I. Overview:

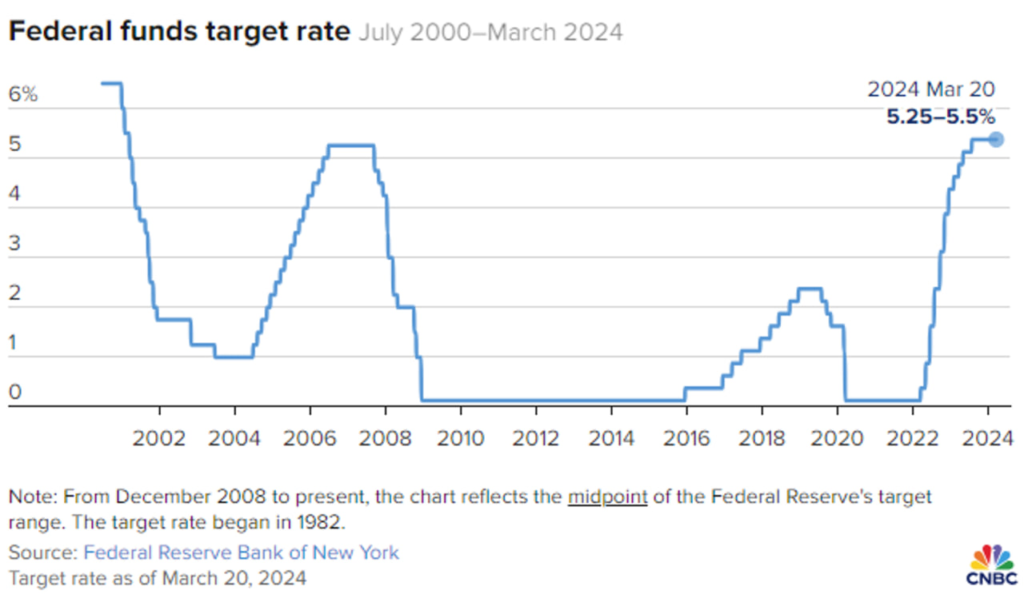

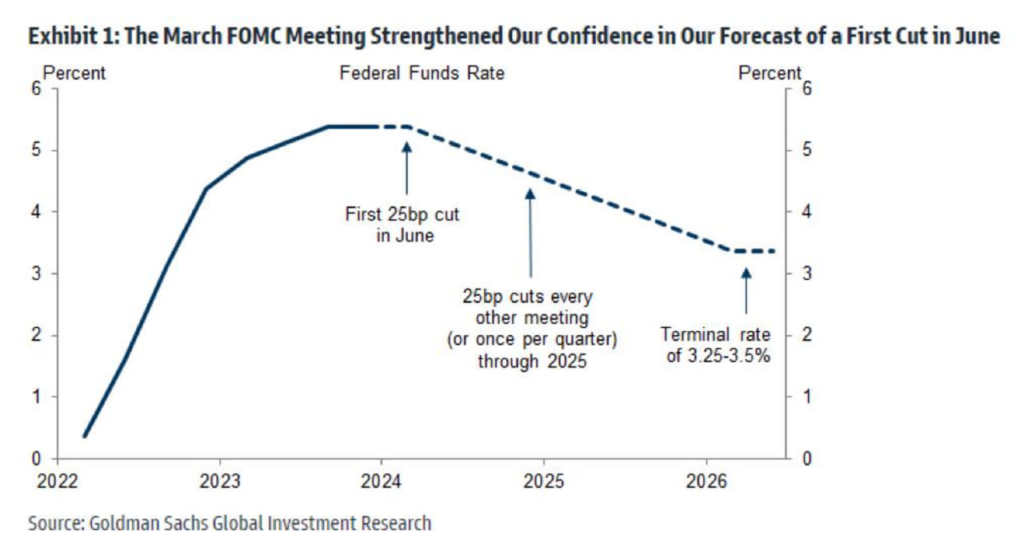

- Policymakers maintained the benchmark overnight borrowing rate in the 5.25%-5.5% range for the 5th straight meeting, as expected as inflation remains high and stubborn.

