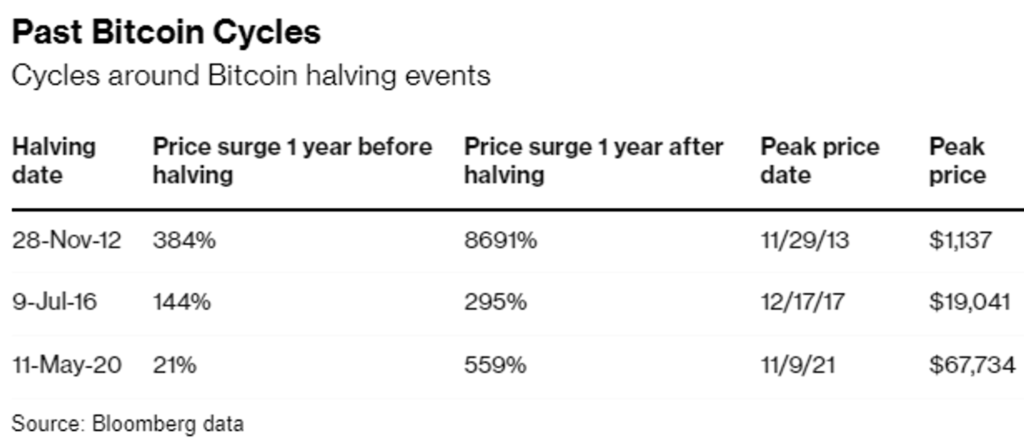

1.2 Previous Halving Events and Market Performance:

- Usually, Bitcoin’s price rises for about 1 years before halving and is rather stable during the event. The primary growth occurs in the year following the halving. If Bitcoin mirrors its performance from the previous two periods, its price could reach the $220k mark in 2025.

1.3 How Will 2024 Halving Affect Bitcoin performance?

- The halving has historically been a bullish catalyst for Bitcoin, but past performance really does have no connection with future results. Each cycle is unique and influenced by a complex interplay of market forces as miner, market maker, retails and institutional investors, macroeconomic and regulatory environment,…

