Tether, the company responsible for the popular Tether (USDT) stablecoin and the world’s largest stablecoin in terms of market value, is undergoing a restructuring process. This restructuring aims to bring forth additional divisions beyond the development of stablecoins. The company recently introduced a new framework incorporating four new business divisions: Tether Data, Tether Finance, Tether Power, and Tether Edu. This information was officially announced on April 18.

Tether’s objective in introducing these new divisions is to broaden its mission and offer innovative infrastructure solutions, investments, and services. The company seeks to expand its scope and provide an extended range of offerings to meet the evolving needs of its customers.

The brand-new structure

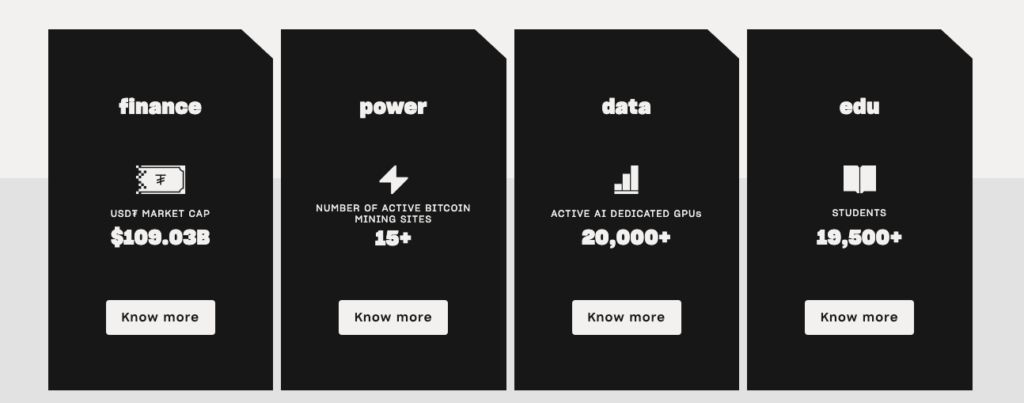

The new structure includes 4 core divisions:

- In Tether Data, the company will primarily invest in strategic technologies such as artificial intelligence and peer-to-peer platforms like Holepunch, Keet, and Pear Runtime.

- Tether Finance will function as the central hub for Tether’s traditional stablecoin products and financial services, to make the global financial system more accessible to all, according to the announcement.

- Tether Power aims to further develop Tether’s mining and energy initiatives, as detailed in the article on Tether’s major expansion into BTC mining.

- Tether Edu will concentrate on digital education and promote the adoption of blockchain technology on a regional and global scale.

Despite already being involved in these sectors, the creation of separate divisions by the decade-old company signifies its increasing emphasis on ventures beyond its primary stablecoin. In the previous year, the company made investments in BTC mining activities in Uruguay and a payment processor in Georgia. Additionally, it allocated funds towards AI initiatives through its partnership with Northern Data Group, a data cloud provider.

Beyond Stablecoins

In addition to USDT, Tether manages a variety of other stablecoins, such as EURT (Tether Token pegged to the Euro), CNH₮ (offshore Chinese Yuan), XAUt (gold-backed Tether Gold), and various others. Tether’s restructuring is just another step in the company’s efforts to move beyond stablecoins.

“With this evolution beyond our traditional stablecoin offerings, we are ready to build and support the invention and implementation of cutting-edge technology that removes the limitations of what’s possible in this world.” - Tether CEO Paolo Ardoino

Tether currently makes up around 70% of the $142 billion stablecoin sector, according to DeFiLlama data, while its next closest competitor Circle’s USDC sits at 19.4%.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.