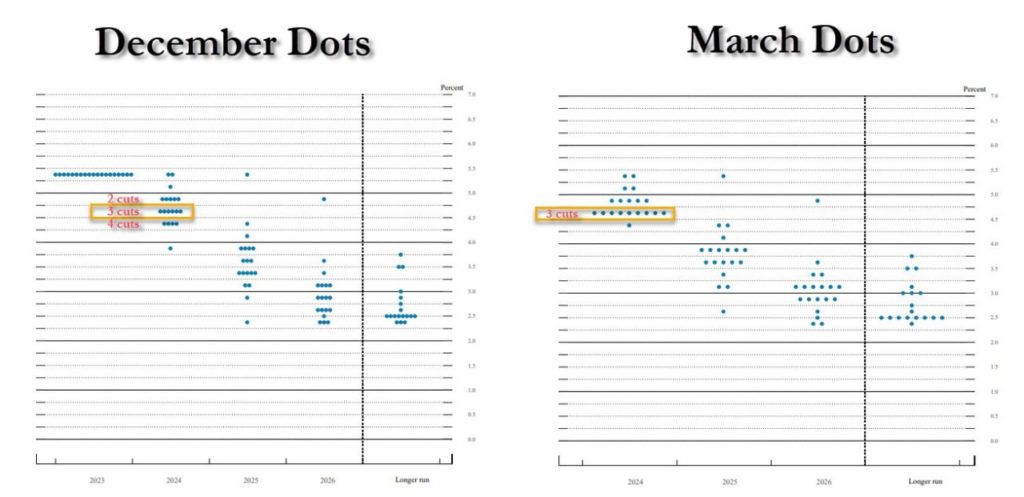

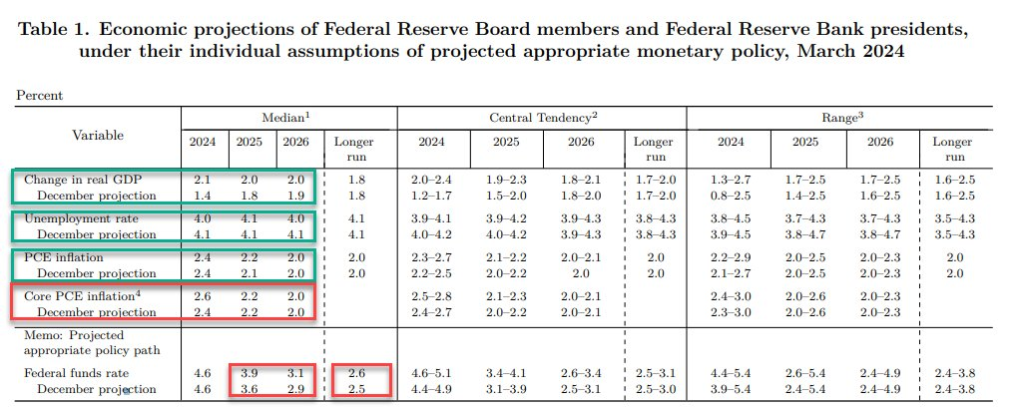

- The Federal Funds Rate is expected to STAY at 4.6%, with the FOMC median forecast suggesting 75 bps of rate cuts in 2024. However, Fed officials forecast FEWER rate CUTS in 2025 (3.9% vs 3.6% in Dec) and 2026 (3.1% vs 3.19% in Dec), with an emphasis on waiting for greater confidence in inflation before making cuts.

- Big upgrade to the Fed’s economic projections:

- Real GDP growth expectations RAISED to +2.1% from 1.4% (driven by strong consumer demand and the recovery of the supply chain).

- Unemployment rate projection LOWERED to 4.0%.

- PCE inflation forecast remains STEADY at 2.4%, while core PCE inflation expectations are INCREASED to 2.6%.

- FOMC’s median rate forecast for 2025 is INCREASED to 3.9% from 3.6%.