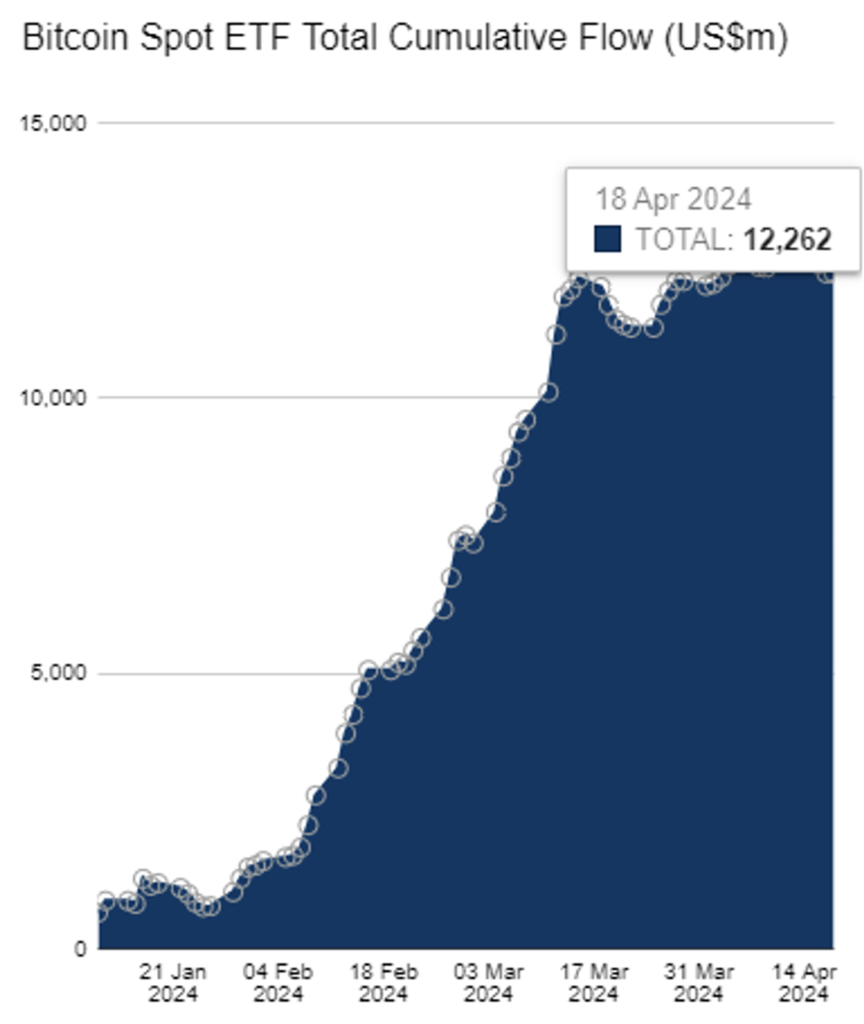

- Previously, most of Bitcoin’s price appreciation in each boom cycle happened after a halving. But already the current market cycle, driven by the launch of US Bitcoin spot ETFs investing directly in Bitcoin, looks different: Bitcoin hit its all-time highs before the April halving.

- It is evident that the impact of U.S. Bitcoin spot ETFs on Bitcoin’s price could be even more significant moving forward, as these ETFs serve as a critical bridge linking traditional financial markets to Bitcoin exposure. This connection amplifies demand and attracts significant capital inflows, with net inflows exceeding $12 billion in just three months.

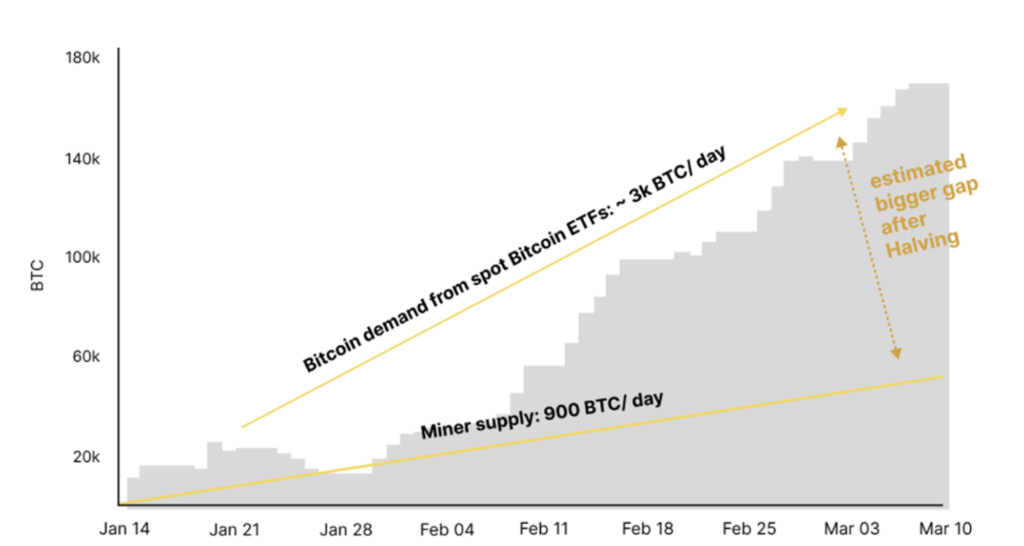

- Notably, Bitcoin halving will reduce the number of tokens issued daily by half to about 450, which could lead to a supply shortage while ETF inflows have consistently been higher than BTC issuance (now at 3x). Demand > Supply = upward price pressure.

- In terms of price appreciation, Samson Mow, CEO at JAN3, predicts that Bitcoin could reach $160,000 within the next one to two years, when the regulatory landscape in major markets continues to evolve, and mainstream acceptance of Bitcoin could be further strengthened by the entry of institutions, pension funds, registered investment advisors (RIAs),… allocate capital to BTC to diversify their investment portfolios.

II. Bottom Line for Investors:

2.1 Risk Considerations:

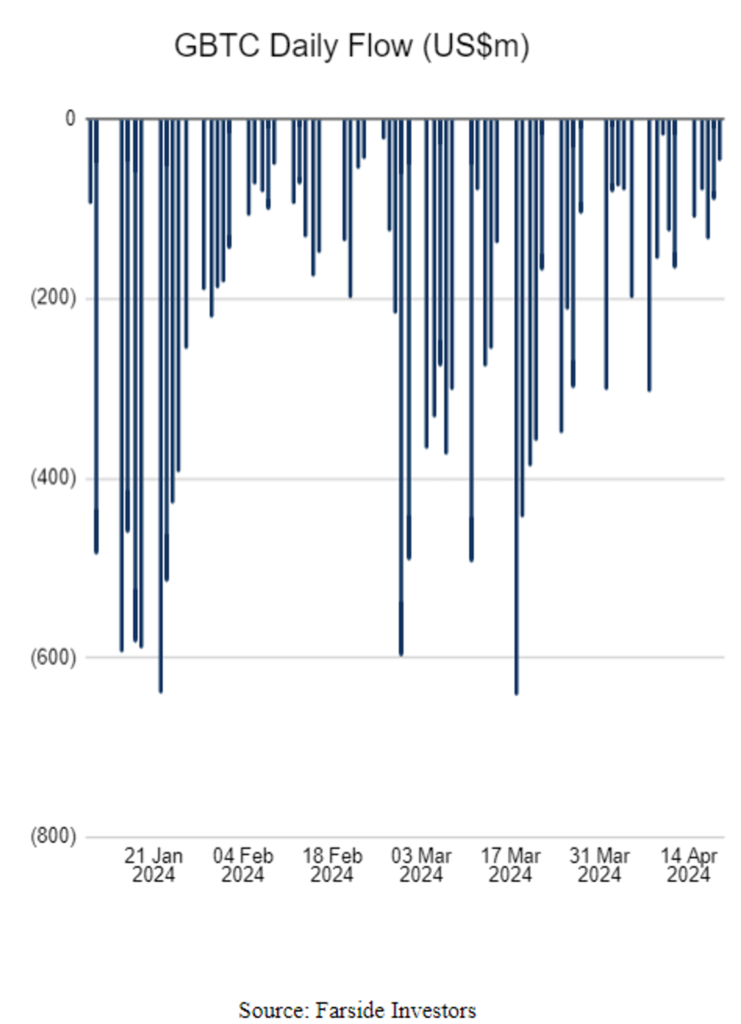

- Short-term selling pressure brought about by GBTC and Bitcoin holders.