II. Market Response:

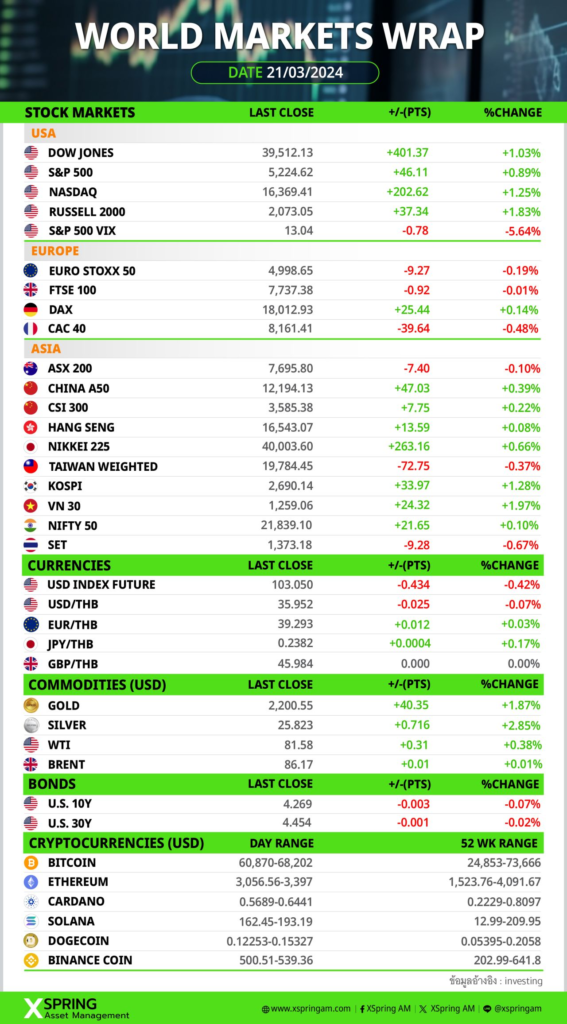

- The Fed keeps rates unchanged, coupled with indications of three rate cuts this year, acted as a catalyst for a market-wide uplift:

- U.S. Stocks reached record highs (led by the industrials and banking sectors), while Treasury yields and the Dollar index declined.

- Asian stocks also reached new record highs in Japan & Taiwan following the U.S.

- Bitcoin rebounds to $66K, up from the day’s low of $60,976.

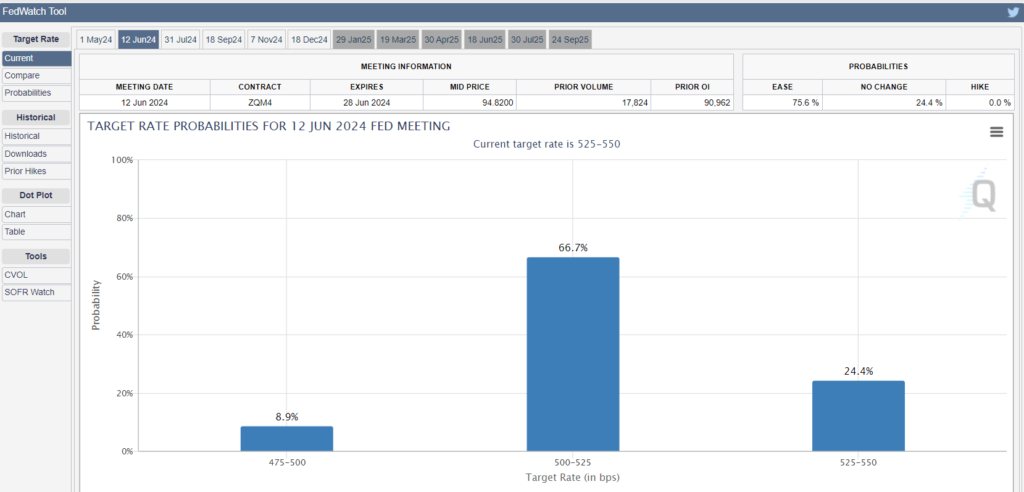

- Post-meeting futures markets were pricing in nearly a 67% probability of the first cut occurring at the June 12 meeting, according to the CME Group’s FedWatch tool.

III. Final Thoughts:

- Market focus has gradually shifted from inflation/interest rates to growth. And the positive signal is that the Fedhas raised its GDP growth forecast to reflect the view that there is no recession.

- Hot inflation reports in January and February haven’t changed the overarching narrative, which is the trend of inflation is still strongly downward.

- Most traders are betting on the first Fed rate cut in June, but the Fed will cut only when they have “sufficient confidence.” This means the Fed could disappoint the market, leading to a correction.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.