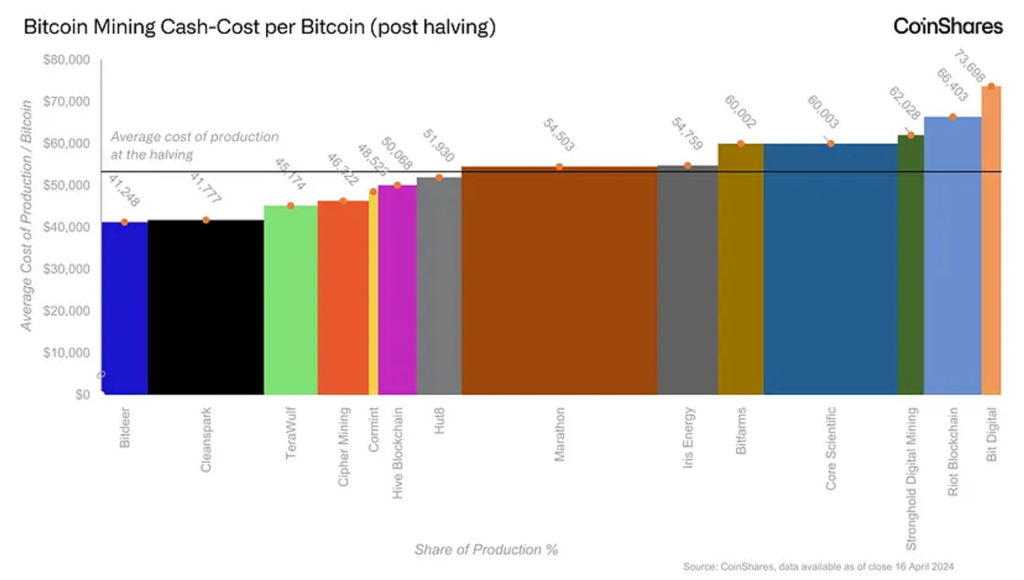

- Changes in miner behavior, while the average production cost per Bitcoin among listed mining companies is now approximately $53,000, which is significantly higher than before the Halving event. Consequently, to balance costs and profits, miners may need to execute large Bitcoin sales transactions when necessary.

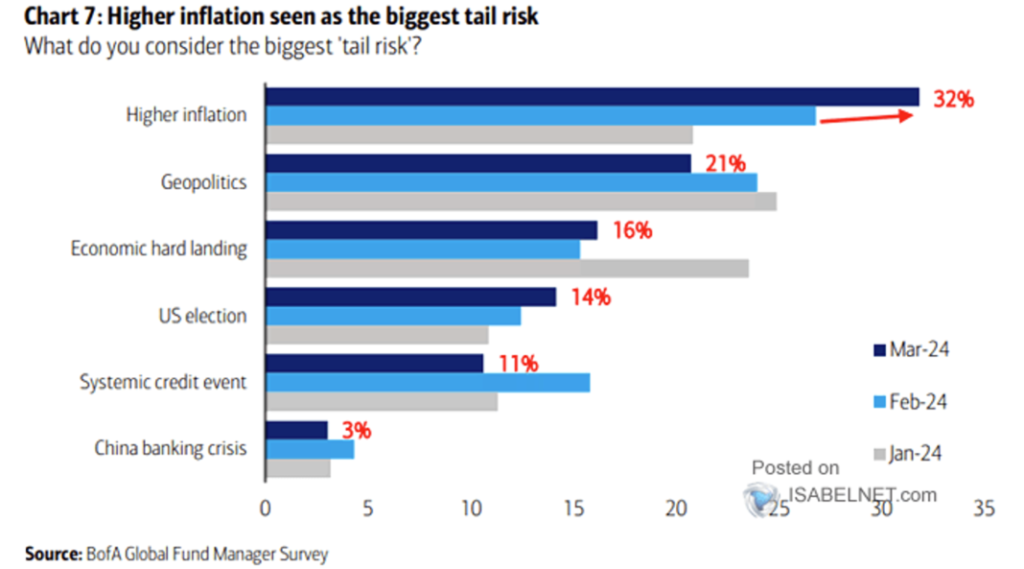

- The crypto market is renowned for its high volatility, which could be further exacerbated by global economic instability. Additionally, unforeseen black swan events could pose downside risks.

2.2 Investment Strategies:

- While historical data suggests a potential for high returns post-halving, investor expectations leading up to the halving often fuel significant speculative activity in the short term. The anticipation of potential price increases can lead to preemptive buying, which itself can escalate the price in a self-fulfilling prophecy.

- Therefore, investors need to establish clear investment goals, ensure portfolio diversification, implement risk management, and consider potential hedging strategies in anticipation of expected volatility. It is advisable to adopt a long-term investment strategy as Bitcoin’s price can be highly volatile in the short term but has demonstrated significant growth over the long term, especially following halving events. Focus should be maintained on projects surrounding the Bitcoin ecosystem (brc-20), Real-World Assets (RWAs), AI, and Restaking narratives.

III. Final thoughts:

- While the halving’s direct impact on supply suggests potential bullish sentiment, the market does not respond to the halving immediately like it does to events that directly affect cash flow such as geopolitical tensions or Fed interest rate hikes. Factors such as ETF-induced demand, institutional adoption, and broader economic conditions play substantial roles in determining Bitcoin’s trajectory post-halving.

- For venture capitalists, the aforementioned considerations should inform a nuanced investment strategy tailored to capitalize on the opportunities and navigate the risks presented by this significant event.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.